Capital requirements

Basel II regulators issue key QIS 3 survey

Global banking regulators said they launched their key survey today seeking information on how the Basel II bank capital accord aimed at making the world’s banking system safer would affect banks.

Op risk rules inadequate, says Isma professor

LONDON - The Basel II capital accord rules regarding operational risks for financial institutions are inadequate, Jacques Pézier, a visiting professor at Reading University’s Isma Centre, told delegates at a conference in London this morning.

UK expects EU countries to reopen Basel II arguments

LONDON – UK regulators expect that other European Union (EU) countries will try to reopen Basel II bank accord discussions within the EU framework, a senior UK supervisor said yesterday.

Single bank capital accord for all banks is impossible, says Basel Committee chief

CAPE TOWN, SOUTH AFRICA – Differences between banking systems make it impossible to conceive of a single bank protective capital accord that would work for all banks in all countries, the world’s top international banking regulator said today.

Australian capital/asset ratios consistent with credit ratings, says S&P

MELBOURNE – The capital to asset ratios of the four major Australian banks, as measured by credit rating agency Standard and Poor’s own approaches, are consistent with the banks’ double A ratings, S&P said today.

UK accepts large banks could use basic op risk approach

LONDON - The UK’s chief financial market watchdog said in July it accepted that a large international bank could use the basic indicator approach, the simplest of the three approaches to calculating operational risk capital charges proposed under the…

UK bankers fear capital floors higher under latest Basel II plans

The British Bankers' Association (BBA) is concerned that global banking regulators appear to have raised and expanded the application of the capital charges floor in the Basel II bank Accord, a BBA official said today.

Loss survey supports arguments against capital charges, say fund managers

London - The results of a survey by global banking regulators of banks’ operational loss experience support arguments against using capital charges as the main protection against operational losses in fund management and broker activities. This is the…

In search of clarity and focus

Greater precision is needed in defining operational risk, but the Basle regulators' latest thoughts are lost in generalities, says Jacques Pézier, in the final article of a three-part series.

Basel shortcomings: Danger lurks on the rocky road to Basel II

The Basel Accord proposals to define operational risk contain many fatal flaws, says Jacques Pézier. He argues that it would be better to focus management time on managing key risks than on developing op risk databases and measurement procedures.

SME debate delays next Basel II paper

The Basel Committee on Banking Supervision has delayed its next consultative paper for Basel II, the new rules that will determine the amount of regulatory capital internationally active banks put aside against risk.

The Basel II capital accord: op risk proposals in brief

This summary has been updated to include the revisions to the Basel II op risk proposals contained in the Working Paper on the Regulatory Treatment of Operational Risk issued in September, 2001 and available on the Bank for International Settlements'…

Will Germany scupper Basel II?

How real is Germany’s threat to veto the proposed Basel II bank capital accord if the country fails to get the concessions it wants on the accord’s treatment of bank lending to small to medium-sized companies (SMEs)?

Unresolved Basel II issues include total capital and economic impact, says UK central banker

OXFORD, ENGLAND - The question of what should be the appropriate overall level of protective capital in the world’s banking system remains one of the unresolved issues of the Basel II banking accord, said deputy Bank of England governor David Clementi…

Op risk capital charge difficult to devise in imperfect Basel II, says US central banker

NEW YORK - The lack of an agreed methodology and credible loss data has made it extremely difficult to devise an operational capital risk charge under the terms of the Basel II bank capital accord, a senior US central banker acknowledged in mid-October.

Basic shortcomings

The Basel regulators have missed their chances with their latest op risk paper, argues Jacques Pézier.

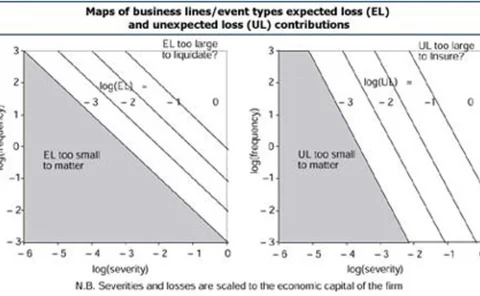

A new role for op risk insurance

As expected, the Basel Committee on Banking Supervision said in late September that it is prepared to consider a role for insurance in reducing operational risk capital charges proposed under the Basel II bank capital adequacy accord.

Double-counting fears ease as w -factor is removed from Basel II capital charge

BASEL - The so-called w -factor that bankers feared could result in double-counting of op risk under the Basel II bank capital accord will be removed from the capital charge provisions of the accord, global banking regulators said in September.

Advanced measurement approaches

The September working paper on operational risk from the Basel Committee on Banking Supervision confirmed that global banking regulators are looking at a range of advanced ways of calculating op risk capital charges instead of a single method.

Pro-cyclicality in the new Basel Accord

Could Basel II worsen recessions? By backtesting the proposed capital rules to the last recession, D. Wilson Ervin and Tom Wilde argue that the increased risk sensitivity of loan portfolio regulatory capital in the new Accord could have unwelcome…

New op risk paper gets cautious welcome, but reservations remain

BASEL - Bankers gave a cautious welcome to the further thinking of global banking regulators on their controversial plans to make internationally active banks set aside capital against op risk under the Basel II banking accord.

Independent collapse highlights Basel II op risk insurance dilemma

LONDON - Some of the concerns of banking regulators about the effectiveness of insurance cover when operational disaster strikes a company could be illustrated by the plight of Independent Insurance, the UK general insurance group that collapsed in June…

Regulatory capital volatility

Basel II