Pricing options with temporal difference backpropagation

Miquel Noguer i Alonso, Daniel Bloch and David Pacheco Aznar

Preface

Introduction

Markov decision problems

Learning the optimal policy

Reinforcement learning revisited

Temporal difference learning revisited

Stochastic approximation in Markov decision processes

Large language models: reasoning and reinforcement learning

Deep reinforcement learning

Applications of artificial intelligence in finance

Pricing options with temporal difference backpropagation

Pricing American options

Daily price limits

Portfolio optimisation

Appendix

10.1 INTRODUCTION

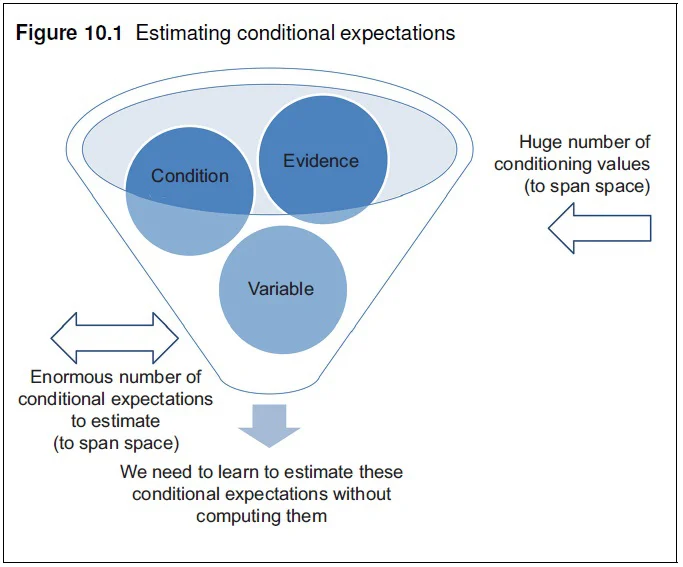

Quantitative trading and risk management require the computation of expectations. However, we need to recompute the risk–return profile as it evolves over time. Hence, we must dynamically modify our positions based on the surrounding environment and hedge against adverse moves. The problem is that conditional expectations are very difficult to estimate from experiments directly (see Figure 10.1).

Existing solutions include the following.

-

Parametric models: conditional expectations of path-dependent events are tied to their ability to capture the dynamics of the underlying stochastic processes.

-

Neural networks: these use data to estimate the implicit stochastic processes driving the dynamics of the future events, although they cannot solve multi-step prediction problems.

-

Reinforcement learning: this allows for computations of path dependent payouts from past data; the temporal difference backpropagation (TDBP) model is a special case (see Section 5.6).

There are wide range of numerical techniques for computing conditional expectations (eg, integration, partial differential equations (PDEs), Monte Carlo simulation and Fourier transform)

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net