This article was paid for by a contributing third party.More Information.

Leveraging a hybrid cloud for better decision‑making

The panel

- Jason Loh, Head of Analytics and AI, SAS Global Technology Practice

- Vincent Caldeira, Chief Financial Services Technologist, Asia-Pacific, Red Hat

- Manish Chawda, Partner, Pragma Singapore Ankita Gupta, Head of IFRS 9 and Model Risk Management Technology, Standard Chartered Bank

- Steven Low, Chief Risk Officer, Prince Bank

At a Risk.net webinar in association with open-source solutions provider Red Hat and analytics services provider SAS, panellists discussed how financial institutions can leverage the hybrid cloud to analyse data, reach trustworthy decisions and maximise profits in the post-pandemic future

Decreased genuine face-to-face interaction during the global Covid-19 pandemic has increased demand for technological efficiency and agility. As part of its strategic planning and digital transformation, the financial services industry has responded by moving towards a hybrid cloud environment.

A hybrid cloud integrates public and private cloud infrastructures, in which organisations can choose the optimal cloud environment for each application or workload. In highly regulated financial markets, organisations must carefully assess their needs to adopt cloud systems, and rely on technologies and orchestration tools that allow them to move across the two environments in order to meet performance, cost, compliance and security requirements.

“Cloud is not just a fancy technology for us. There is a lot of thought process, restructuring, cultural change and regulation that we need to think of before moving to the cloud,” said Ankita Gupta, head of IFRS 9 and model risk management technology at Standard Chartered Bank. She added that, with this in mind, “it has been realised that moving to the cloud can create a host of benefits for financial organisations.”

The webinar’s panellists highlighted the benefits presented by the cloud, including slashed IT costs, flexibility and efficiency brought about by myriad data analytics tools hosted on a public cloud, as well as improved security and even a potential boost for reaching environmental sustainability targets.

Cloud providers nowadays have their environmental, social and governance agendas, which financial institutions can rely on to adhere to their respective net-zero agendas when adopting cloud services.

For a slew of newcomers in the financial sector – such as digital banks – a hybrid cloud provides the efficiency to scale a business up quickly, saves costs at the initial stage and maintains control from both the regulatory and data analytics perspectives. This is the case according to panellist Steven Low, chief risk officer at Prince Bank, a Cambodia-based digital bank.

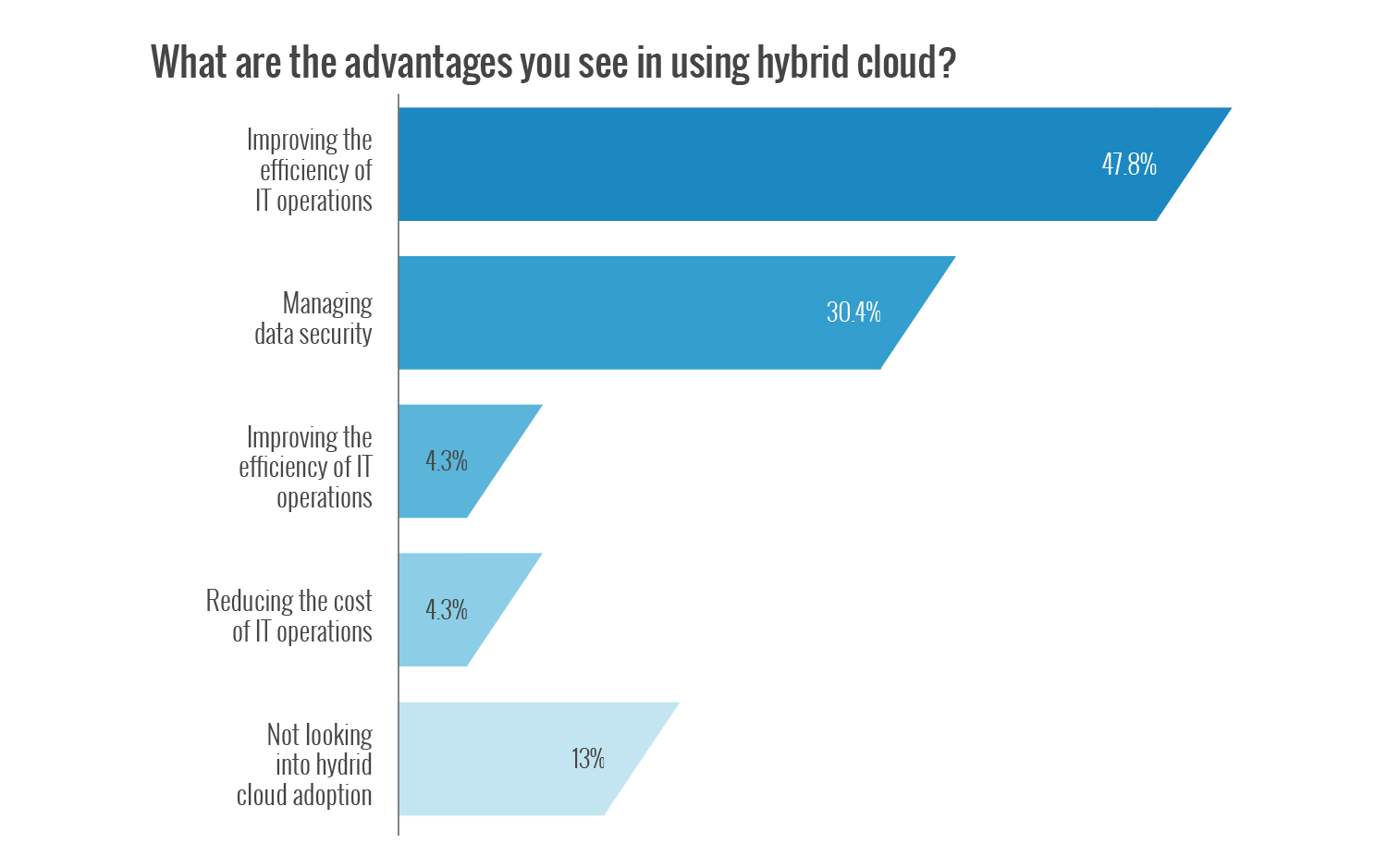

The webinar’s live viewing audience also perceived distinct advantages in using hybrid clouds. In a real-time poll, close to half of the respondents (47.8%) said they saw hybrid clouds as improving the efficiency of IT operations. The next highest-ranked answer (30.4%) was that it met security and compliance requirements. And 4.3% of respondents viewed the hybrid cloud as being both useful for managing data security and for reducing the cost of IT operations. However, in contrast to these positives, 13% of respondents said they were still not looking into hybrid cloud adoption.

Paradigm shifts

In today’s rapidly changing environment, financial institutions are constantly adapting to meet their current business needs, while also evolving for a flexible, agile, scalable and automated future. And discussion on the topic of the cloud has shifted from whether to adopt a cloud to how to make the best use of a cloud’s services.

“The fundamental shift I have seen in the past couple of years is that the focus is not so much on adopting public cloud, but more about the industrialisation of cloud. How to leverage cloud capabilities in a better way,” said Vincent Caldeira, chief financial services technologist for Asia-Pacific at Red Hat.

On average, financial firms prefer lean, standardised, consistent and interconnected systems that enable broader diversification, centralised governance and smarter capabilities. This is due to the highly regulated nature of their operations.

The cloud can help organisations gain new capabilities that match up with updated compliance, regulatory requirements and artificial intelligence (AI)-powered models more efficiently, as opposed to financial institutions doing everything out of their data centres. However, implementing a hybrid cloud leads to a series of new challenges. For one, organisations will need to come up with new models for better provisioning of infrastructure services and improving their ability to consume varied infrastructure on a self-service basis so that internal teams can innovate and develop new services quickly.

These processes can be time-consuming and require continuous updates and the democratisation of skills and knowledge. Financial institutions should work with software providers to simplify the skills and knowledge required in this space and develop user-friendly interfaces, ensuring the changes are accepted throughout enterprises.

Additionally, once an organisation is onboarded to a cloud or migrated into a hybrid cloud environment, it is essential to quantify the benefits by factoring in the costs of engineering and re-architecting. Financial institutions need to properly assess their new technologies and the appropriate delivery methods to effectively leverage the capabilities.

‘Ops’ goes a long way

Now that they have access to limitless compute and storage capabilities for analytics workloads, financial firms should invest in processes and kick-start culture change to assist with the operational aspects of analytics and the machine learning lifecycle.

Operationalisation accelerates processes to improve the quality of what is being delivered in the areas of data (DataOps), models (ModelOps) and software (DevOps). It represents the next generation of principles for moving from raw data to analytically driven decisions in a fast, efficient and productive manner.

DataOps is the foundation of analytics and is focused on transforming the intelligence systems and analytics tools used by data analysts and data engineers. The backbone of efficient DataOps is not just based on utilising the right tools and technologies, but by building the right culture.

The next step, ModelOps, centres on how portal data scientists can build efficient lifecycles. This step includes examining the the ways organisations consume their data to train an appropriate model, deploy the model and then monitor the model in action.

The third step, DevOps, focuses on speeding up the software deployment lifecycle by automating and integrating the efforts of development and IT operations teams, two functions that traditionally work in silos. DevOps requires continuous communication, collaboration and shared responsibility among all software delivery stakeholders. This runs the gamut from software development and IT operations teams all the way to front-line business professionals, middle-office risk managers and compliance officers.

Organisations now stand at a critical juncture to realise, embrace, prioritise and reap the benefits of new technologies and operationalisation principles. The webinar’s panellists were in agreement that, in doing so correctly, businesses could achieve a more sophisticated deployment and improved automated environment.

Jason Loh, head of analytics and AI at SAS Global Technology Practice, said that the ops discussed could help speed up the response time of organisations to emerging risks, while also providing a bigger picture perspective and greater transparency to financial institutions.

“You will have a full image of what is going on – when a model makes a decision, recommends a product to a customer, approves a loan, and so on. That transparency is very important because stakeholders and data owners want to know how the data is used in which model, and how it ultimately transfers to the intelligence of decisions,” Loh said.

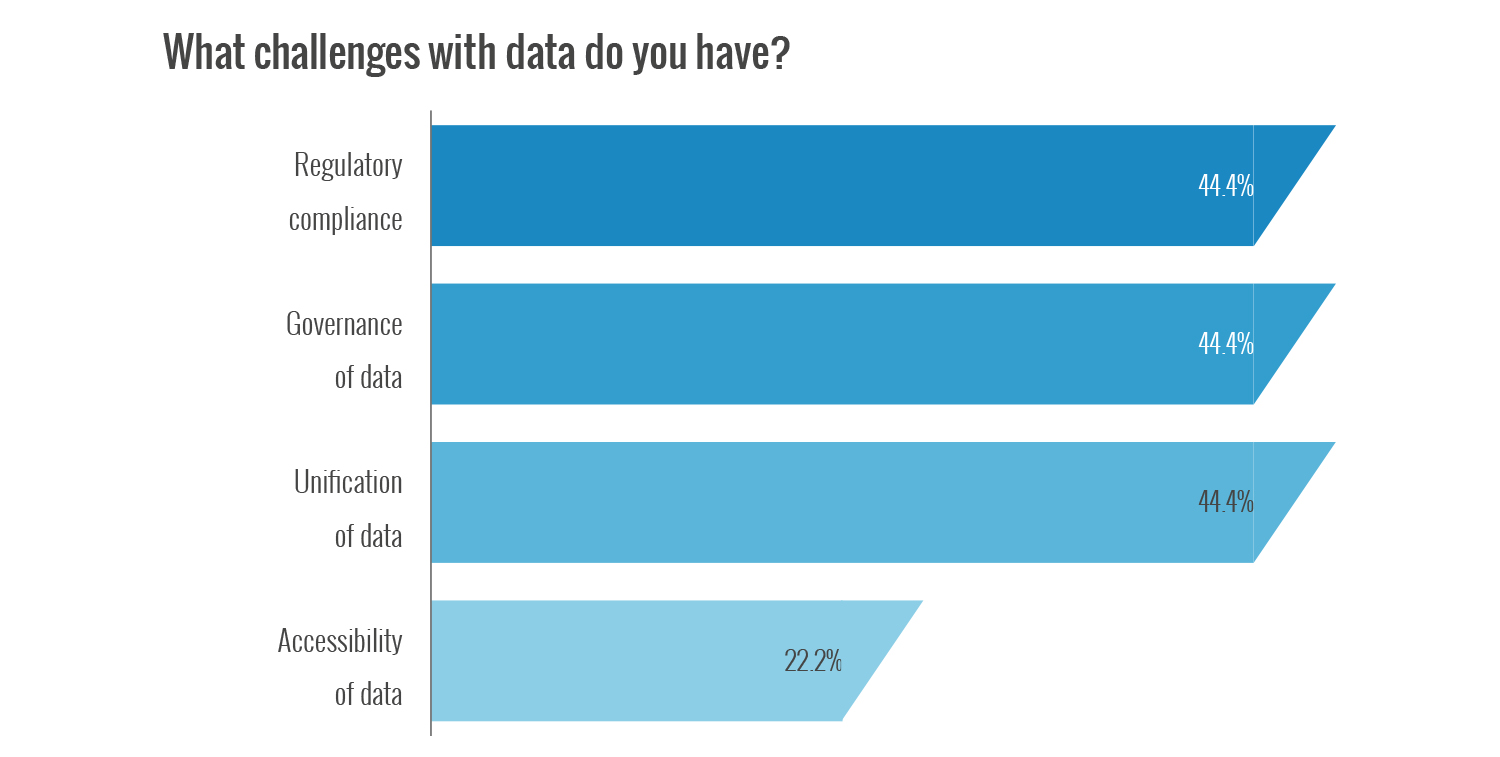

The webinar audience was largely in agreement regarding the major challenges that remain. In a multiple-choice polling question, an equal number of respondents (44.4%) found regulatory compliance, governance of data and unification of data to be hurdles, while only 22.2% cited accessibility of data as a challenge.

New-generation technologies

Financial institutions are being advised to apply choices and controls when it comes to using data more effectively. The purpose of this is to democratise data in an organisation by offering tooling choices – be it Python or any other programming language to comb through data – and to maintain better governance of any trace of data usage.

Controlling data is essential for financial services firms because failed governance often impacts the customer. Organisations need to ensure the correct data is used for each action by tagging metadata as close as possible to the source. Edge computing will come in handy in this undertaking as it offers opportunities to improve application performance by bringing workloads and data closer to where the actual computing gets done. Companies that use edge computing with edge analytics capture valuable, real-time insights, and reduce latency in analytic processing.

For example, many financial institutions have systems that originate raw data on-premises and perform calculations and compute at the raw system level rather than bringing the data from the raw system into a pool or a data warehouse. In cloud-based cases, organisations pull data from the raw systems, put it on the cloud and perform the required calculations on the spot, automating decision-making and action.

Organisations are now beginning to realise the benefits of having a unified hybrid cloud strategy. This includes supporting cloud-native application development and deployment across all cloud types and providers. A container orchestration platform automates the deployment of applications across cloud environments using a single operating system across all settings.

Leveraging the hybrid cloud is about “efficiency and control”, according to Low. “Efficiency means from a cost perspective and how we provide the most in terms of revenue; control is what we need to make sure the data is safe, and our customers feel safe that their data is secured in that [hybrid] environment.”

“Do not let cloud complexity hamper your innovation,” said Gupta. “Think about how you would achieve going to the cloud, what structuring and cultural change, and thought process changes you have to do. Cloud has its benefits proven by a lot of studies. Continue to innovate and help others to innovate.”

Caldeira summed up by saying that financial firms should focus on use cases, rely on their existing analytics vendors, and challenge vendors to demonstrate the benefits of implementing a hybrid cloud and conducting the necessary work to get it working right.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net