This article was paid for by a contributing third party.More Information.

Trends in risk management

The regulatory agenda for the forthcoming 12–18 months will present a diverse set of challenges for risk managers across all segments of the market. The rigours of continued stress testing by national regulators, imposition of tighter capital adequacy rules and looming collateralisation requirements for uncleared derivatives will mean a renewed focus for firms of all sizes on reporting data quality and risk alignment, as this global survey sponsored by SunGard reveals.

Beyond compliance

A plurality of firms ranked understanding their organisation’s overall level of risk and its decomposition in respect to regulatory capital adequacy as their most important priority in the short term. Overall, however, a greater number of firms cited assessing their own risk appetite framework and passing enterprise-wide stress tests as their priority, though they assigned varying degrees of importance to this. The trend towards capturing risk at inception and reporting at a higher frequency across risk types is prominent. The most common constraint preventing managers from doing their jobs properly, firms said, was poor-quality or inconsistent data inputs. The primary constraints at smaller banks – those with total assets of between $2 billion and $10 billion – were an inadequate company-wide understanding of risk, and an inadequate number of staff to perform daily risk production functions.

Large banks ($200 billion–$500 billion in assets) experience, in particular, constraints on the sophistication and capabilities of their risk engines. Firms of all stripes cited issues around the quality of data inputs and analytics processes as the key challenge facing the risk management industry going forward. One European firm said data cleansing and risk understanding for all decision-makers was its key challenge, while another firm based in Canada said data gathering and analytics was also likely to become its key focus.

Trend 1 – Risk pricing at inception

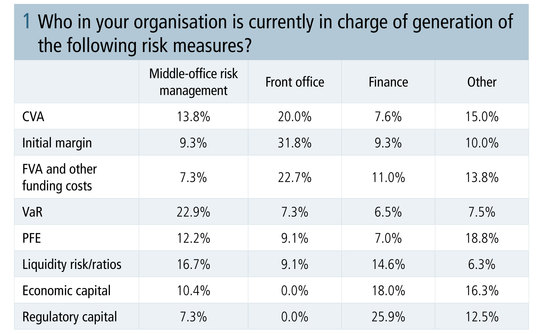

The survey highlighted the importance of risk pricing in the front office, with an overall plurality of firms, 20%, assigning responsibility for calculating credit valuation adjustments (CVA), initial margin requirements (31.8%) and funding valuation adjustments (FVA) and other funding costs (22.7%) to the front office (figure 1).

A large number of Tier 2 banks – those with between $10 billion and $100 billion in assets – also preferred to assign the calculation of potential future exposure (PFE) to the front office (22.2%). A plurality of large banks, 24.2%, also saw calculating value-at-risk (VaR)-based metrics as a job for the middle office, though they tended to allocate calculation of liquidity risk ratios (20.5%), economic capital (19.2%) and regulatory capital (26.9%) to their central finance functions.

Trend 2 – Drive risk alignment

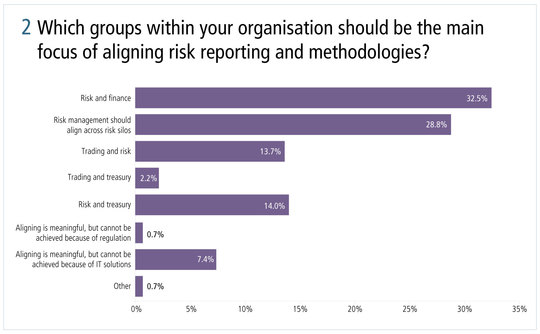

Overall, nearly one-third of firms, 32.5%, said it was the responsibility of their risk and finance departments to ensure risk reporting and methodologies were aligned (figure 2). Almost as many, however, said risk management should be aligned across risk silos. Among Asian firms, that figure was still greater, at 39.4%, compared to 18.9% of firms in the US. A significant minority of firms in the US, 13.2%, said that aligning risk across silos was meaningful, but that it could not be achieved with their current IT systems, indicating a potential willingness for firms to invest in solutions to improve the alignment of risk management across silos.

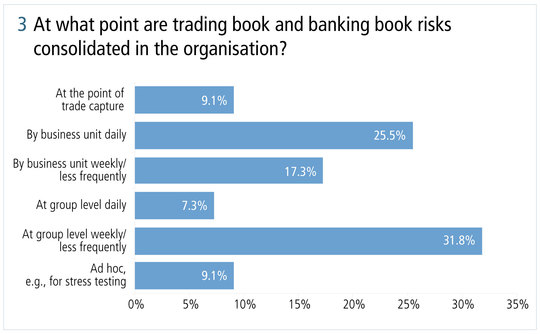

When it comes to consolidating trading book and banking book risks (figure 3), firms showed significant divergence according to both scale and region. Overall, just under one-third of firms, 31.8%, said they did so at group level weekly or less frequently. That figure was higher for larger firms, however, at 44.8%.

Just over one-quarter of firms, 25.5%, consolidated trading and banking book risks daily at each business unit. That figure was far higher among Asian firms, at 44.4%, whereas 30% of US firms and only 9.1% of European firms said they did so.

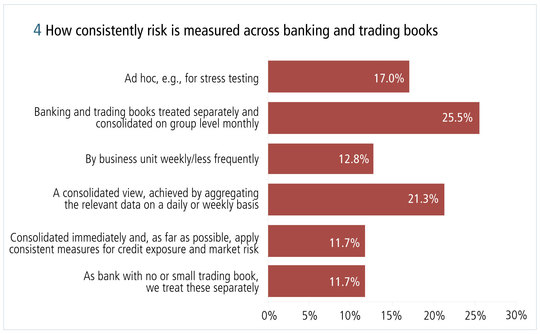

An overall plurality of firms, 25.5%, said they measured risk across their trading and banking books separately (figure 4). This trend was amplified at large organisations, with 38.1% doing so – perhaps unsurprisingly, given the very different valuations and accordant capital treatment assets face when shifted from one book to the other by large banks. In contrast, almost one-quarter of Tier 2 banks, 22.2%, said they consolidated risks immediately, and sought to impose consistent risk measures for credit exposure and market risk measurement as far as possible. Only 14.3% of large firms did so and no medium-sized firms, likely reflecting the difficulty of doing so at firms with diverse, cross-border operations. One firm said developing a unified approach for market and credit risk, both in terms of modelling and management, would be their biggest challenge going forward.

Trend 3 – Right-time risk reporting

There is a clear trend for pricing risk pre-deal and increasing the reporting frequency of key enterprise economic values to at least daily (figure 5). On the calculation of key risk metrics, a majority of firms, 58.3%, said they calculated VaR-based market risk metrics on a daily basis, while half also calculated initial margin requirements on a daily basis. The trend was still more concentrated among larger firms, of whom 57.1% and 75.9% calculated the metrics daily. Sixty-eight per cent of large firms also said they calculated market risk according to greeks on a daily basis, while the overwhelming majority, 81.8%, calculated PFE daily.

Almost half of large firms, 47.8%, said they calculated CVA daily, while just under one-third, 30.4%, did so on an ad-hoc or on-demand basis. Small firms, given the relative scale of their asset base, were able to calculate metrics such as liquidity ratios more frequently, with 56.1% doing so on a daily basis versus 29.6% of large firms.

That trend looks set to change going forward, however, with 56% of large firms saying they hoped to calculate the liquidity ratio metric on a daily basis in future, suggesting a willingness by larger firms to continue investing in sophisticated risk analytics capabilities (figure 5). That trend is reflected across different jurisdictions globally: 36.4% of European firms currently calculate liquidity ratios daily, while more than half, 51.2%, say they should do so going forward. Among US firms, 42.9% calculate the ratios daily, while 50% hope to do so in future. Among Asian firms, 66.7% hope to calculate the metric daily in future, versus 46.2% now.

“These results show how risk management is becoming more prevalent across banks, being used by more stakeholders in new situations, demanding banks to be agile with their risk infrastructures,” says Dan Travers, head of product management, Adaptiv, SunGard.

Dowload/read the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net