Fed data dependency backfires

The past year has seen a huge change in the formation of rate expectations

Marcello Minenna is professor of financial mathematics at Bocconi University and head of the quantitative analysis unit at Italy's markets regulator, Consob

In her speech following the decision to hike interest rates in December, Federal Reserve Bank chair Janet Yellen stated that further rate rises would be tied to the US economic outlook – a reiteration of the central bank's data-dependent policy model. Almost from that point, there has been a steady stream of bad data, and rate hike expectations collapsed as a result. The Fed has cornered itself.

The numbers are stunning. Using prices on Fed funds futures contracts as a guide, the probability of at least a 25 basis point increase by year-end tumbled to 11.2% on February 12, from a peak of 95.6% just over a month earlier. Put another way, even though Fed officials continued to indicate there would be three or four more rate increases this year, the market no longer appeared to believe them. And they were right: at the Federal Open Market Committee (FOMC) meetings of March 16 and April 27, which saw decisions to hold rates, the Fed updated its forecasts to only two more rate hikes in 2016, to occur probably in July and September.

To understand the importance of the behavioural change in expectations, some background is needed. References to a data-dependent model have been seen in Fed documents since 2012, but in rather obscure terms. Perhaps deliberately, the Fed has never clarified the data on which its decisions would depend, and whether markets would have to make their own minds up about how the Fed viewed the signals, or whether they would be given guidance on the data by the central bank.

Those doubts meant the principle was largely ignored. Even after the abandonment of calendar-based forward guidance (for example, ‘no rate hike at least until mid-2013'), market participants took their cues mainly from public speeches or in Fed minutes. Longer-term, persistent trends in rates expectations were largely unaffected by the constant stream of changing economic and financial information, which only generated short-lived adjustments.

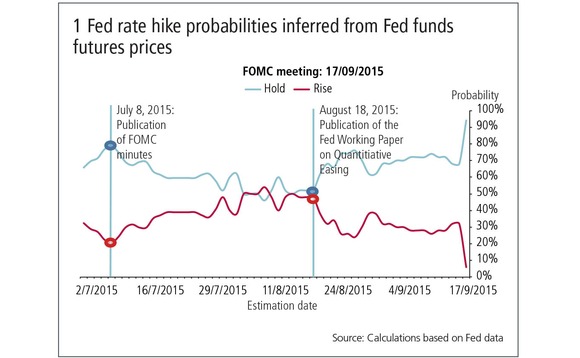

As a case in point, let's look at the meetings of the FOMC on September 17 and December 16 last year. In the first instance, we know the Fed decided to hold. The weeks leading up to the meeting were characterised by bouts of intense equity market volatility – in July, from fears about Greece and the eurozone; in August, following the devaluation of the renminbi (see figure 1). If the market believed the data-dependent principle, we should have seen a visible correlation between rates expectations and the market volatility. At the time, Yellen remarked the FOMC decision would be tied to "unfolding data".

Instead, expectations of a rates change were largely unaffected by the two large regional crises, at least in a direct way. They reacted punctually only to direct Fed declarations.

In fact, the publication of FOMC minutes on July 8 produced a marked increase in the odds of a rate hike. Here, the Fed was signalling unambiguously rates would start to normalise before the end of the year, and expectations of a hike grew throughout the following month, despite the worsening Greek drama, worries about China's slowing economy and a stream of contradictory figures about the real health of the US economy.

A decisive reversal in the market's expectations occurred in August, following publication of a Fed research report on August 18, which questioned the effectiveness of quantitative easing in boosting US GDP and inflation. A week earlier, the People's Bank of China moved to devalue the renminbi, but rates expectations appeared to be insulated from the shockwaves that immediately hit the stock and foreign exchange markets.

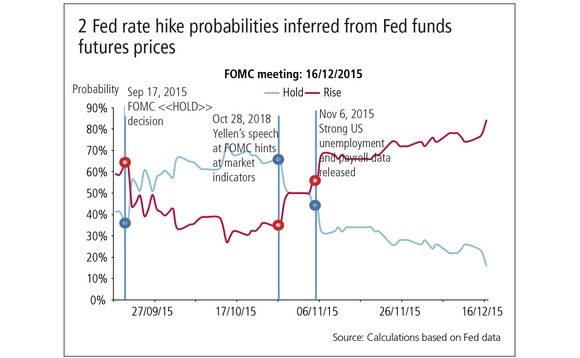

Moving on, the second dataset illustrates rates expectations approaching the FOMC December meeting, in which the long-awaited hike finally arrived (see figure 2). Not surprisingly, the first shift in probability resulted from the hold decision of September 17. Ignoring the October rally in stocks and the stabilising renminbi, expectations of a near-term hike continued to weaken throughout the month, amid forecasts of persistent low inflation.

This pattern changes abruptly with the FOMC meeting of October 28, at which Yellen took a hawkish view. Expectations of a rate hike were brought forward to December. In a single day, the odds of a rate hike surged from 35% to 50%. More importantly, the FOMC press release pointed directly to "labour market conditions" as the most sensible data to be monitored, giving a clear example of guidance on the data that would inform the committee's decision.

This explicit reference to a specific statistical driver helps explain the big reaction in rates expectations on November 6, following the release of a stronger-than-expected unemployment and payroll report. That day, traders adopted a 70% probability of a US rate hike in December and this view would not change significantly before the FOMC meeting.

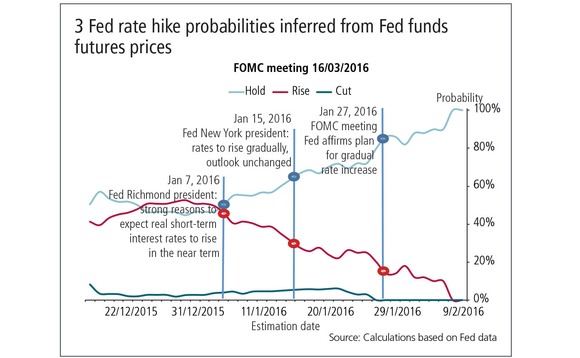

This year, the reaction function visible in futures markets has changed significantly: suddenly, official Fed declarations seem to have lost much of their power to influence expectations (see figure 3).

Figure 3 shows that, in no more than 40 days, the probability of a rate hike in March 2016 cratered from a peak of 52.6% at the end of December 2015 to an astonishing 0% and hovered around very low levels until the Fed hold decision of March 16. That is despite a consistent narrative from Fed officials that rates will continue to rise – each of those statements provoking only short-lived fluctuations from the downward trend.

There is no doubt all the main indicators of the health of the world economy have worsened noticeably: lower expected inflation and depressed commodity prices are taking their toll, both in developed and emerging countries. The Chinese market rout at the start of this year, and the introduction of the bail-in clause in European banking regulation have contributed to a strong bearish attitude in the world's markets. Signals of slackening growth can be seen from the US manufacturing sector, even if the overall picture of the labour market conditions is remaining stable.

So, the Fed has cornered itself in a very effective way.

It cannot ignore the data flows from the markets since it has declared its decision process is data-dependent – and forcing an interest rate increase when the market does not expect it would destroy the founding basis of forward guidance and risk a net loss of credibility that a central bank cannot afford.

Neither can the Fed divert the market's attention towards a particular set of data that would support its narrative about the need for further rate hikes when all indicators are flashing red. It is a checkmate.

The only path open to the Fed was to gradually change its point of view about the broad economic framework, shifting towards a more dovish attitude. There is evidence this has already happened: it was no accident that Yellen referred to the chance of negative rates in her speech of February 11, nor that the meetings in March and April saw hold decisions and a bold revision of forecasts of future rate hikes, from four to two.

Marcello Minenna

Marcello Minenna

But the time left to implement at least two further rate hikes is rapidly shrinking: by October, the US electoral campaign will be entering its final phase, and it would be unpalatable for Yellen to make a strong monetary policy move. Moreover, the probability of a June rate hike remains fairly low, since the Brexit referendum already carries severe political risks; this means the market is now repricing strongly its expectations for the meeting of July 27 and September 21, 2016.

Email: marcello@minenna.it. The opinions expressed in the article are those of the author and do not necessarily reflect the views of these institutions.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Market risk

Repo and FX markets buck year-end crunch fears

Price spike concerns ease as September’s surprise SOFR jump led to early preparations for bank window dressing

Market risk solutions 2023: market and vendor landscape

A Chartis Research report that examines the structural shifts in enterprise risk systems and the impact of regulations, as well as the available technology.

The new rules of market risk management

Amid 2020’s Covid-19-related market turmoil – with volatility and value-at-risk (VAR) measures soaring – some of the world’s largest investment banks took advantage of the extraordinary conditions to notch up record trading revenues. In a recent Risk.net…

ETF strategies to manage market volatility

Money managers and institutional investors are re-evaluating investment strategies in the face of rapidly shifting market conditions. Consequently, selective genres of exchange-traded funds (ETFs) are seeing robust growth in assets. Hong Kong Exchanges…

FRTB spurs data mining push at StanChart

Bank building “single golden source” of trade data in a bid to lower NMRF burden

Asian privacy laws obstruct FRTB data pooling efforts

Bank scepticism and regulatory hurdles likely to inhibit cross-border information sharing

Seizing the opportunity of transformational change

Sponsored Q&A: CompatibL, Murex and Numerix

Doubts grow over US FRTB implementation

Fragmented roll-out would price European banks “out of the market”