Quant Guide 2017: Erasmus University Rotterdam

Rotterdam, Netherlands

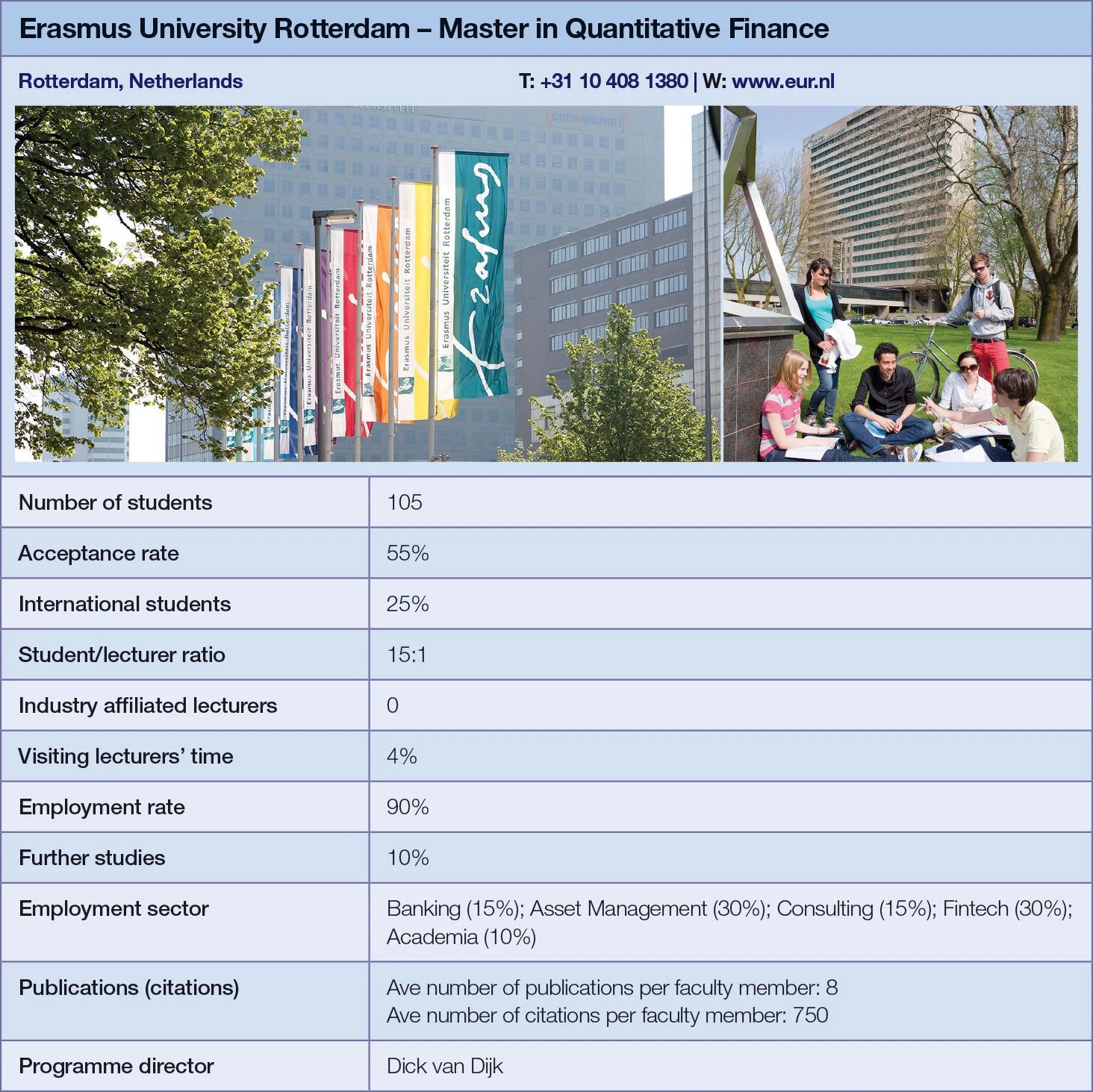

Master in Quantitative Finance | metrics table at end of article

Erasmus University Rotterdam offers a one-year programme focusing on econometrics. Dick van Dijk, the programme’s director, highlights in particular teaching on Bayesian econometrics – a strand of the discipline he says is finding growing application in the industry.

“We find students like it a lot,” says van Dijk. “At first they’re afraid of this Bayesian approach because it’s very different from what they may have seen up until then. But they really enjoy it and often apply it in their master’s theses.”

Bayesian econometrics allows quants to account for uncertainty in parameter estimations. “One good example is asset allocation and portfolio management,” explains van Dijk. “With traditional approaches like Markowitz’s mean-variance methodology, estimates of input values are retrieved from historical data. But recent research has shown it is very difficult to get reliable estimates. A Bayesian approach makes it easier to build both external information and personal views on, for example, the future performance of various asset classes into the portfolio optimisation framework.”

A significant portion of the programme is taken up by a 10-week research project. Here, students have the opportunity to apply the techniques they’ve learned during the programme to practical problems. “Dutch firms, pension funds, insurance companies and asset managers all provide cases and co-supervise the students as they work on these projects,” says van Dijk. “It gives the students actual experience with the possibilities but also the limitations of the econometric tools we teach them.”

Students can also do an internship, although this is not compulsory. About two-thirds of students take up an internship and write a thesis based on it. The other students’ theses are purely academic.

The course, which launched in 2007, is intended for students who have completed a bachelor’s in econometrics or applied mathematics, or can demonstrate relevant knowledge. The master’s programme has expanded rapidly, doubling its intake of students over the past five years from 50 to about 100, and there is currently no upper limit on the number of students that can be accepted.

According to van Dijk, econometrics programmes are becoming increasingly popular across the Netherlands. Erasmus University also offers a one-year pre-master’s programme for any students who do not have the required academic background.

In the next year, the university hopes to add a course on machine learning, introducing techniques such as high-dimensional computing and neural networks. “We find from the industry that there is increasing demand for students who are data scientists and know how to handle very large datasets with machine-learning techniques,” says van Dijk.

Bram Lips graduated with the master’s in 2012 and currently works in fixed-income sales at BNP Paribas in London. Before joining the programme he had completed a bachelor’s in international economics at Erasmus. Lips says the master’s had a strong practical focus and nearly every course featured guest lectures by financial practitioners.

“I think Erasmus University is very well connected to a lot of companies through various study associations and through the institution itself. There are a lot of events, case studies and guest lectures being offered that allow you to get in touch with potential future employers,” Lips says.

One part of the programme Lips particularly enjoyed was the research project. He worked with three other students to build a model for Cardano, a risk management consultancy, predicting currency crises in frontier markets. The students regularly met with their supervisors at Cardano and were given feedback on what to improve. At the end of the project, the students wrote a report on the findings.

“The company explains exactly what they expect from the students, and it’s a very practical application of the theory we’ve learned or have to find out for ourselves based on what we’ve learnt. It becomes evident before you have even graduated from the programme that the skills you learned are valuable and useful for companies in the industry.”

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director