This article was paid for by a contributing third party.More Information.

Risk doesn’t wait for market close

Many market participants rely on end-of-day batch systems to perform analytics and, in the current environment, they may see significant negative impacts on their business. Leila Sadiq, front-office risk head of product at Bloomberg, explores how the turbulence caused by the Covid‑19 outbreak renders end-of-day pricing and risk analytics ineffectual, and considers the alternatives

Since the financial crisis that began in 2007–08, an eclectic range of risk management practices have been integrated across the whole value chain, from execution to post-trade. However, significant gaps remain – especially in terms of the ‘when’ and ‘how’ of risk management best practice. While various larger institutions are able to compute and monitor intraday risk, many market participants still rely on end-of-day batch systems to perform analytics – which, in the current environment, could have a significant negative impact on their business.

The main problem is that Covid‑19 renders end-of-day pricing and risk analytics ineffectual, if not obsolete. Extreme volatility and unprecedented daily swings in market activity, alongside fundamental changes in market structure, have left some risk managers and risk-takers with access to limited information, and unable to make informed decisions. Waiting for an overnight batch, or even the next day, to act means valuable time can be lost, potentially coming at a financial loss for the organisation.

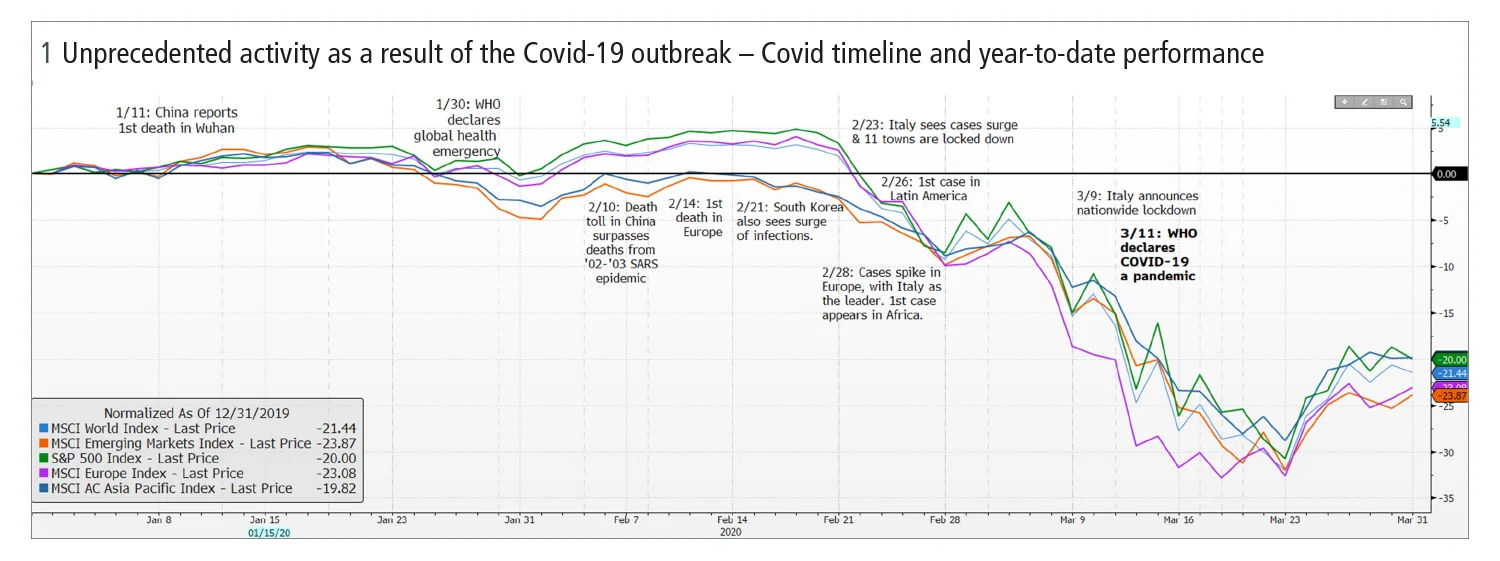

Examples of unprecedented activity abound. We’ve seen massive selloffs across various markets and a significant increase in volatility, with the Chicago Board Options Exchange Volatility Index reaching 82. West Texas Intermediate futures went negative for the first time in history. Meanwhile, in equity markets, there have been rallies followed by drawdowns followed by rallies within the same day (see figure 1).

In the shifting sands of this environment, looking at overall market value – delta and vega – during the day is vastly different to end-of-day risk reports. Traders and portfolio managers executing hedges based on their end-of-day risk may have found themselves exposed to huge drawdowns. In periods of extreme volatility, any hedges need to go beyond local Greek exposures to incorporate a broader set of macro scenarios, as well as granular term structure risk. Waiting for end of day can double or triple the cost of hedging – or even send it in the opposite direction.

Meanwhile, unprecedented market structure changes – such as low US interest rates and negative oil prices – have precipitated system failures, impacting some firms’ ability to meet their reporting obligations. Systems unable to cope with such changes pose a serious business continuity risk for those firms that continue to use them.

Lessons learned – Intraday scenarios and agility

Although Covid‑19 has created a turbulent environment for financial markets, some clear lessons have already begun to emerge.

First, it has brought the ‘when’ of risk management to centre stage. The reality is that, in extremely volatile markets, understanding risk exposures in real time means you will be better equipped to take the best actions to mitigate them and protect the interests of your organisation. Relying on an overnight batch or the next day is no longer a dependable way of doing business.

Another lesson learned is the importance to firms of upgrading their scenario analysis and modelling capabilities to be able to weather such turbulent market conditions. Having flexible and robust scenario analysis can prove an essential lifeline when everything else might be failing.

Agility is also essential – firms must be able to deploy features and fixes to deal with issues sparked by huge market structure changes. They need access to the right information at the right time to know where they stand. They also need to build relationships with the right vendors that are nimble and can provide new features and fixes in a timely manner.

Bloomberg’s solution

Bloomberg’s Multi-Asset Risk System (MARS) offers a comprehensive suite of risk management tools that delivers consistent, consolidated results powered by state-of-the-art models and cross-asset pricing libraries. Intraday and end-of-day risk analytics sit side by side within MARS. Sensitive to the huge structural changes of recent months, Bloomberg is able to respond quickly and update models in an appropriate and timely manner.

MARS offers a flexible and transparent scenario and risk engine that encompasses historical market moves and customised shocks. Bloomberg’s MARS provides transparency, scale and agility to customers in an ever-changing market environment.

The seamless integration of diverse but related tools means a single system takes care of pre-trade, idea generation, market moves, trading workflow and risk management.

Covid‑19 has shown market participants that their systems need to be agile and provide intraday and robust analytics. Being complacent with what you have won’t prepare you for the unexpected. Visibility is the first step towards informed action – if you can see the present clearly, you can prepare for the future.

Covid-19: Pandemic risk – Special report 2020

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net