This article was paid for by a contributing third party.More Information.

Evaluating the impact of Libor fallback

The planned discontinuation of Libor and other interbank offer rates (Ibors) in 2022 will affect a large number of existing financial contracts based on these benchmarks. According to some estimates, Libor-based contracts – such as interest rate swaps, floating-rate notes and syndicated loans – total more than $350 trillion in notional outstanding value globally

Contracts with maturities extending beyond the Ibor discontinuation date – representing about $35 trillion in notional outstanding value for USD Libor – will need to fall back on a replacement rate; a transition that will likely impact the values of those contracts.

This article analyses the potential impact of Ibor fallback provisions on the value of such contracts, and estimates the amount of repricing that might have already occurred in recent months. Investors with large exposures to such instruments – such as banks, corporations and liability-driven investors – can proactively consider this repricing risk, as it may affect them well before the formal discontinuation of Ibors.

Approaches to calculating Ibor fallback rates

Recent industry-led consultations on Ibor fallback provisions have helped identify the likely replacement rate candidates.1 Although the details are not yet final, the expected fallback provisions would replace Ibor rates with alternative risk-free benchmark rates – such as the US’s secured overnight financing rate (SOFR) and the UK’s sterling overnight index average (Sonia) – plus a spread. The International Swaps and Derivatives Association (Isda) has surveyed market participants on several rate and spread adjustment approaches.

One proposed spread calculation approach – called the forward spread adjustment – would compute the spread using the market prices of derivatives. While theoretically ensuring no immediate value transfer for vanilla Ibor-based instruments, this approach would require a liquid derivative market and is sensitive to the assumptions used in the calculation.

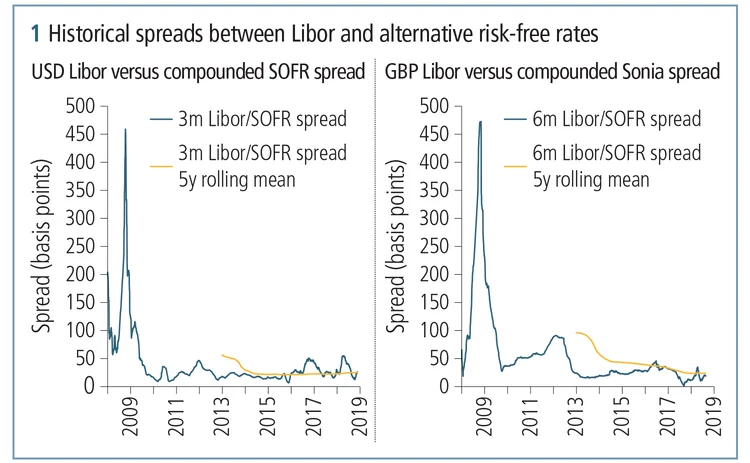

The other, more popular, approach is the historical mean/median spread adjustment, which computes the spread using a long-term series of historical values.2 While this approach is straightforward to implement and based on historical data only, its adoption would likely cause changes in the value of Ibor-based contracts. Furthermore, contract repricing could occur as soon as the market converges on the replacement rate.

What impact might Ibor fallback have?

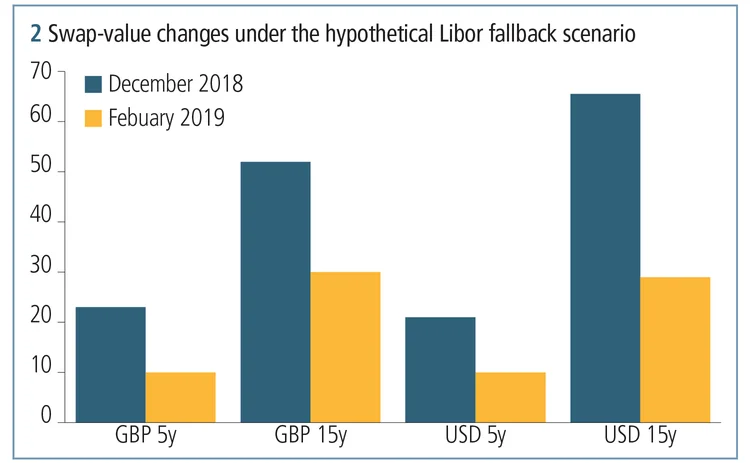

One can gain a sense of whether markets have started pricing in the expected fallback outcome. As an illustration, MSCI estimated the repricing impact for at-the-money vanilla receiver swaps, with remaining maturities of five and 15 years as of the assumed future Libor discontinuation date, under the historical spread adjustment approach.3 Figure 2 shows swap-value changes estimated under the same fallback scenario in December 2018 – prior to Isda’s publication of the results of its consultation – and again in February 2019.

Under this fallback method, the fixed-rate receivers would gain value, while floating-rate receivers would lose value in the event of fallback triggering. However, the repricing impact became less significant over the three months between the analysis dates, indicating that market-forward spreads have moved closer to the historical spread values following publication of Isda’s consultation results.

As this example illustrates, assuming the historical spread adjustment is incorporated into fallback provisions, sudden contract-value changes would occur if market-forward spreads differed from historical spreads at the time of fallback triggering. Therefore, market-forward spreads will likely converge to the historical spread values as the anticipated Ibor discontinuation nears. While such convergence would prevent abrupt value transfer on the discontinuation date, it would effectively mean value transfer had already gradually occurred. In other words, the Ibor forward curve will have changed as a result of fallback specifications. Market participants could act on their existing Ibor trades well before then under this scenario.

Related reading

Notes

1. See, for example:

Isda, Consultation on certain aspects of fallbacks for derivatives referencing GBP Libor, CHF Libor, JPY Libor, Tibor, Euroyen Tibor and BBSW, December 2018.

ARRC, ARRC consultation regarding more robust Libor fallback contract language for new originations of Libor bilateral business loans, December 2018.

ARRC, ARRC consultation regarding more robust Libor fallback contract language for new issuances of Libor floating rate notes, September 2018.

Isda, Anonymized narrative summary of responses to the Isda consultation on term fixings and spread adjustment methodologies, December 2018.

2. The historical spread adjustment method was favoured by more than 60% of respondents to Isda’s December 2018 consultation, making it the most popular approach to spread calculation. The method’s practical viability and low risk of manipulation were cited as primary reasons for its selection by respondents.

3. The setup mimics what would hypothetically happen in the event Libor cessation occurs in February 2022, under the fallback using the historical five-year mean spread adjustment method. Original Libor swaps are forward-starting at-the-money receiver swaps and, in each case, the fallback-adjusted risk-free rate is assumed to be compounded setting in arrears.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net