Model risk management – Special report 2019

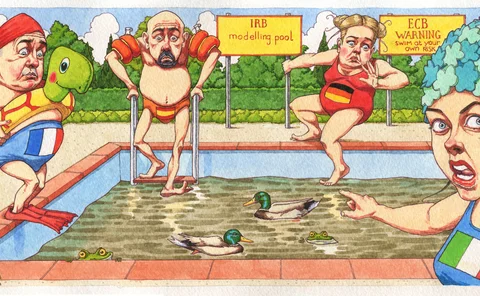

A spectre is haunting Europe – the spectre of model risk. Launched in 2016, the European Central Bank’s (ECB’s) Targeted Review of Internal Models (Trim) has forced a step-change in attitudes among European lenders towards ensuring their capital models are fit for purpose. In keeping with other regulators worldwide, the watchdog’s team of inspectors is visiting banks to check everything from internal governance processes to the data inputs that underpin modelling assumptions.

If the early evidence from the review is anything to go by, banks still have significant work to do to get their houses in order. The latest set of findings, on the safety and soundness of banks’ market risk models, landed in April – and made for grim reading. Of 30 banks that had been subjected to supervisory visits, the ECB found, on average, 32 issues with modelling practices – with, on average, nine issues deemed severe.

The review is already proving costly to lenders – and not just from a compliance point of view: ABN Amro cited changes made to its modelling practices as driving a €1.3 billion jump in credit risk-weighted assets during the first quarter of this year – implying the regulator thought its models were not adequately gauging the credit risk in its loan portfolios previously, necessitating a top-up.

Download the full 2019 Model risk management special report in PDF format

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

Not random, and not a forest: black-box ML turns white

Bayesian analysis can replace forest with a single, powerful tree, writes UBS’s Giuseppe Nuti

Converging on sound model risk management practices

Although most banks are progressing rapidly towards a certain standard in MRM practices, the rate of progress is uneven and so are the ambition levels. Management Solutions provides a summarised overview of the state of MRM evolution and how banks are…

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements

Finally, a professional group for model-risk managers

As models of all stripes crowd into finance, the people who screen them form an association

The disputed terrain of model risk scoring

There is no concord on how banks should police their model risk. But two Fed economists have an idea