This article was paid for by a contributing third party.More Information.

The transformational role of the XVA desk

Regulatory changes that are increasingly complicating valuation methodologies are having a transformational effect on the derivatives industry. Satyam Kancharla, chief strategy officer and senior vice‑president of the Client Solutions Group at Numerix, examines how firms have reacted to and tackled these influential regulatory forces to meet new market requirements

The financial crisis that began in 2007–2008 completely changed the paradigm for the pricing of over-the-counter (OTC) derivatives. Because of its systemic economic impact, the crisis launched a mass of changes, particularly in prompting regulatory requirements that impacted the valuation of OTC derivatives. The effect 10 years later has been transformational for the derivatives industry.

Valuation methodology has become complex, and reforms posed profitability challenges to banks. There are many risk factors that affect the price of trades, and the new trading environment brought counterparty risk, funding and capital costs into focus.

This is where XVAs come into play. Today, it is mostly standard practice to adjust derivative prices for the risk of a counterparty (credit valuation adjustment (CVA)) and the risk of one’s own default (debit valuation adjustment (DVA)). Funding collateral also plays a significant role in pricing a trading portfolio (funding valuation adjustment (FVA)), and other adjustments used in practice include the cost of regulatory capital (capital valuation adjustment (KVA)) and initial margin costs (margin valuation adjustment (MVA)). Clearly, the family of XVAs reflects the costs of running an OTC derivatives operation because all XVA costs must be factored in everywhere the price and valuation of OTC derivatives trades are pertinent, such as for pre-trade pricing, profit and loss (P&L), hedging and accounting.

These valuation adjustments have resulted in billions of dollars of P&L impact across the industry. The hits (and gains) to profitability have driven the industry to think about these adjustments more holistically, delving into their relationships and overall impact on not only the profitability of an individual trade, but across the balance sheet.

Research and advisory firm Aite Group authored a valuable report on XVA and risk transformation that examines how firms have reacted to and tackled transformational regulatory forces to meet new market requirements. This article highlights key insights from this and other research, and shares the author’s experience from his years of confronting these issues alongside clients.

The XVA desk

XVAs play a role to varying degrees in a wide range of business groups, depending on the various contexts, including sales, trading, risk management, product control, enterprise risk and treasury. Working out how to organise the management of XVAs is not an insignificant undertaking. While it could be argued that the front office or treasury group should oversee the function, a broad set of stakeholders is impacted by it. This has led to the establishment of what is now known as the XVA desk.

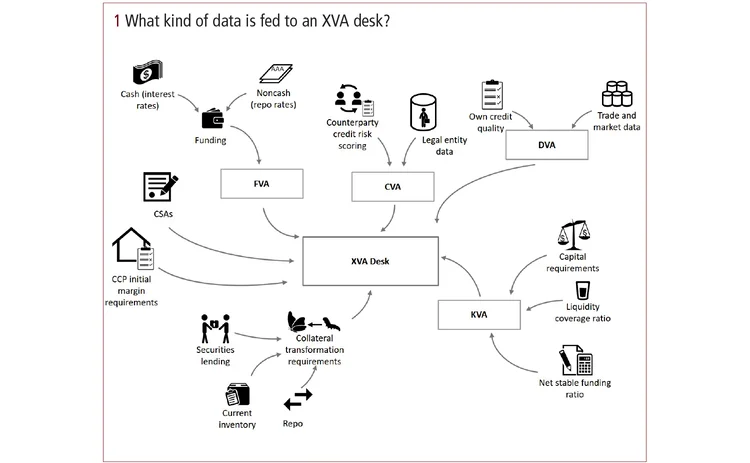

The XVA desk centralises the various valuation adjustments and receives all data inputs for measuring XVAs. XVA centralisation offers significant benefits in terms of best practice, one of which is the aggregation of trades from across different trading desks and asset classes. This allows XVA desks to take advantage of netting and collateral effects in counterparty credit risk (CCR) and funding risk. Firms could minimise collateral usage at both the overall portfolio level and the specific counterparty level, while mitigating CCR.

Measuring XVAs is a hugely complex process that requires different types of compute-intensive calculations, risk factor simulations and very large amounts of data. Sophisticated multifactor modelling (also known as hybrid) frameworks are essential to model XVAs properly, improve the efficiency of XVA analysis and support regulatory demands.

XVA desks also function very much like other desks in managing a book and P&L, and taking hedging or other activities to mitigate risks and cost of capital and collateral.

The data challenges of XVAs

The data aggregation tasks required to support an XVA desk are significant, and the quality of this data is of paramount importance in accurately determining the price of OTC derivatives. This requires siloed parts of a bank to work from a unified set of data. These data inputs are gathered from a range of sources across a firm (figure 1).

Breaking down silos is one of the critical challenges presented by XVAs. Banks culturally and operationally are simply not designed to make it an easy task. Aggregating and marrying data from individual lines of business with no common data models could be far more complex. Integrating processes that have previously been independent can be challenging and akin to navigating cultural and political landmines within an organisation.

Not surprisingly, while the concept of an ideal enterprise‑wide risk data management end-state seems a pipe dream, new technologies have emerged that offer powerful and effective approaches capable of linking front‑, middle‑ and back‑office operations. With real‑time, pre‑ and post‑trade risk analytics and a customisable infrastructure, users are able to reduce compute times and boost efficiency, ultimately leading to better trading and risk decisions.

To learn more

The full Aite report, The rise of XVA and how it transformed an entire industry, is available at www.numerix.com

Read more articles from the 2018 XVA special Report

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net