This article was paid for by a contributing third party.More Information.

Facing the future: the growth of automation in Asia‑Pacific fixed income trading

How can automation improve fixed income trading strategies and best execution? In a recent Asia Risk webinar, in partnership with Tradeweb, a panel of market experts discussed the outlook for automation in the trading space

Automation has become an increasingly powerful way to tackle added complexity, as electronic trading activity has grown in markets such as equities, foreign exchange and, more recently, fixed income. While the trend for greater automation began on trading desks in Europe and the US, it is now also accelerating in Asia as more of the region’s traders embrace automated solutions and electronic workflows.

In a webinar hosted by Asia Risk and Tradeweb, panellists from the buy and sell sides, as well as technology and platform providers, discussed the reasons for the rise of automation, and how it can improve trading strategies and their best execution.

Automating the trade lifecycle

The trade lifecycle can benefit from automation at every stage, whether in portfolio construction, managing fund flows and data aggregation in the pre-trade stage, or working out how to route and execute a trade most efficiently and effectively.

“From a post-trade perspective, there are many pieces [that could be automated] – straight-through processing, application of transaction cost analysis [TCA] or analytics,” said Joram Siegel, managing director and head of fixed income outsourced trading at Cowen. “There really is a wide array of opportunities to automate different parts of the trade lifecycle.”

The benefits of automated trading include a boost to all-round efficiency, tighter markets and faster response times from the sell side. It can also help with booking trades faster and taking the legwork out of back-end trading processes. This way, automation frees up traders for more high-touch transactions that benefit from greater human attention and expertise.

Evolution driven by electronification

Automation has become an invaluable tool for meeting trading needs as electronic trading activity has scaled up. “In Europe, we saw a steep rise, first in electronic trading and then gradually in automated trading [for the first half of the 2010s],” said Viktor Östebo, managing director and head of institutional trading, Asia‑Pacific (Apac), at Flow Traders. According to the Bank for International Settlements, between 2010 and 2014, daily trading volumes in most fixed income instruments on electronic platforms rose by about 40%. Electronic trading has continued to grow since, fuelled more recently by the impact of the Covid‑19 pandemic. In the US corporate bond market, electronic trading rose by more than 100%, and in Europe this activity increased by 61% between 2017 and 2020, according to figures from Coalition Greenwich. Östebo continued: “My experience in the Apac region is that we are only starting to scratch the surface of what’s possible in terms of electronification, with the second step being automation.”

As markets develop, automation of trading activities is not expected to replace traders, but will rather enhance their ability to navigate an increasingly complex market. And, while there will always be a certain percentage of high-touch versus low-touch trading taking place in most markets, organisations should be aware of how this ratio could change.

“Electronification of trading certainly doesn’t mean there is no longer high-touch or low-touch, although we have very much seen a separation of the two with the right level of automation required for each one,” confirmed Laurent Ischi, Automated Intelligent Execution (AiEX) product development, Asia, at Tradeweb. In many fixed income markets and exchange-traded funds (ETFs) trading, organisations are moving towards no-touch workflows, but the degree to which this is happening typically depends on the asset class. “We’ve been working on finding the right degree of automation for the right type of instruments with our clients,” he continues. “This also depends on where a company is on its workflow automation journey.”

Requirements can range from no-touch workflows for very liquid instruments –where the trader does not even have to trade individual tickets – to those where only dealer selection or request for quote submission is automated. Again, the degree of automation differs between markets – for those with more systematic activity, trading automation creates much-needed efficiencies. “A manual trading desk may handle 20 tickets per trader a day but, once that starts to scale, the number of traders also needs to increase,” said Ischi. “What we often see happening now is that companies will look at the opportunities to automate instead, in order to free up traders.”

Addressing technology challenges

In Apac, there is still some distance to go before electronification has the same knock-on effect on demand for automation, according to the panellists. “In the markets in which we are active in Europe, activity is probably 98% or even 99% electronic,” said Östebo. “In Apac, it’s obviously less but there is nothing to hold back the same development in terms of technology or risk frameworks – on the sell side, we are ready … We are hoping the buy side will become more engaged and interested.”

There are, of course, initial investment costs in setting up automated systems. This may cause some buy-side firms to hold back from implementation, at least at first. However, general technology advancements in this region are starting to make automated trading more attractive. “More organisations are using standardised or larger-scale order management or execution management systems,” said Ischi. “This greatly reduces the technology costs as most connectivity will be out of the box.”

Enhancing sell-side relationships

Some organisations are also looking towards outsourced solutions to solve this cost issue. This provides access to a wider range of markets and a technology stack that enables the use of automation tools. “[The electronification of the markets] has created lots of new trading protocols, the ability to access liquidity electronically and the proliferation of many different trading venues and ECNs [electronic communication networks],” said Siegel. “While larger firms may have the [in‑house] scope and resources to employ technology, not all firms do.”

Fears around greater information dissemination could also be a source of hesitancy for buy-side firms in Asia to automate, according to James Hullah, vice-president, fixed income trading at AllianceBernstein. “With an electronic platform, a wider range of sell-side organisations are seeing your orders. I think concerns about frontrunning have caused Asian organisations to be a little hesitant as a result,” he explains.

Some buy-side firms may also worry about the potential impact on long-standing relationships of offering business out to a wider panel of dealers via an electronic platform. “For example, some firms may worry about getting a certain level of service from preferred dealers for higher-touch trades,” Hullah said. “But electronic trading actually enables you to see more of the sell-side community, especially those that specialise in certain segments. You may improve your TCA as a result.”

Automating ETF trading

Automation is also scaling up in relation to certain types of instruments, according to the panellists. For example, the level of electronic trading in the ETF space makes this type of product a very obvious use case for automation. In October 2021, for example, automated ETF transactions on Tradeweb’s platforms reached 76% for European Union ETFs (data for European markets as a proportion of ‘in comp’ trades). “For ETFs, adoption has been massive in terms of electronic trading,” Ischi said. “In Europe, on venues like Tradeweb, this activity has grown quite significantly, and we expect in time the same thing will happen in Asia.”

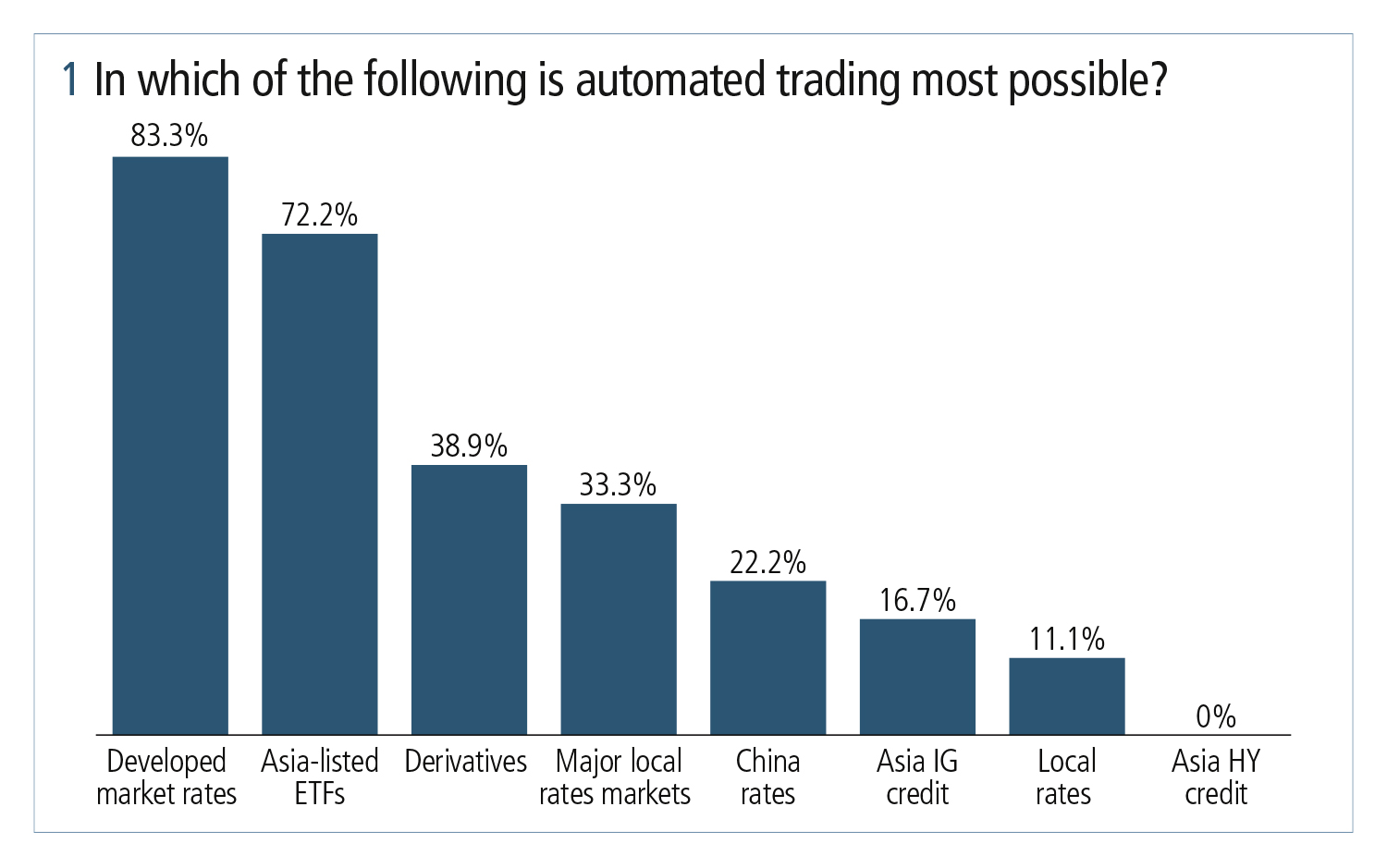

Automated trading is particularly useful in fast-moving markets such as ETFs, or any others with continuous price updates. This was reflected in responses to a poll question posed during the webinar, that asked attendees to rank suitable markets for automation. Developed market rates (US Treasury/ European government bonds) were seen as most suitable, followed by Asia-listed ETFs.

Indeed, electronification and automation could relieve some of the concerns around liquidity in Asian-listed ETFs, according to Östebo. “From a trading and execution standpoint, there is a huge implementation shortfall if you are waiting for execution for 12–18 hours [because of the time difference with other markets],” he said. “But electronification and platforms can actually solve that via automated trading,”

Next steps

For those that decide to automate trading processes, the panellists believe the next logical question would be: to what degree? “It’s not just about what you automate, it’s how you do it,” said Ischi. “Find something you already trade that is relatively easy and of modest size, automate it and get an understanding of how it works and then expand from there. Start small in a liquid market and increase from there in terms of transaction sizes and product scope.”

It is also important to see automated systems as evolving entities. “At Tradeweb, we have regular conversations with clients using our automated solution AiEX to see how it is working and how we can help them tap into other markets,” Ischi added. Whatever an organisation might start with will change over time, as the markets and the company develop.

And, once organisations take this step, it is unlikely they will turn back. “Once you start trading electronically, you really don’t go back to voice trading, unless it’s for high-touch execution – that’s where a trader can now add the most value,” said AllianceBernstein’s Hullah. “I think the buy side can really get behind creating their own algos and utilising automated tools that are already prevalent in other markets such as equities and FX.”

The degree to which organisations choose to automate will depend on the instrument, the market and the company itself, but the trend towards automated trading will continue, according to the webinar panellists. With electrification continuing apace across Apac, it’s clear the fixed income trading desk of the future will involve automation as standard practice.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net