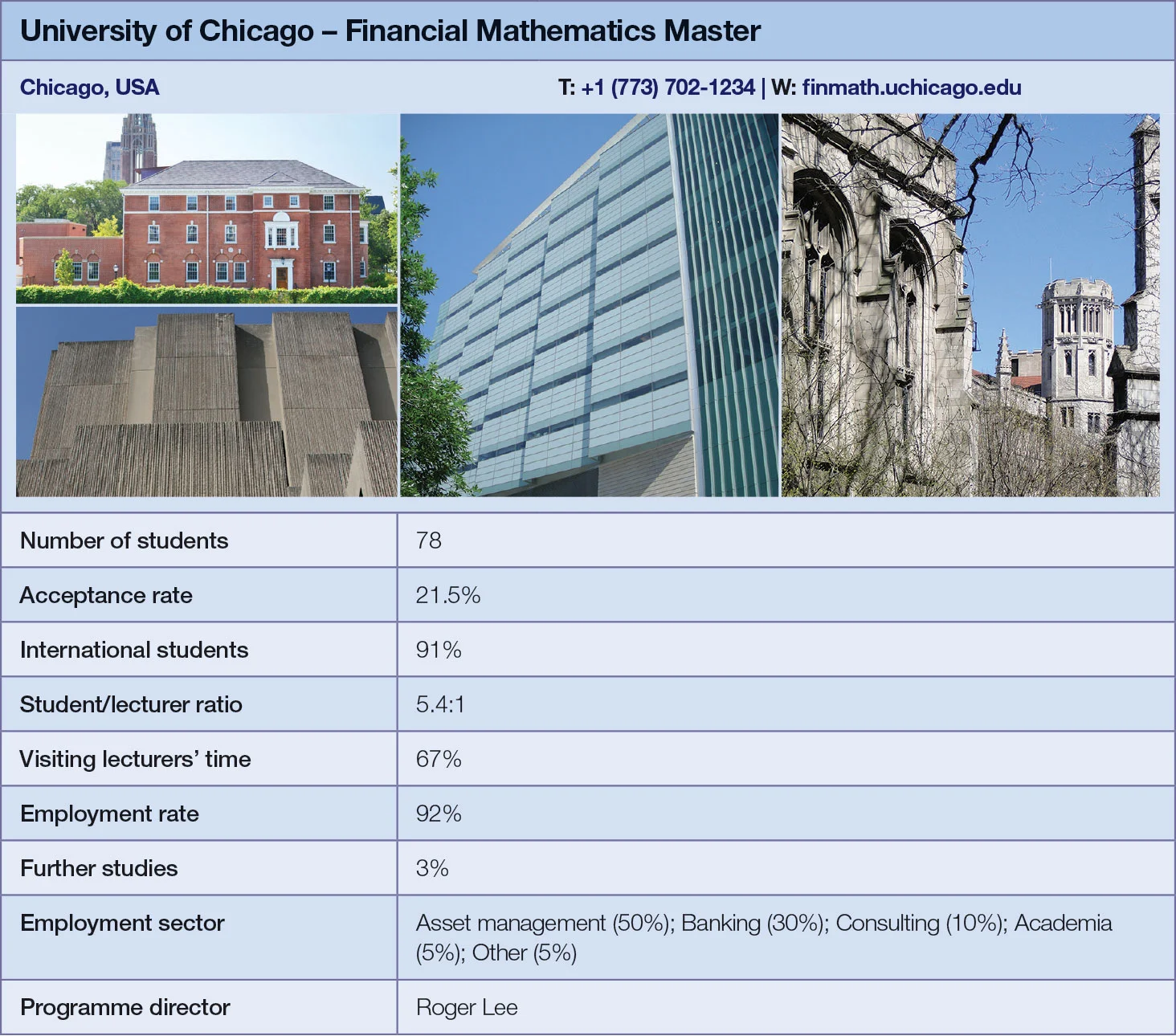

Quant Guide 2017: University of Chicago

Chicago, USA

Financial Mathematics Master | metrics table at end of article

Offering a 15-month programme, the University of Chicago’s financial mathematics master’s provides students with a steady flow of industrial projects and coding throughout the year to complement its local industry connections.

“Being in Chicago we’ve always had the benefit of being a centre of algorithmic and quantitative trading,” says programme director Roger Lee. “We continue to be the world’s capital of exchange-traded derivatives.”

Every quarter, the university hosts a “project lab”.

“Our project lab serves as a clearing house for companies to come in year-round and bring us projects, and be matched with teams of students,” says Lee.

The university has a standardised information sheet where companies specify the nature of the project, their expectations, the required background of the students, and some sense of the project’s scope. This clearing house works both ways, with students able to submit résumés attracting potential industry partners.

“It’s a lot easier for students to get matched with a project lab company than to independently find an internship,” says Lee. “Three-quarters of our students take part in project lab. It’s not a requirement, but it is popular and it’s an elective we recommend.”

A common sequence is to do project lab during the academic year, and then an internship during the summer. Being located in Chicago means the bulk of these projects are sourced from proprietary trading firms and exchanges such as CME or Eurex.

Dedicated computing courses can be found in each of the first three quarters with a focus on C++ and Python. Opportunities to practise coding are further found in various projects across other modules.

“One of the recent changes in our programme is to introduce Python because of the high demand from industry,” says Lee. “These are skills our students have immediately been able to use when doing projects on behalf of companies. Based on the feedback we’ve got from employers, covering both Python and C++ is putting our students in a good position.”

The instructors focus on financially relevant projects, looking into issues such as dealing with live data feeds or connectivity to databases. Another recent change has been the greater emphasis on data analysis and machine learning applied, in particular, to quantitative trading.

Following the crisis the industry has paid greater attention to risk management, a development that has benefitted Chicago, says Lee. “We offer coursework in risk management from a statistical viewpoint and from a portfolio-theoretic viewpoint. We’ve featured those modules for years, and our students have reaped the benefits of that, especially post-crisis.”

This has allowed graduates to take advantage of the added opportunities in risk management, he says. The programme’s connections with local industry have helped it to adapt to new developments.

Networking opportunities are supplied by the career development office and various student organisations which invite practitioners to give talks. One such organisation is the Trading Club. It schedules events specifically tailored to careers in trading. The university has also been successful in competitions, with one of its students winning first place in the ETF Global Portfolio Challenge and a team winning the International Association for Quantitative Finance student competition in 2016.

When the programme was originally established in 1996 it was nine months in length, but in 2014 the programme was expanded. “One of the advantages of this 15-month programme that might not be obvious is that each year, from September to December, you have these overlapping cohorts,” says Lee. “With those three months of overlap, you’re really building bridges and that’s been tremendously helpful from a networking standpoint.”

Jessica Mitra is a vice-president in treasury modelling and analytics at Deutsche Bank, covering models for the trading book. Mitra graduated in 2011 and was impressed with the programme’s teaching. “In the first quarter, Roger Lee taught us option pricing. He explained the Black-Scholes equation and how to derive it very well,” says Mitra. “I have kept my lecture notes and I keep on reviewing them because I am always using one concept or another every day at work.”

Mitra remains impressed by the programme. “They make such an effort with the alumni to update their knowledge whenever there is a new course. There are alumni networking events with keynote speakers and they are a great opportunity to talk to other practitioners. Recently, the professors arranged an alumni day with lectures on the latest topics in quantitative finance.”

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Quant Finance Master’s Guide 2022

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked