Portugal

EU banks cut €67 billion in non-performing loans

Greece remains the country with the highest NPL ratio, at 45%, followed by Cyprus at 34%

Sovereign risk manager of the year: IGCP

Portuguese debt office ensured clean exit from bailout while ending swaps disputes

"Worst trade of all time" pits Santander against Portuguese client

Interest rate swap with €79 million notional is nearly half a billion euros underwater

UK banks reveal size of eurozone funding gaps

Banks reduce cross-border funding of peripheral eurozone assets in an attempt to mitigate redenomination risk - but funding gap still tops £10 billion for Spain

Product providers in eurozone periphery face stiff challenge from bonds

Bonds beef up in southern Europe

Greek exit threatens eurozone ALM

The Greek gift

Deposit flight threatens banks' eurozone ALM efforts

Attempts to match assets and liabilities on a country-by-country basis could be threatened if Greece exits eurozone, lenders fear

European power market series: Iberia

Building bridges

Greek bailout deal fails to dent CDS spreads

Sovereign spreads flat or wider despite agreement on fresh bailout for Greece

CDS market holds breath as Greek bail-out talks continue

Spreads are static and volumes light as EU finance ministers and the Greek government try to reach agreement over bail-out terms

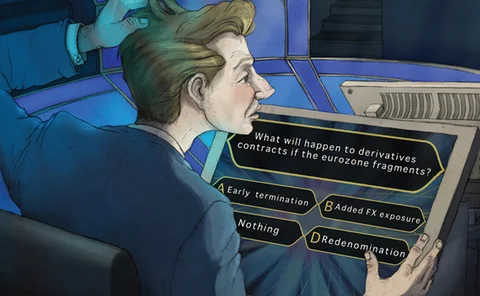

Dealers tackle euro redenomination risks

Back to the drachma?

Interest rate derivatives house of the year: Deutsche Bank

Risk awards 2012

OECD debt offices call for derivatives collateral debate

New report calls for debt offices to weigh the pros and cons of two-way collateral and clearing

Germany downgrade threat sees eurozone CDSs widen

Eurozone CDS spreads were back on the rise today after Standard & Poor's warned it could downgrade 15 eurozone member states, including Germany

Eurozone CDS spreads fall on French-German fiscal deal

Risk perceptions in the eurozone fell today as France and Germany agreed new treaty plans that will sanction fiscally irresponsible member states

Dealers predict CVA-CDS loop will create sovereign volatility

A recipe for disaster?

Europe's democracy deficit contributing to crisis

The democracy deficit

CDS spreads in holding pattern as row delays eurozone deal

Spreads flat or slightly tighter despite political squabbling over size of EFSF

Lloyds and RBS CDS spreads steady despite downgrade

The decision by Moody’s to downgrade Lloyds and RBS fails to spark surge in CDS spreads, while other European banks finish more or less unchanged on the week despite continuing woes in the eurozone

Bond markets rally as ECB moves on Italian and Spanish debt

Yields on Italian and Spanish debt fall as European Central Bank signals it will implement its bond purchase programme

Irish debt office agrees to collateralise derivatives

The NTMA follows Portugal's debt office in adopting two-way collateralisation - but unlike Portugal it appears it will have to post cash