Quant Guide 2017: University of Florence

Florence, Italy

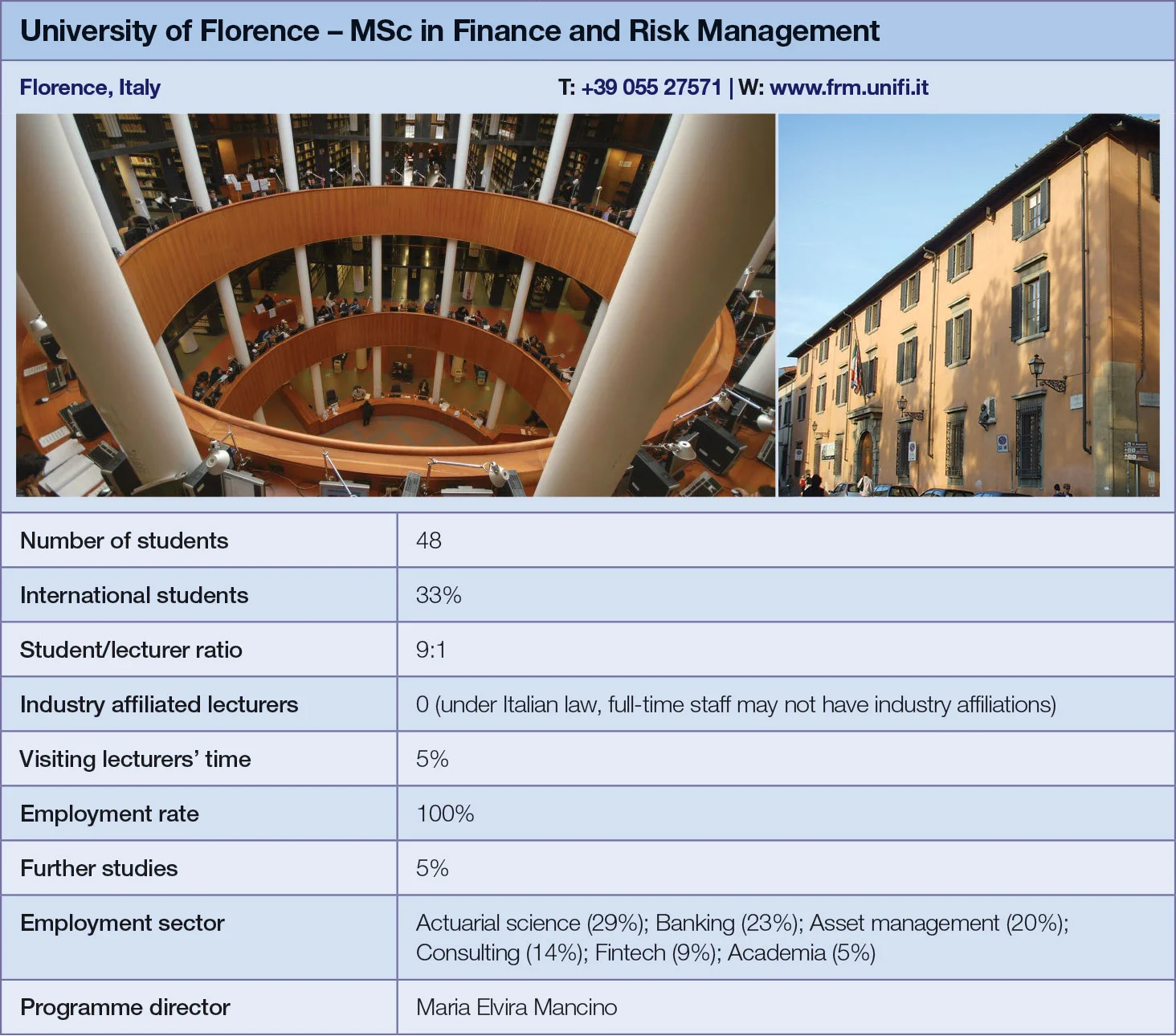

MSc in Finance and Risk Management | metrics table at end of article

While many quant finance schools tout their links with the financial industry, the University of Florence places the emphasis elsewhere. “Some quant finance degrees are very focused on the market or the business side. A large part of this degree is spent covering fundamental matters,” says Antonio Iannizzotto, a professor on the university’s master’s programme in finance and risk management. “Where we want to keep up-to-date is in the workshop space.”

The university website describes the two-year, English-language programme as “a combination of economic theory for finance with mathematical methods – probability theory, statistics, numerical analysis – for finance and insurance”. Students are not allowed to choose their courses until the second year; Iannizzoto explains: “We want to give them knowledge of specific subjects.” The optional subjects are taught in what are known as workshops rather than classes, and cover new topics such as ethical finance or provide additional training in topics covered earlier.

“On the insurance side, we would like to introduce a workshop on innovation in insurance. What we currently teach is classic insurance,” says Iannizzotto.

All but one of the teachers on the programme are academics rather than practitioners. The exception is Lorenzo Parrini, partner at Deloitte, who runs the workshop in advanced corporate finance.

Simone Biondi graduated with the master’s in 2015 and currently works at Bloomberg as an equity analyst. “The master’s was well structured,” he says. “You have a good overview of all aspects of finance: corporate finance, derivatives, computational finance and a little bit of accounting.” There is no cap on the number of students.

Under a recently signed agreement, students can spend their second year at Warsaw School of Economics on the master’s in finance and accounting, obtaining both degrees at the end. In each academic year, up to five students from each of the two master’s programmes can make the switch.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director