This article was paid for by a contributing third party.More Information.

Why credit risk managers need to see around corners

The Covid‑19 pandemic – and the subsequent extreme volatility – has exposed the fragility of long-established market and supply chain systems, affecting borrowers’ ability to repay debt. David Croen, global head of credit risk products at Bloomberg, details the need for firms to identify credit risk early on, and be able to make informed decisions to prevent negative impacts

Volatility driven by Covid‑19 has exposed the fragility of market and supply chain systems. In these times of turbulence, identifying signs of distress that may impact a borrower’s capacity to repay debt, or a customer or supplier’s capacity to meet its obligations, has proven critical. As the economic downturn continues, the importance of understanding credit risk will only increase.

Firms that evaluate credit on a periodic or quarterly basis have found themselves particularly exposed, if only by the sheer speed and scale of the changes. Between January and April 2020, a company might have gone from looking ‘healthy’ to being distressed or even declaring bankruptcy. There are no such things as bad loans, only loans that go bad, as the old adage goes. Keeping abreast of credit risk developments in times of volatility is a key challenge for all traders, front-office staff and risk managers.

With central banks supporting markets by purchasing specific securities, evaluating credit risk runs into an extra level of complication. The moral hazard is apparent – once the US Federal Reserve checks in, can it ever really check out? And, if it does, what could happen to credit? What do these vast and determined purchasing schemes mean for market structure?

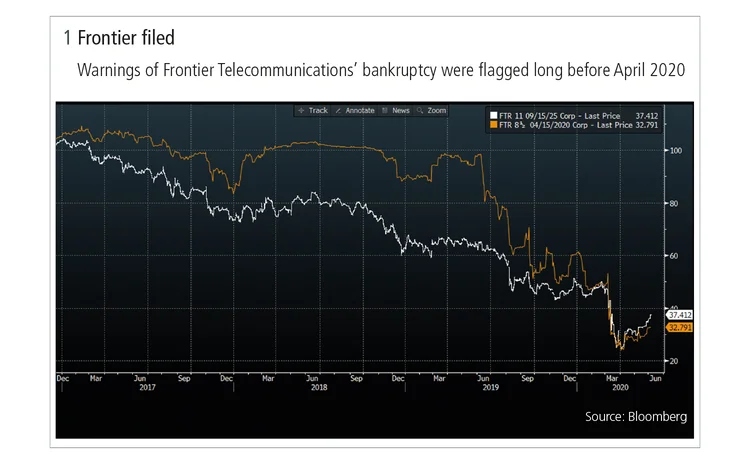

Price does not always indicate risk. Frontier Telecommunications, for example, filed for bankruptcy in April 2020. Bloomberg’s analytics flagged a rise of default risk beginning as early as 2017, but the bonds did not deteriorate substantially until 2019.

Figure 1 highlights how Frontier bonds responded to the firm’s crumbling credit condition.

Firms need to understand the borrower’s ability to pay as well as the externalities that may impact it.

Lessons learned – Looking ahead

Covid‑19 has shown a need to identify credit risk early on – to see around corners, so to speak – to keep abreast of changes and make informed decisions before the worst happens.

The first task is identifying credit risk. Questions that firms need to ask themselves include: What is the risk of default? In the event of a default, how much can the investor expect to recover? How long could that take?

Then there could be factors such as correlation risk. If a bank lends to a coal mining company, it will need to understand the general state of affairs in the coal mining industry. Technological change is also a consideration as new solutions – such as alternative energy – disrupt old business models.

Pricing, as previously mentioned, should never be the sole measure of risk. Another measure is performance. Is a company paying its bills on time? Beyond this, what is the probability of default? The ability to calculate probabilities of default regularly and dynamically in near real time is crucial for risk assessment – especially in times of Covid‑19 and economic volatility.

As for monitoring credit risk, comparability is a useful assessment measure. Comparing credit default swap (CDS) spreads, for example, may be a good place to start, if prices are available and executable.

Systems need to be in place to watch out for daily developments – waiting until the end of the quarter could mean missing valuable clues and perhaps missing opportunities.

Bloomberg’s solution

Bloomberg’s Multi-Asset Risk System for Credit Risk (MARS Credit Risk) consists of three key elements. First, it provides a comprehensive suite of credit risk analytics, including full calculations of default risk across a term structure of three months to 20 years, model-implied CDS spreads, loss given default, and support for other analytics.

Second, its extensive coverage includes daily updates for more than 385,000 companies worldwide. It also allows room for analysis of private companies in clients’ portfolios that are not part of the Bloomberg ecosystem.

Third, it offers flexible delivery, reporting and retrieval so that banks, asset managers and corporations can readily integrate it into their own systems and workflows.

A screen-based interface provides analytics on a near real-time basis. From generating early warnings to monitoring markets, companies and moves, to running time series, peer comparisons and history, MARS Credit Risk aligns with current best practices, providing connectivity across the lifecycle of the credit or counterparty, from front office to trading to risk and capital management.

MARS is one of Bloomberg’s ways of helping firms with their predictive analytics.

Covid-19: Pandemic risk – Special report 2020

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net