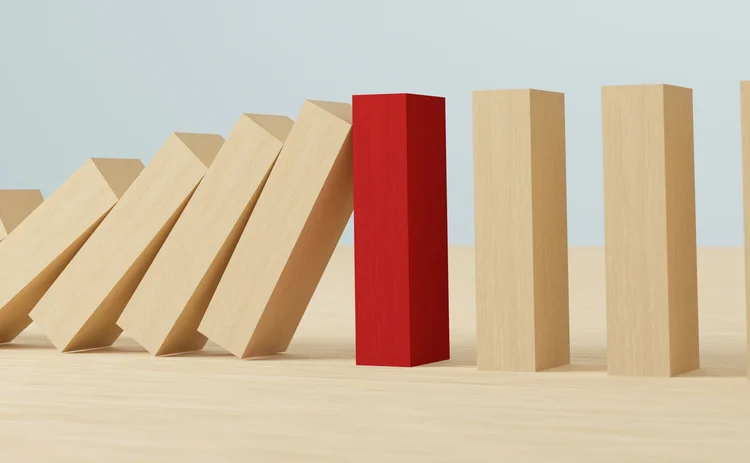

Limited-loss hedges help US firms dodge costly FX moves

Structurers say corporates’ use of options-based net investment hedging helped soften impact of USD selloff

Foreign exchange structurers are seeing increased demand from US corporates for options-based hedges that can limit losses on their net investment hedges caused by the US dollar’s selloff.

While the economic value of derivatives hedges offsets changes in foreign assets, when those positions hit maturity companies can face hefty mark-to-market payments.

Bank structurers, though, say companies with

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Fireside chat: Advancing FX clearing for safer settlement

Developments in FX clearing are supporting the creation of a safer, more scalable settlement infrastructure

Leveraged ETFs may have fuelled Kospi plunge

Record one-day drop in Korean equity markets follows months-long surge driven by leveraged bets

Iran conflict forces EM carry trade unwinds

Surging oil prices, rising vol and dollar flight triggered stop-outs of emerging market positions, say dealers

Eurex mulls ‘integrated’ prediction market

Dividend derivatives seen as template for event contract expansion

After market whipsaws, banks put new twist on QIS options

Variable strike options aim to catch recoveries after volatility spikes

Broker quoting gap keeps Eurex-LCH basis alive

Lack of differentiated prices helps retain CCP basis

QIS futures debut – but only simple ones for now

Goldman and Societe Generale kick-start Eurex market with equity baskets

Hedge funds trim US swap spreads on tariff decision

Investors cut back asset swap positions as Supreme Court ruling reignites deficit concerns