Banks making big op risk advances, says Fitch

Fitch surveyed 50 of the world’s largest financial institutions and concluded that the industry has come a long way in terms of establishing methodologies and processes to measure and manage operational risks in preparation for Basel II, the new capital adequacy rules currently slated to be in place by January 2007.

“Based on the survey results, it looks as if many of the global banking institutions are working hard to meet the data requirements of Basel II,” says Gordon Scott, managing director in Fitch’s bank group.

Those that sell operational risk expertise to banks agree. Speaking last month at Risk’s Italy conference in Milan, Renzo Traversini, director of systems provider SAS’s risk management business unit, said processes are now becoming more standardised. “Operational risk systems are becoming more and more stable, and this should lead to an improvement in business processes,” she said.

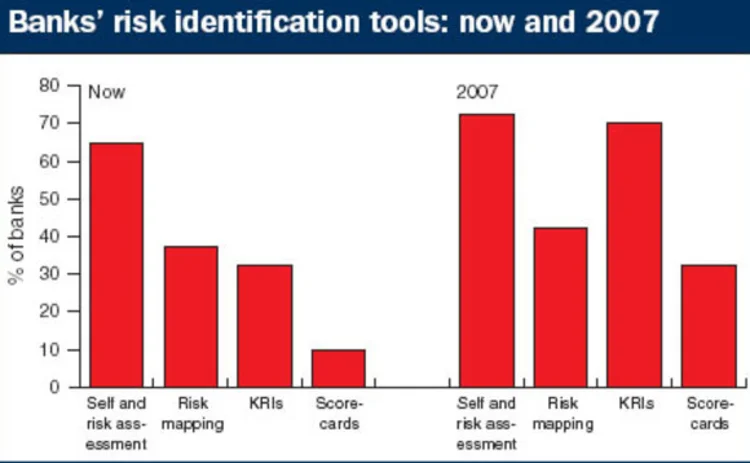

Fitch found that 65% of banks surveyed are already using risk and control self assessments, while 33% have developed tools for monitoring key risk indicators. Some 38% of banks surveyed use risk mapping, with only 10% using scorecards as additional tools. The number of banks using these tools will have significantly increased by 2007, says Fitch (see chart). It also found that only 13% of the respondents to the survey had collected internal data necessary to measure operational risk for one year or less.

But Fitch says significant sophistication is required within an institution to use the full arsenal of tools necessary to derive appropriate capital numbers, and it added that many survey respondents noted that there are inherent challenges in combining these pieces into an integrated approach. These include the difficulty of supplementing the use of internal data with external data and structured scenarios. “Some respondents expressed concern over the high level of value judgement that is necessary in pulling all these items together into integrated models,” says Fitch. It also says that some respondents expressed concern that a reliance on expert opinion could lead to the manipulation of operational risk models.

Scott added that some of the banks surveyed expressed concerns about the quality of the data they have collected.

Banks create a ‘loss distribution function’ for operational risk by either collecting data internally, using external data or coming up with loss scenarios. Fitch says that due to uncertain parameters and data availability, and integrity issues, many of the banks surveyed noted that a high degree of judgement is needed when constructing a ‘best-fit’ statistical distribution for modelling the data.

The big problem with operational risk is that it is much more difficult to quantify at a high confidence level than, for example, market risk, which has the benefit of frequently changing and easily seen prices. Op risk loss events tend to occur less frequently, so there are less data points for analysts to work with. “Thus, in addition to some science, a good bit of art is involved in modelling this risk,” says Fitch.

“It may well be that a bank can model different loss distributions that fit the data equally well from a statistical standpoint, but which produce greatly differing capital charges. Accordingly, this will make it very difficult for banks and regulators to validate the ‘accuracy’ of operational risk models,” adds Fitch.

The new Basel capital Accord lets banks choose one of three approaches to measuring op risk depending on how sophisticated the institution wants to be. Fitch says some of the banks that divulged their estimated capital charges for op risk have found that with the most advanced method – known as the ‘advanced measurement approach’ – their capital charges could be higher than those calculated using the less sophisticated ‘standardised approach’.

“If the Basel Committee’s intended goal is to provide incentives for banks to adopt the more sophisticated risk measurement and management approach, it will be important that the advanced measurement approach generates a lower capital charge than the other less sophisticated approaches,” says Scott.

Fitch added, however, that its figures do not take account of diversification benefits that would lower capital charges with the advanced approach.

“In view of the challenges involved in estimating the correlation between the occurrence of operational events, it is likely that both banks and regulators will struggle with the issue of how much of a benefit to allow, and whether the ‘proof’ provided is acceptable to warrant appropriate capital reduction,” says Fitch.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

EU clearing houses pressured to diversify cloud vendors

CROs and regulators see tech concentration risk as a barrier to operational resilience

Why better climate data doesn’t always mean better decision-making

Risk Benchmarking research finds model and systems integration challenges almost as limiting to effective climate risk management

CanDeal looks to simplify third-party risk management

Six-bank vendor due diligence utility seeks international reach

Market players warn against European repo clearing mandate

Regulators urged to await outcome of US mandate and be wary of risks to government bond liquidity

Italy’s spread problem is not (always) a credit story

Occasional doubts over Italy’s role in the monetary union adds political risk premium, argues economist

Esma won’t soften regulatory expectations for cloud and AI

CCP supervisory chair signals heightened scrutiny of third-party risk and operational resilience

AI spend in US could be good for bonds in Europe – finance chiefs

Development of AI is capital-intensive, but adoption less so, which could favour EU

Climate risk managers’ top challenge: a dearth of data

Risk Benchmarking: Banks see client engagement and lender data pooling as solutions to climate blind spots – but few expect it to happen soon