Collars

European exporters add flexibility to FX hedges

Corporates with USD exposures have been reducing hedging tenors and adding optionality

Corporates eye complex FX hedges as carry costs mount

Leveraged forwards and options-based structures entice treasurers facing rates uncertainty and FX volatility

Gamma jitters from defined outcome funds

Tumbling equity markets could flip dealers’ exposure to gamma from long to short, leading to hedging losses

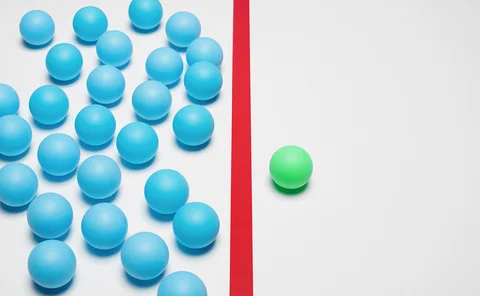

Corporates look to collars amid rates uncertainty

Selling the floor can cover majority of cap’s premium

FX hedging dilemma vexes corporates as costs spiral

High volatility jacks up option prices, forcing firms to reconsider hedging activities

Asia collar financing surges on back of Covid-19 volatility

Options-based structures gain ground on margin loans – and dealers say it may be a structural shift

Shale firms pump hedge books for liquidity lifeline

Lucrative hedge portfolios offer promise of cash but unlocking residual value won’t be simple

New frontiers

Innovative investment opportunities are helping to mitigate risk and satisfy Solvency II capital requirements as insurers face continued economic uncertainty. Frederic Morlaye, managing director, insurance and capital management solutions, Global Markets…

Cash no longer king in European swaptions

Barclays executives explore weaknesses of current pricing formulas for cash-settled swaptions

Euro swaptions market prepares for pricing revamp

Interdealer market to adopt collateralised cash price from July, but some fear impact on legacy books

Oil rout roils E&P and airline hedging strategies

Price dive rewards producers with cautious risk management practices

Equity derivatives house of the year

Equity derivatives house of the year

UK banks face up to SME swap misselling claims

Sales of the unexpected

Air China CFO wants simpler fuel hedges; other airlines remain unhedged

Air China will seek simpler hedging strategies when its current contracts expire. Meanwhile, other airlines in Asia are taking differing approaches to hedging, with some risking big profit losses by staying completely unhedged.