First Republic Bank

Bank treasuries should help monitor hidden optionality – JPM exec

Risk Live: JP Morgan ALM structurer calls for greater treasury involvement in product design

Latest FDIC special assessment tougher than 2009 version

Most US banks face higher toll under new methodology

FDIC scrutinised over move to cover all SVB deposits

Advisory panel questions whether guaranteeing uninsured deposits was necessary to prevent contagion

Derivatives house of the year: JP Morgan

Risk Awards 2024: Response to regional banking crisis went far beyond First Republic

Filling the gaps in Basel’s interest rate risk measures

Reverse stress-testing or VAR may work better than existing outlier tests, but are hard to manage

US banks offload FHLB advances after record glut in Q1

First Citizens leads shift, Regions bucks trend

SRB head asks for extra tools to restore faith in resolution

Laboureix disputes Swiss claim that G-Sibs are not resolvable, but wants improvements to framework

Lawmakers ask how big is too big for US banks

JP Morgan purchase of First Republic sparks debate over 10% cap on deposit market share

Lessons on bank resolution, from Silicon Valley to Zurich

After the chaos of SVB and Credit Suisse, is First Republic a model for future bank rescues?

US regionals need at least two years for TLAC transition

Market participants think issuance will be feasible for largest, but only in calmer conditions

US banks load up on time deposits amid liquidity concerns

Charles Schwab leads charge with fourfold increase

JP Morgan heading for highest ever share of US deposits

Acquisition of First Republic helps bolster bank’s status as nation’s biggest deposit-holder

In bank runs and market crashes, it matters how ideas ‘catch’

Contagion episodes show importance of network effects in finance

Three FHLBs increase loans by $150bn in Q1

Atlanta, Cincinnati and Dallas dominate first-quarter lending splurge despite accounting for just 37% of total assets

FHLB advances hit record $1trn as banks scramble for funding

Schwab, Truist and First Republic heaviest users of Federal facility in Q1

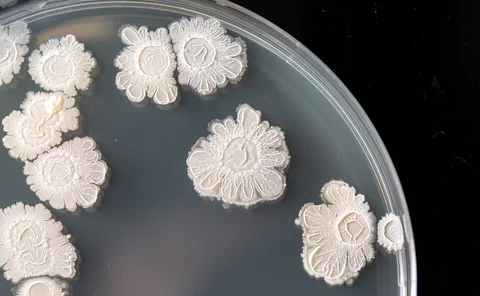

The tweet and the trust collapse: how banks can fall on a dime

In March’s market contagion, experts see lessons in the rapid erosion of confidence

First Republic taps Fed facilities in effort to plug funding hole

Discount window and BTFP provide temporary relief as deposits slump $72bn in Q1

As rates rose, KeyBank unwound 94% of pay-fixed swaps

Sale of AFS hedges left book exposed throughout late 2022, much as at ill-fated SVB

First Republic burned through short-term investments in 2022

Cash and securities maturing within a year went from over- to undermatching short-term funding liabilities

Five regional banks predict lower income from higher rates

IRRBB simulations show lending revenue shrinking as Fed policy gets tighter

At regional US banks, BTFP-eligible securities top $300bn

Assets classified as held-to-maturity made up less than 19% of aggregate securities portfolios in 2022