This article was paid for by a contributing third party.More Information.

Japanese generally accepted accounting principles – CVA accounting

In April 2021, Japanese generally accepted accounting principles (JGAAP) will incorporate credit valuation adjustment (CVA) and debt valuation adjustment (DVA) pricing for derivatives portfolios. With several challenges left to overcome and the deadline looming, firms have limited time left to take action. Banks need to prepare for JGAAP CVA changes now

Adopting CVA to reflect the fair value of derivatives has happened more slowly at banks in Japan compared with Europe, the Middle East and Africa, and the Americas. However, in April 2021 JGAAP will require firms to account for their derivatives exposures using both CVA and DVA for the first time.

Japan’s larger financial institutions have incorporated a range of valuation adjustments (xVAs) into their pricing and risk management processes in recent years, but the take-up among smaller entities has been slower. According to Hiroyuki Yoshizawa, executive director, pricing valuations and reference data, IHS Markit Group Japan, the April 2021 JGAAP deadline is a “significant change for local and regional Japanese banks that will be using CVA and DVA for the first time”.

When Mizuho Bank restated its profits using Basel III methodologies for the first time in March 2019, the megabank was forced to write down the value of its derivatives portfolio by JPY30 billion ($270 million). But, according to Yoshizawa, the issues facing smaller financial institutions in Japan in implementing CVA and DVA pricing for JGAAP is adoption of technological and operational processes rather than market-related issues.

Five challenges

With larger institutions having implemented CVA into their business structures, they already have the systems, market data and, most importantly, the people in place to absorb the changes to the JGAAP rules. However, this is not the case for Japan’s regional banks. According to IHS Markit research, several institutions in Japan will be required to start accounting for their CVA and DVA exposures for the first time in April 2021. Yoshizawa says the majority of them face five challenges to implementing the updated requirements into their pricing and risk management protocols.

1. Technology

The first of these challenges is technology.

Revised JGAAP will require CVA/DVA figures priced at fair value, and computation of the end-results will mean a significant step-up in the technological infrastructure required by the financial institutions. Market-standard CVA/DVA calculation will require an increase in computing power compared with traditional market risk value-at-risk; while computing requirements for xVA sensitivity for hedging increases requires a similar increase in technological capability.

To help firms overcome this challenge, IHS Markit provides daily and real-time credit default swap (CDS) pricing data, which is a core input for CVA pricing and modelling. It also offers a monthly CVA/DVA calculation service using a risk engine that has been tested and proven at tier one banks for their internal model method (IMM) approvals. This range of capabilities means that banks looking to meet their JGAAP CVA/DVA requirements can use IHS Markit’s CDS data service to power their calculations, or they can opt to fully outsource the process using IHS Markit’s analytical service.

2. Model risk

Once the technological issue has been addressed, banks face model risk. A key aspect of CVA/DVA calculation is calibrating models to ensure firms’ prices are in line with market consensus and behaviours, and this applies equally to an external provider as an in-house system, says Yoshizawa.

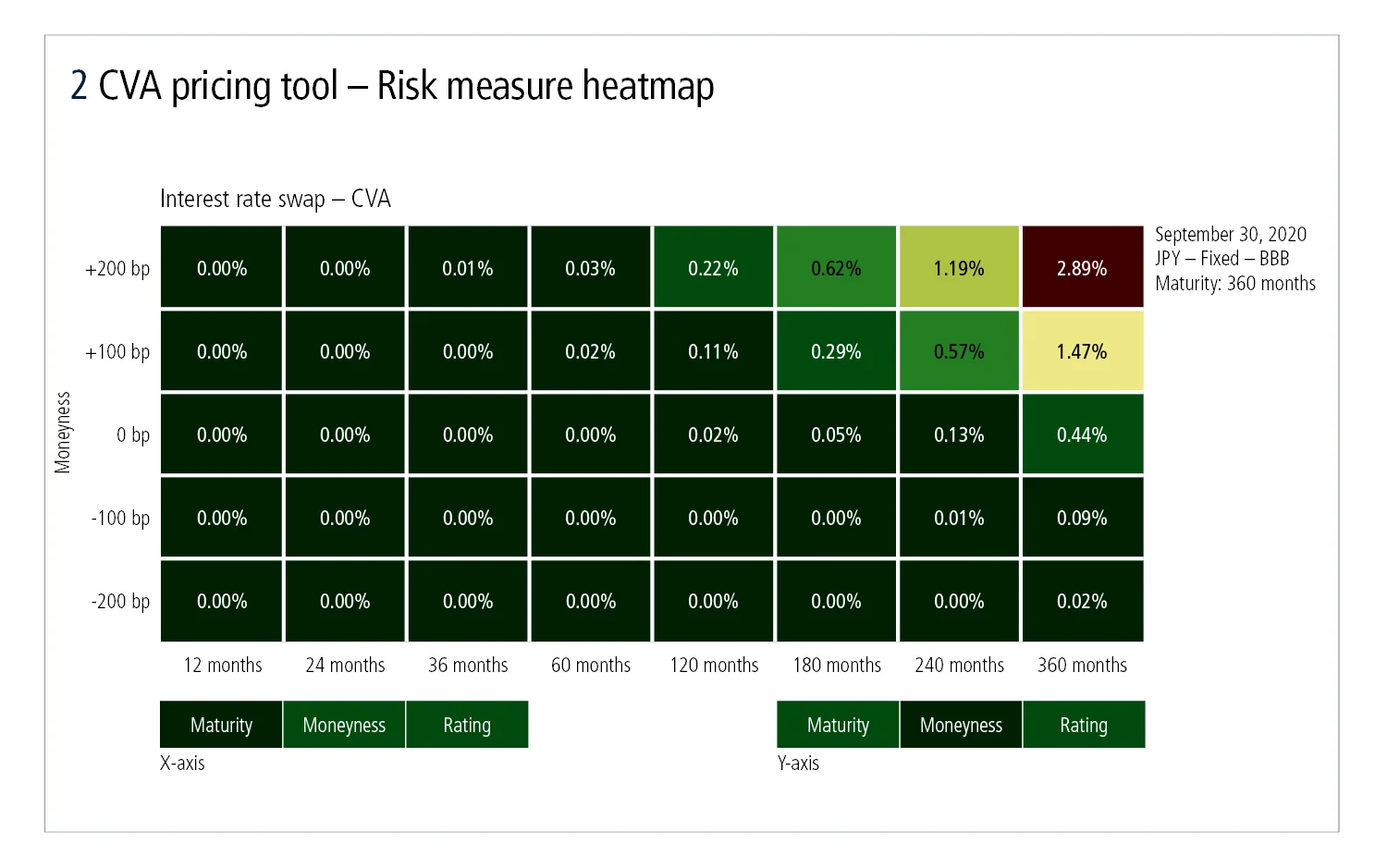

“If they outsource their calculation, banks need to assess whether the vendor can calculate the appropriate scenarios. The optimal way is to validate the transactional data available when banks execute in the market and compare with their CVA pricing. IHS Markit provides a consensus service for over-the-counter (OTC) derivatives valuations globally, and backtests the output to validate the model calibration. IHS Markit also offers a CVA pricing tool, which has the same model and input data and is part of the CVA calculation service.”

3. Accurate market data

The third challenge is ensuring the model is populated with accurate market data. In order to obtain the correct CVA and DVA figures, banks must calculate the probability of default (PD) as well as the loss given default (LCD).

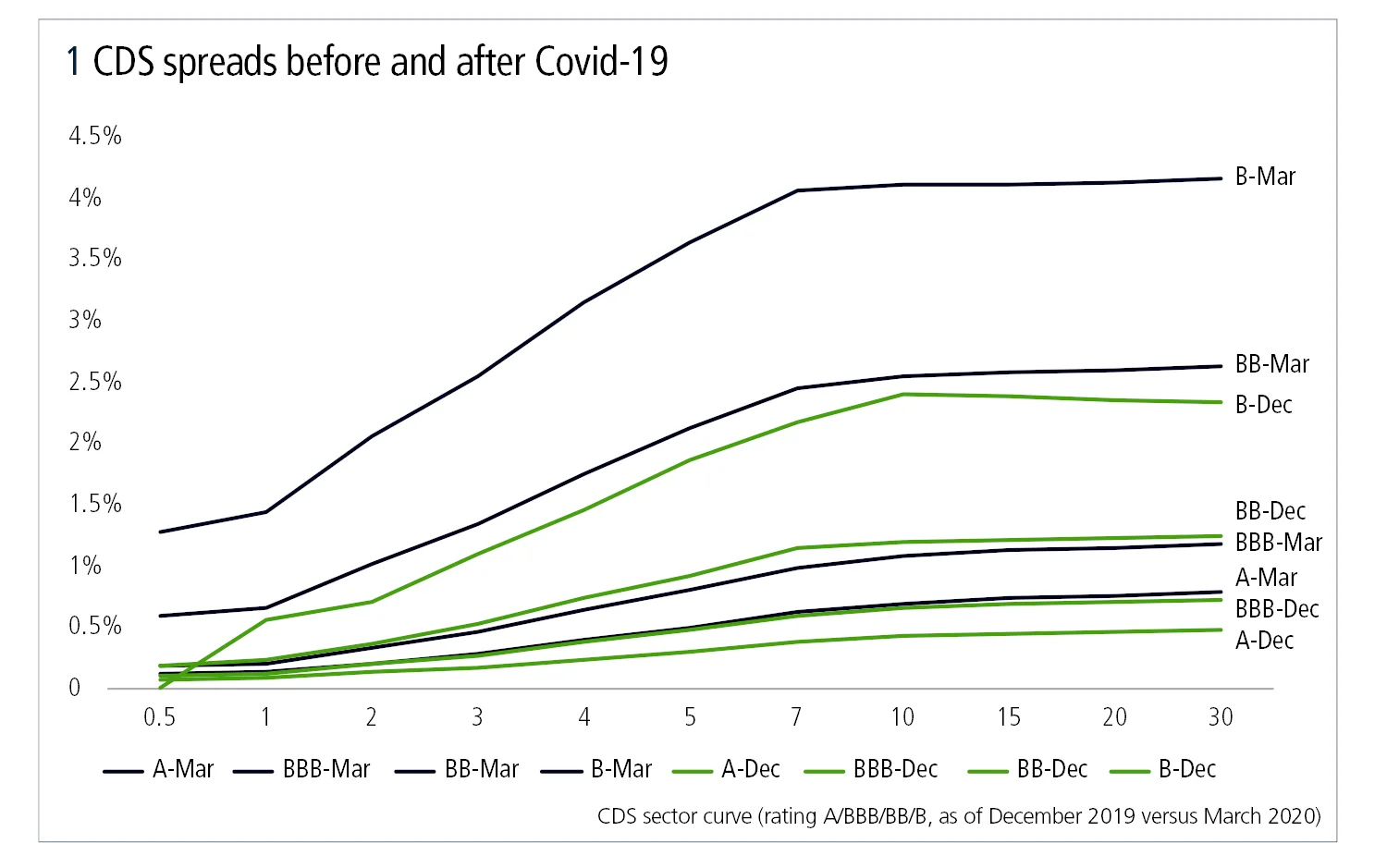

Those dealing with OTC derivatives transactions must come up with values for trades that have maturities covering the short end of the credit curve (less than six months) out to 30 years. Given the wide range of CDS tenors within portfolios, it is vital they use accurate CDS pricing data with a term structure that is based on market consensus numbers and available liquidity.

A lack of liquidity in the Japanese CDS market, particularly regarding single names, is a well-known challenge and one that is even greater for banks that have limited CDS exposures. However, it is possible for firms to find ‘proxy curves’, which are calculated from single-name CDS data using the IHS Markit CDS Sector Curves tool. These figures are derived from best-in-class CDS data that uses the three core insights of rating, sector and region within its factor model.

“Banks need to select the vendors in terms of which ones can provide accurate or market consensus PD and LCD figures – something IHS Markit can do via its industry-recognised CDS Pricing data service,” says Yoshizawa.

An additional benefit from taking an outsourced approach to CVA/DVA calculation to meet the requirements of JGAAP is that banks will already have the systems in place to deal with later regulatory standards.

“Our risk engine is capable of meeting general Basel requirements so that banks that outsource CVA/DVA calculation to us can also use our platform for future regulatory calculations, as well as meeting JGAAP requirements,” says Yoshizawa.

4. Operational challenges

The penultimate challenge is operational. In practical terms, the new JGAAP requirement to calculate CVA in line with market consensus means coming up with an exit price in the market for each derivatives transaction using qualified market data, such as volatility, skew and correlation. Major banks in Japan already have this capability due to their regulatory-mandated IMMs, but smaller regional firms in Japan need to acquire this skill set quickly. An obvious solution to this problem is to use IHS Markit, which can easily provide a pricing platform that calculates values in line with market consensus.

5. Timelines

The final and most difficult challenge is timelines. Local banks have historically used packaged software to price OTC derivatives. However, upgrading these systems to meet the enhanced requirements of CVA and DVA calculation for JGAAP will be expensive or, in some cases, impossible because the existing software cannot handle the new requirements. If banks are looking to outsource this calculation process, they will need to provide transaction data and counterparty data – as well as the underlying legal documentation related to each trade – in order to rebuild the whole cashflow on vendor platforms.

Japanese local banks with a relatively large derivatives portfolios typically have thousands of derivatives transactions, and the process of outsourcing the related CVA and DVA calculations will be complex and could take several months.

“Outsourcing is not straightforward – there is a lot of information banks need to provide that could take a significant time given the resources and development that may be needed,” says Yoshizawa. “My message to the market is that it needs to make decisions soon and minimise all operational risks where possible. These five challenges need to be addressed in a timely manner, which will help a smooth transition to the April 2021 deadline.”

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net