Quant Guide 2017: Imperial College London

London, UK

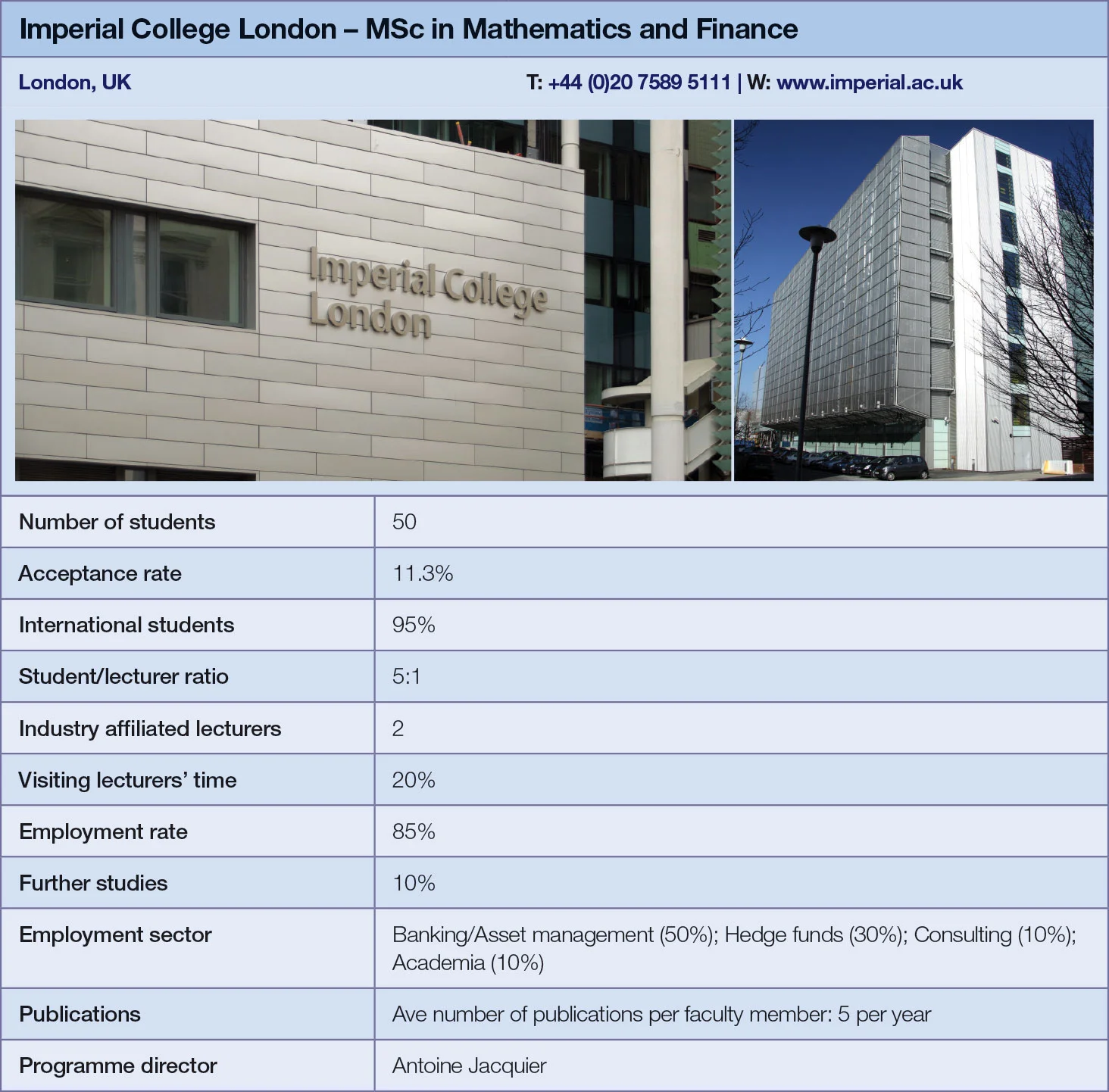

MSc in Mathematics and Finance | metrics table at end of article

Established in 1999, Imperial College London’s mathematics and finance master’s is one of the oldest programmes of its kind.

Each intake consists of approximately 50 students, with a significant proportion drawn from mainland China – a factor amplified by the present weakness of the pound. The programme size is maintained at the same level every year, says Antoine Jacquier, course director, and the admission criteria are kept deliberately rigid.

“We receive a lot of applications from people with financial engineering backgrounds – without a strong mathematics component – and most are rejected. A degree in financial engineering often means that students know options, derivatives, and how to compute and implement basic products, but do not necessarily know the rigorous mathematical foundations,” says Jacquier. “I believe this is dangerous for quantitative roles: as soon as markets change, they may not be able to understand how models react.”

The curriculum is updated periodically, but the main maths components remain unchanged. There are currently nine core modules, including advanced derivatives pricing, stochastic processes, quantitative risk management, interest rate models, and two courses in computing. Students are also encouraged to attend research seminars.

“We recently added more statistics and data components, as well as a course in machine learning and algorithmic trading,” says Jacquier. “Next year, there will be mini-courses in R and Python, and several weekly mini-courses run by industry practitioners: insurance, regulation, big data – the trendy topics.”

The course in algorithmic trading and machine learning provides an overview of various techniques and recent advances in the field. Students will be expected to perform a detailed analysis of popular machine learning algorithms, with a focus on neural networks and support vector machines.

Later in the course, students are introduced to a number of tools originally developed for signal processing applications, but becoming more widely used in finance over the past few years. The course is taught with the use of trading applications that draw on real market data.

Jacquier notes that over the past 10 years the financial industry has undergone significant changes – and so has the typical career of a quant finance graduate.

“People were interested in pricing; now, they’re interested in evaluating their risk. That’s why we’ve added elements such as algo trading and machine learning into the curriculum. We’ve also removed some modules: for example, on exotic options and added more data-oriented modules. People were doing exotics 10 years ago – now most exotics are dead, because even for basic options you have to incorporate pricing adjustments – credit and debt valuation adjustments, and the rest of the XVAs,” he says.

As a result, the profile of an in-demand quant has also changed, he adds: “[The industry] needs more people who know how to handle data, how to program – who understand the maths and the data.”

Programming is an important element of the master’s. The curriculum incorporates C++, as well as Python and R. In a couple of years’ time, the university may add a new programming language: Julia. “It’s more recent, it’s extremely fast and convenient to program with, and its use is expanding,” says Jacquier.

Damiano Brigo, who teaches interest rates models with credit risk, and Richard Martin, who teaches fixed-income markets, are among the professors who have current or past industry affiliations, while being prolific and influential contributors to the financial literature.

Elisa Barbaro, from the class of 2014, joined Citi’s graduate programme, and currently works for the bank in structuring.

“The programme gave me a broad overview of quantitative finance as a subject, which was enough to understand the basic concepts of different asset classes and their technicalities. The master’s prepared me for that: it’s very application-oriented,” she says.

Click here for links to the other universities and an explanation of how to read the metrics tables

Correction, June 19, 2017: This article has been corrected to state that the programme does not, in fact, teach Java.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director