Climate risk, ethics, and mega-bankruptcies

Q&A: New York Fed’s Stiroh on climate change and Covid

Co-chair of Basel task force discusses possible supervisory approaches to climate risk

Stuart Lewis, Deutsche’s survivor, confronts Covid-19

CRO talks loan reserves, VAR breaches, and the lessons of a lurid past

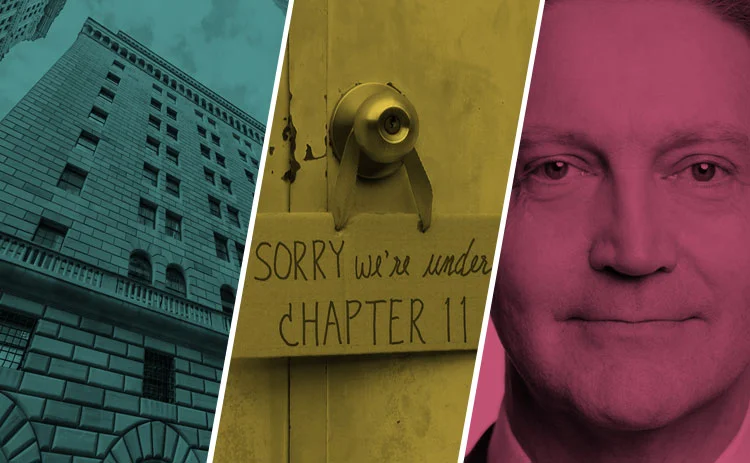

Altman: mega-bankruptcy wave coming

Credit conditions were worsening before Covid, research finds

COMMENTARY: Doing well by doing good

Deutsche Bank’s problems have cost it billions of dollars and four chief executives in the last eight years – but the biggest had nothing to do with financial risks such as mistakes in calling the market or predicting default rates. The bank’s long-serving chief risk officer Stuart Lewis blames the bank’s culture. A focus on revenue at the expense of morality involved the German lender in sanctions evasion, mis-selling, benchmark rigging, and a hands-off approach to wealthy but questionable customers such as Jeffrey Epstein and Donald Trump. All these things have come back to bite Deutsche, which has paid more than $20 billion in fines and settlements since 2008.

Deutsche is an extreme example, but the link between bad citizenship and bad finances is borne out across the market. This week Risk.net looked at new evidence that good environmental and social performance predicts creditworthiness. Well-behaved companies are less likely to incur heavy fines, settlement costs and cleanup bills, as well as being more attractive employers – all of which makes them a better credit risk. (Interestingly, the study found, the predictive value of behaving well does depend on companies having the option to behave badly if they wish. In less-regulated North America, good environmental behaviour means something; less so in greener Europe.)

One regulatory option is to introduce a new disclosure regime and provide markets with the information they need to invest and trade on environmental grounds (which, if the studies are correct, they should be increasingly keen to do from purely financial motives). But that’s raising hackles about the administrative burden of reporting 32 different environmental and social metrics – many based on data that isn’t easily available.

Or regulators can get involved more directly. The New York Fed’s Kevin Stiroh is co-chair of Basel task force on climate risk and favours much greater supervisory effort to prepare for climate risk from a resilience point of view. The US response is hampered by its president’s apparent belief that climate change is a Chinese hoax – but that may change next year under a different government more prepared to deal with the reality of the situation. Not only for corporate borrowers, but for the US and for the world, ethical behaviour, environmental policies and future prosperity are all tied very closely together.

STAT OF THE WEEK

The positive market value of derivatives positions held by international banks leapt 43% over the first three months of the year to $4.4 trillion, the highest level since Q2 2016. Unprecedented market volatility sparked by the coronavirus crisis caused the market values of outstanding derivatives positions to swing around in sympathy with the assets and benchmarks they referenced. The surge was most pronounced, in dollar terms, among UK banks, highlighting the importance of London as a global financial centre, especially as the home of central clearing – Global banks’ derivatives assets hit $4.4tn in Q1

QUOTE OF THE WEEK

“On the one hand, there’s an arbitrariness to the [synthetic Libor] number and it doesn’t matter how you calculate it – you could put last night’s Yankees score on the screen. On the other hand, it is supposed to represent something real and it goes back to the financial realities of whether you have a mismatch between your assets and liabilities” – Anne Beaumont, Friedman Kaplan

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on 7 days in 60 seconds

Bank capital, margining and the return of FX

The week on Risk.net, December 12–18

Hedge fund losses, CLS and a capital floor

The week on Risk.net, December 5–11

Capital buffers, contingent hedges and USD Libor

The week on Risk.net, November 28–December 4

SA-CCR, SOFR lending and model approval

The week on Risk.net, November 21-27, 2020

Fallbacks, Libor and the cultural risks of lockdown

The week on Risk.net, November 14-20, 2020

Climate risk, fixing Libor and tough times for US G-Sibs

The week on Risk.net, November 7-13, 2020

FVA pain, ethical hedging and a degraded copy of Trace

The week on Risk.net, October 31–November 6, 2020

Basis traders, prime brokers and election risk

The week on Risk.net, October 24-30, 2020