This article was paid for by a contributing third party.More Information.

Intraday Volatility Forecast for Dax, Euro Stoxx 50 and Euro-Bund

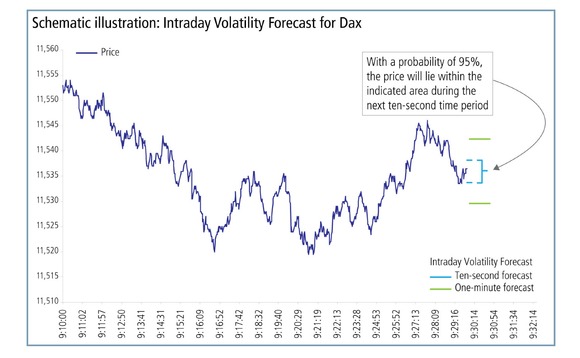

Providing insight for the next ten seconds to 30 minutes

In November 2015, Deutsche Börse will launch the Intraday Volatility Forecast, a new analytic that forecasts volatility for Dax, Euro Stoxx 50 and Euro-Bund. The forecasts are based on trading data of the respective futures, the most important instruments traded on Eurex Exchange.

The following metrics will be provided:

• Average realised volatility – a reference for the last second is sent every second

• Ten-second forecast – published every five seconds, covering the next three ten-second periods

• One-minute forecast – published every 30 seconds and covering the next five one-minute periods

• Ten-minute forecast – published every five minutes, covering the three subsequent ten-minute periods

How it works

The Intraday Volatility Forecast is based on a proprietary mathematical model that uses historical futures data to forecast the direction (increasing or decreasing) and magnitude of volatility. The input going into the calculation can be grouped into one of the following three categories:

• Short-term memory of realised volatility

• Historical intraday seasonality

• Scheduled economic data releases

The short-term memory component of the volatility forecast model incorporates the fact that the future value of volatility is highly dependent on its current value. The second component analyses historical data to identify the drivers of intraday seasonality in volatility. The model automatically accounts for relevant holidays, other calendar effects and daily events such as the opening and closing auctions of the different markets. The final model component dynamically evaluates the average impact of different scheduled releases. Releases with significant impact on volatility – for example, US employment or gross domestic product figures – are used in calculating the volatility forecast.

Utilising the Intraday Volatility Forecast

Traders can use the forecast to support the assessment of the likelihood of price changes and therefore the risk involved in using certain automated strategies. Using an automated trading strategy set against a benchmark, such as a volume-weighted average price algorithm, is less risky if the likelihood of huge price changes in the underlying can be gauged. As such, the volatility forecast is a natural choice for a state variable in the generation of a trading algo.

On the other hand, traders who are looking for high-volatility opportunities and trade respective option strategies can use the forecast to help determine a good point in time for order submission.

The Volatility Forecast is not only interesting for algo traders, but also for screen traders who can use the forecast to support their live trading. Pre-trade transaction cost analysis can likewise be enhanced considerably as the risk of price slippage can be assessed using the volatility forecast.

Read/download the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net