Quant Guide 2017: University of Amsterdam

Amsterdam, Netherlands

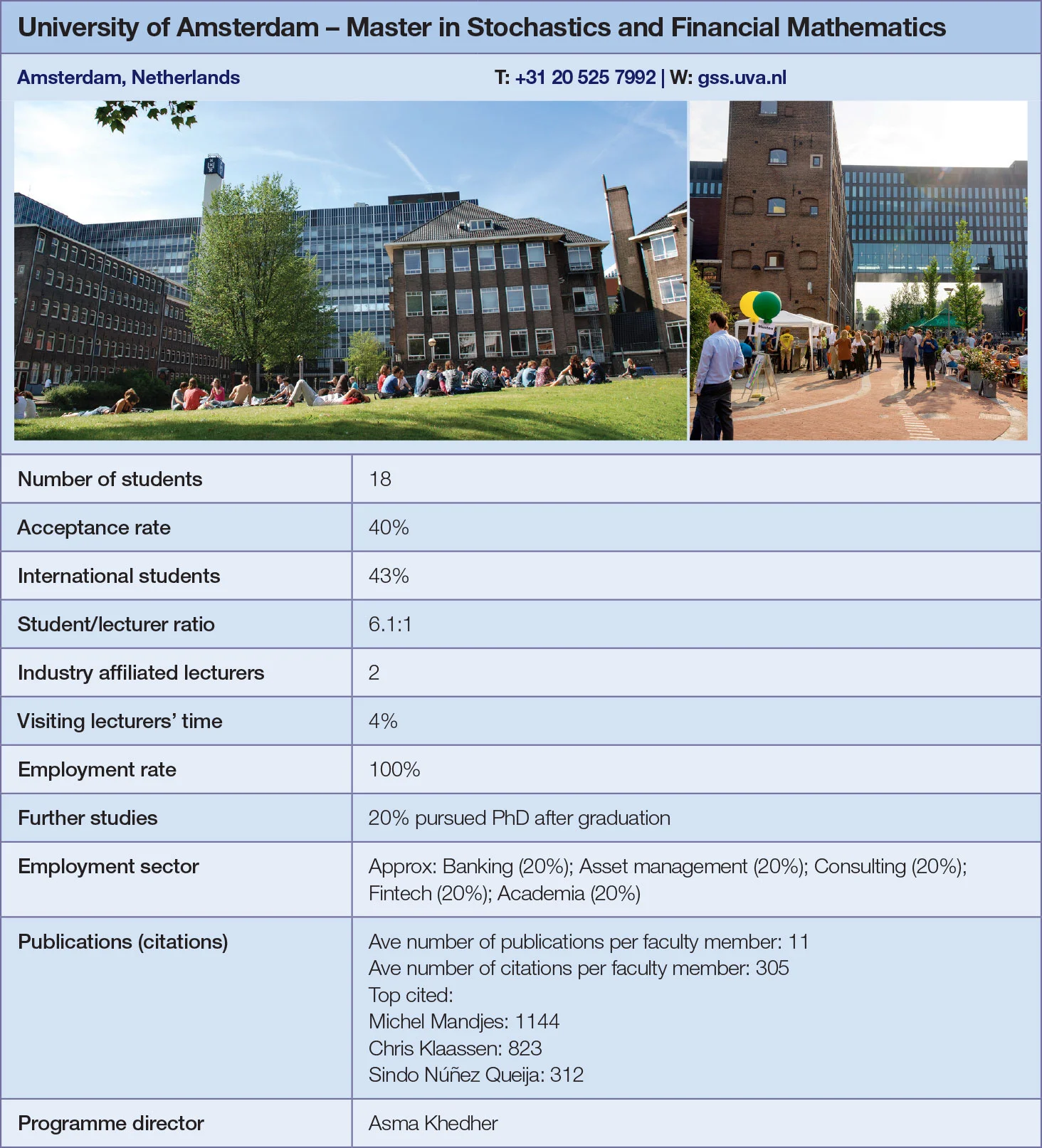

Master in Stochastics and Financial Mathematics | metrics table at end of article

The University of Amsterdam offers a two-year master’s in stochastics and financial mathematics in collaboration with Vrije Universiteit Amsterdam and Utrecht University. In addition to mandatory modules, students have a lot of flexibility in choosing optional courses. They can attend lectures at all three universities and from any other department, becoming part of a much larger community of students and staff.

Established in 2002, the programme has a strong mathematical slant. Most of its 18 first-year students – two-fifths of the usual number of applicants – have backgrounds in mathematics, but some would have studied econometrics. The programme is taught in English.

Asma Khedher, the director of the programme, highlights interest rate models, portfolio theory and statistics for networks modules.

“What makes the interest rate models course attractive to students is that it puts together theory and practice,” says Khedher, noting that she teaches the course alongside Erik Winands, a senior model risk manager at Rabobank.

As of next spring Khedher hopes to introduce a course on backward stochastic differential equations. Malliavin calculus will also possibly be added at a later date.

Throughout the first year, students attend seminars where university researchers lay out their findings and second-year students present their master’s theses. They can also deliver presentations themselves on topics determined by the seminar co-ordinator. The objective of the seminars is twofold: to give students the opportunity to network with those taking different courses and to learn how to present research.

A master’s thesis is a compulsory part of the programme. Thanks to the links with the other universities, students can cast their net wide when choosing the subject. “Machine learning is something many banks are investigating,” says Khedher. “So what we are doing is recommending that all our students go to the computational finance department to take courses there about machine learning.”

The thesis can be either theoretical or based on an internship, in which case both faculty members and industry practitioners supervise the work. Previously students have interned and wrote their theses at firms such as ABN Amro, ING and Rabobank.

The university helps students find internships. “Usually we have our contacts, so the students come to us and then we try to put them in contact with our colleagues from industry,” says Khedher.

This support was one of the aspects that attracted Mark Plomp to the master’s. He graduated in 2013 and is now a pricing actuary at Aegon Blue Square Re. As part of the company’s development programme, every two years he will rotate to a different function.

One reason Plomp opted for the master’s programme was the wide range of courses. “It was really focused on theoretical mathematics, but they provided a lot of freedom to choose courses from economics or econometrics master’s programmes. That really spoke to me,” he says. Programming courses would be a wise choice as he adds that there is an increased focus on data analytics and coding in the industry.

University of Amsterdam has recently started running an annual quants careers event involving representatives from companies. There are also plans for regular guest lectures by practitioners.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director