Derivatives end-users

Major players show support for California carbon trading

First California Carbon Allowance forward underlines US interest in trading, contract standards to evolve as activity increases

Commissioner presses to speed up Dodd-Frank rule-making

CFTC continues derivatives reform rule-making, staff and commissioners concerned about timetable and resources

Upturn predicted for physical energy trading

Trade flow likely to move to physical markets due to new derivatives rules, experts say

Keep pre-Dodd-Frank swaps data for now: CFTC

CFTC deals with pre-enactment swaps reporting and tells energy companies to maintain required data until Dodd-Frank definitions are finalised

Qantas’s head of risk: hedging programme is too conservative

Qantas Airways’ head of risk believes the company could take more risks within its hedging programme

End-users rush into hedging oil prices

End-users are ploughing into hedging their oil positions, as prices remain in a tight range, says Standard Chartered Bank’s head of energy and environmental research

Goldman Sachs: end-users hedge oil prices now for 2011

Crude will be "the bottleneck in the system, rather than refining" says the investment bank

Special report: Energy end-users

Special report: Energy end-users

Editor’s letter - Energy end-users special report

Editor’s letter - Energy end-users special report

Forward planning at M&S

Forward planning at M&S

Demand response challenges

Power to the people

Q&A: Wayne Mitchell, head of corporate sales, npower

Model behaviour

Commodities ‘financialisation’ worries end-users

With recent statistics showing an increasing number of financial institutions jumping into commodities, Lianna Brinded investigates whether this will cause more risks to end-users

More than 2,500 UK end-users at risk of fines over carbon rules

More than 2,500 UK end-users could be stung with a hefty fine from the UK government, as a substantial number of executives at the country’s top firms admit they are unaware of the mandatory CRC Energy Efficiency Scheme, reveals a new report

Derivatives reform to hit energy giants

Several major energy and commodities companies such as Royal Dutch Shell and BP are to face a substantial rise in derivatives trading costs, following the adoption of the Dodd-Frank Wall Street Reform Act.

Legal experts identify end-user issues under new US act

As US regulators embark on redefining over-the-counter derivatives trading, energy end-users need to be aware of how they will be categorised and the potential impact on trading costs.

Shell Gas chief: end-users will face credit issues - Exclusive

Shell Gas Direct’s chief tells Energy Risk that major end-users’ credit worthiness will be one of four major challenges for industrial and commercial users in the next few years

Energy sector awaits regulatory clarity

Energy companies are looking to the Commodity Futures Trading Commission (CFTC) for more clues about the future regulatory landscape after the US Congress set the stage last week for a wide-ranging overhaul of derivatives regulation

OTC reform could strengthen support for energy position limits

The debate over derivatives regulation could provide momentum for the Commodity Futures Trading Commission (CFTC) to impose position limits on energy trading proposed in January.

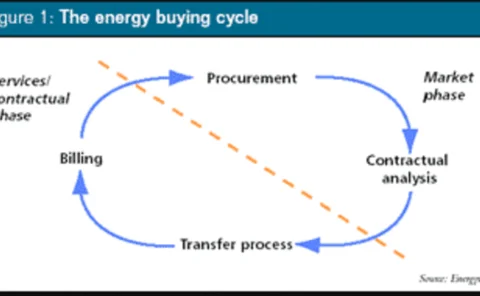

Buying your way out of trouble

UK high-street retailer Littlewoods has saved £1.5 million through an energy risk management and procurement programme. Utilyx’s Nigel Cornwall looks at how other companies can reduce energy costs through purchase programmes

Opportunity knocks for smelters

Aluminium manufacturers have long used sophisticated hedging and risk management techniques to protect against fluctuating metal prices, yet they have only recently looked at transferring these skills to power risk management. David Wilson reports

US retreat hits European trading

The retreat of US energy firms from energy trading has reportedly hit European volumes hard. But volumes aside, James Ockenden finds that the withdrawal may bring a fundamental change in the market. With additional reporting by Eurof Thomas

Playing a waiting game

With energy – and particularly natural gas – costs on the rise, are end-users finally coming to terms with the importance of hedging or are they still waiting to get burned before they enter the hedging market? Kevin Foster reports