Quant Guide 2017: ETH Zurich/University of Zurich

Zurich, Switzerland

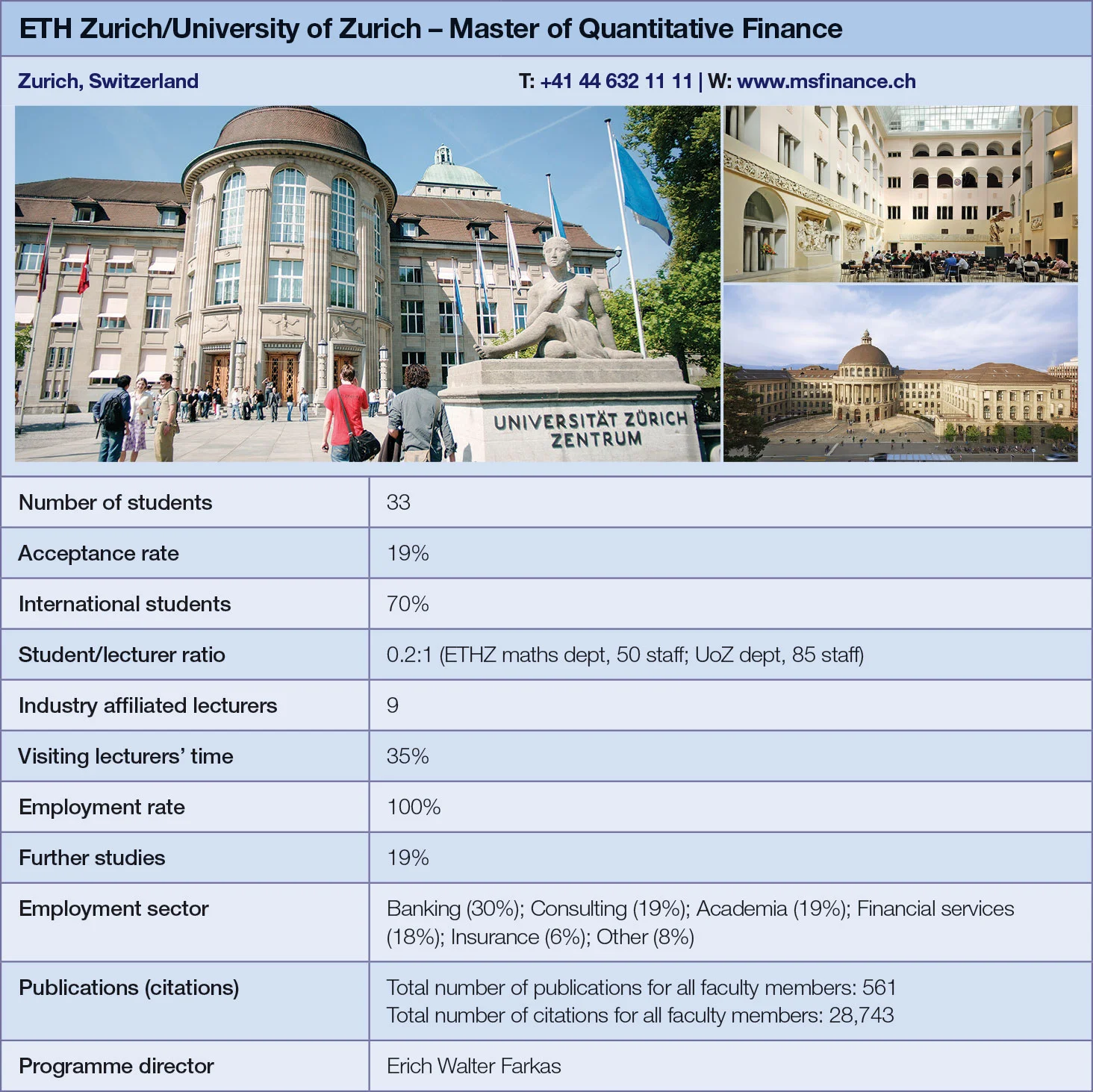

Master of Quantitative Finance | metrics table at end of article

Erich Walter Farkas, director of the quantitative finance MSc programme jointly run by ETH Zurich and the University of Zurich, admits his students currently find themselves in an extremely privileged situation: “We can place all of them very well; at the moment I have jobs, but no people to place.”

The programme was established in 2004. Its curriculum consists of two semesters of coursework, followed by the writing of a dissertation. It is a collaboration between the University of Zurich, represented by its department of banking and finance, and the department of mathematics of the Swiss Federal Institute of Technology, Zurich (ETH Zurich). There are currently 33 students on the programme, but the number of places is not strictly limited – the size depends on receiving applications from qualified students.

The programme provides students with a solid foundation in mathematical methods, statistics, numerical methods and computational aspects. Students are also offered a good background in finance: financial economics, corporate finance and portfolio management. “It’s not just hard-core quant courses. We have about 5–10% go-to consulting companies, where you don’t just need quants,” says Farkas.

Students are required to do five courses in maths and five in finance before they take on any electives that reflect recent developments. “There’s been a slow movement away from classic statistical approaches towards artificial intelligence, machine learning and big data. It’s a request from the industry. Another request is that they’re not only good quants; communication skills are explicitly asked for,” Farkas says.

He stresses that the pool of electives changes every year. In 2018, a group of experts will come in to evaluate the curriculum and structure that can be implemented the following year.

The programme has long-standing sponsoring agreements with five companies: Axpo Trading, Fintegral Consulting, LGT Capital Partners, Swiss Re and UBS.

These companies help finance some guest lectures for the elective courses in the programme. Currently there are 11 elective lectures given by 14 practitioners coming from banks, insurance or financial services. These sponsors also offer students internship opportunities. Students have the option of writing their master’s thesis in collaboration with the sponsorship company and the programme.

The asset management course is taught by Markus Leippold, who is known in the industry for his research on asset pricing, operational risk and credit risk. Paul Embrechts, an influential researcher in statistics and finance, with more than 200 publications in his CV, teaches extreme value theory.

Stefan Roggo graduated from this programme in 2014. He currently works as a financial mathematician for Swiss Life in Zurich. After completing a bachelor’s degree in economics, he interned with the Swiss National Bank and Credit Suisse.

“I wrote my master’s thesis in a joint project with the Swiss Stock Exchange where I had access to actual data, which was very useful for my later work,” he says. “I had a chance to get insights into real data and get in contact with professionals. It’s a really nice feature of the programme.”

He found the quantitative risk management and statistics courses the most useful. “I think it’s important to have experience with data and programming. Programming courses were missing in the programme, and it’s very important in today’s working life,” he adds.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director