This article was paid for by a contributing third party.More Information.

SOFR discounting and price alignment transition – Proposal for cleared swaps

By CME Group

In accordance with the principles of the ARRC Paced Transition Plan, we believe that updating the discounting environment for cleared USD swaps from EFFR to SOFR will foster liquidity across the entire SOFR curve. By conducting a single-day transition, we intend to achieve this goal while mitigating any potential risks and ensuing valuation changes.

After extensive consultation with market participants and the ARRC Paced Transition Working Group, we propose the following Discounting & Price Alignment Plan for transitioning to SOFR. We intend to finalize the Plan on December 2, 2019. In advance of that date, we invite and encourage you to provide any final commentary.

Please direct all remarks and questions to Steven.Dayon@cmegroup.com.

Scope: Cleared US dollar interest rate swap products, comprising:

We believe market practitioners should continue to evaluate a future date for transitioning additional IRS currencies that contain a US Dollar-funding component, taking into consideration potential impacts on adjacent FX forward and cross-currency swap markets.

Timing: We are targeting a discounting transition date of October 16, 2020, with the dual aims of accelerating the timeline outlined in the ARRC Paced Transition Plan while providing adequate notice to market participants, in order to facilitate orderly transition.

Process: After close of business on October 16, 2020, CME Clearing will conduct a standard end-of-day valuation cycle, determining variation margin and cash payments as calculated with EFFR-based discounting and price alignment (“discounting/PA”). Upon completion of this initial cycle, CME Clearing will then conduct a special valuation cycle, determining variation margin and cash payments as calculated with SOFR-based discounting/PA.

Cash Compensation: To neutralize value transfers attributable to the change in the discounting basis, the special cycle will include a cash adjustment that is equal and opposite to the change in each cleared swap’s net present value (NPV) resulting from the discounting.

Cash compensation example

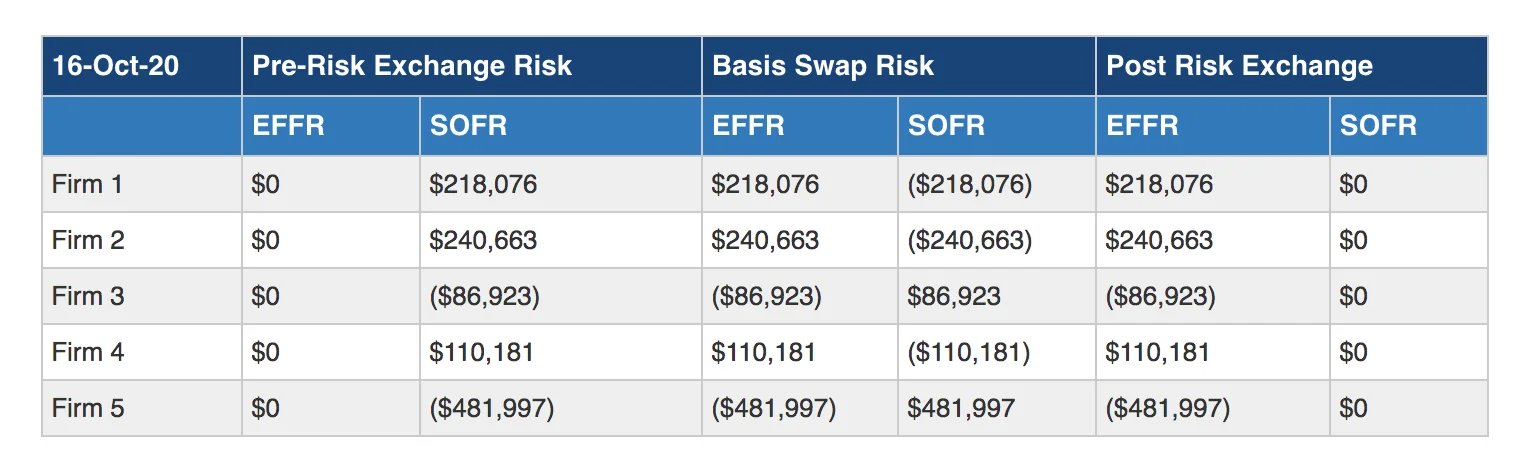

Discounting Risk Exchange: The transition would effectively move the discounting risk of all participants from EFFR to SOFR at closing curve levels on October 16, 2020, as illustrated by the hypothetical examples below.

To mitigate both the hedging costs associated with this transition and the sensitivity of valuations to closing curve marks on October 16, 2020, CME will book a series of EFFR/SOFR basis swaps to participants’ accounts. Such basis swaps will restore participants’ positions to their original risk profiles and will be booked at closing curve levels ($0 NPV) as of October 16, 2020. The hypothetical examples below illustrate the proposed process. (Note that such risk exposures would be bucketed and exchanged at key benchmark tenors during the actual transition.)

To facilitate smooth operational processing, market participants would be able to choose to have such basis swaps booked as either float-versus-float basis swaps or as pairs of fixed-versus-float swaps with equal and opposite fixed cash flows.

Effective October 19, 2020, and thereafter, CME Clearing will apply SOFR-basis discounting/PA to all US dollar interest rate swap trades.

Risk Exchange Liquidation Mechanism: For market participants who cannot or do not wish to hold such EFFR/SOFR basis swaps resulting from the proposed risk exchange, we intend to engage a third-party provider (or providers) to conduct an auction or similar transfer mechanism whereby participants may opt to offload the positions.

Treatment of Legacy Swaption Exercises: Regarding any Swaption agreement that is entered before the discounting/PA transition is complete and that is intended for exercise into a cleared interest rate swap subject to EFFR-based discounting/PA, we propose the following steps to mitigate the impacts of the transition

- Swaption position holders would identify all open Swaption trades executed prior to a predetermined date (e.g., October 16, 2020, when the transition occurs, or December 2, 2019, when the Discounting & Price Alignment Plan for transitioning to SOFR is expected to be finalized) via a new “legacy” affirmation field.

- Upon exercise of any such open legacy Swaption, CME would calculate the difference in value between SOFR-basis discounting and EFFR-basis discounting and settle a corresponding cash adjustment.

- Counterparties would retain the ability to bilaterally negotiate treatment of any such legacy Swaption trades and, provided both parties agree, to remove the identifier and corresponding CCP cash-adjustment.

We fully support efforts to promote liquidity in the SOFR benchmark, and we look forward to facilitating wider adoption of SOFR in continued partnership with industry participants.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net