This article was paid for by a contributing third party.More Information.

Multi-asset class portfolio stress‑testing: best practices and future challenges

Risk and investment professionals will require a sophisticated blend of historical and hypothetical scenarios to navigate today’s volatile markets, says Ivan Mitov, director of risk research at FactSet

It has been nearly two years since the outbreak of Covid‑19 and the pandemic’s effects and the measures taken by governments worldwide are already manifesting longer-term effects. High energy prices and the relatively rapid recovery of the world’s economy after the pandemic have led to rising costs, with global inflation today at unprecedented levels for many younger people in developed countries and economies.

On the other hand, the breakdown of supply chains during the pandemic has further hampered the supply of goods to meet growing demand. Further aggravation of the global geopolitical situation following Russia’s invasion of Ukraine has increased uncertainty and magnified the slowdown of the global economy.

There are emerging indications of a recession. The World Bank recently decreased its global growth forecasts by one-third to 2.9% for 2022 and warns of stagflation. Such economic events have happened in the past and will happen again as they are part of the economic business cycle. On a positive note, recession cycles are reversible and are often followed by expansion. As a result, risk and investment professionals must consider various scenarios – both for recession and expansion. Depending on the current situation, data and technology can assess the likelihood of relevant events and their impacts.

Stress-testing frameworks

There are well-developed risk management and stress-testing practices to analyse investment portfolio profiles under different hypothetical scenarios or in the event of a recurrence of adverse historical events (for example, Black Monday, 1987; the global financial crisis that began in 2007–08; and the Covid‑19 pandemic). Both hypothetical and historical scenarios have added value within a sound risk management and stress-testing framework. It is very important for risk oversight, and for investment professionals to work together to make the best possible decisions.

In hypothetical scenarios, assumptions are made about the behaviour of key market or macroeconomic indicators over a given time horizon. This time horizon can vary depending on the investment portfolio profile and company type (asset owners, asset managers or hedge funds, for example).

Historical scenarios usually look at a past period during which, for example, there has been a significant decline in the value of a particular asset class. An interesting factor in this case is that historical crises are different by nature and duration until the full recovery of the markets. This period must be taken into account when applying the respective scenario to the current portfolio composition.

In both types of scenarios, we have a time interval that indicates a period of a past event or hypothetical occurrence of an adverse event in the future.

The difference between the two scenario types is in the data required to assess the impact of the respective scenario on the portfolio. In hypothetical scenarios, historical data is required to assess the relationship between individual risk factors, asset classes and macro factors, such as GDP and unemployment.

This is because hypothetical scenarios usually predict a limited number of variables but, effectively, a multi-asset class portfolio depends on hundreds of risk factors. For example, the third generation of FactSet’s Monte Carlo-based Multi-Asset Class Risk Model has more than 1,000 risk factors, including interest rates, equity factors (style, industry and country), exchange rates and credit spread factors. Since the portfolio return is modelled as a linear combination of exposures to factors times the respective factor returns (see equation 1), one must project the factor returns – and sometimes factor exposures – for each factor under the respective stress scenario.

The difficulty here is assessing the relationship between the various risk factors, considering the specifics of the hypothetical scenario. This requires high-quality data, adequate technological solutions and people to interpret the results. Only a combination of these three factors can achieve a truly meaningful stress test.

In historical scenarios, data is required for a specific historical period, such as Black Monday. The main task is to approximate the behaviour of a class of assets that exist now and are part of our portfolio but did not exist during the crisis. Again, this analysis requires high-quality data, appropriate technology and people to analyse and interpret the data.

Just as the approach to modelling and measuring portfolio risk depends on the investment horizon, we are interested in a solid stress-testing approach that uses several types of ‘lenses’ with different focal lengths to look ahead. One lens is wide-angle (short focal length) that observes the situation in front of us in detail but, in turn, focuses relatively close. The other type of lens is a telephoto lens (long focal length), which is used to zoom in and focus on specific objects that are relatively far away. In both approaches, the current reality must be considered – that markets and economies are closely interdependent.

Global market connectedness

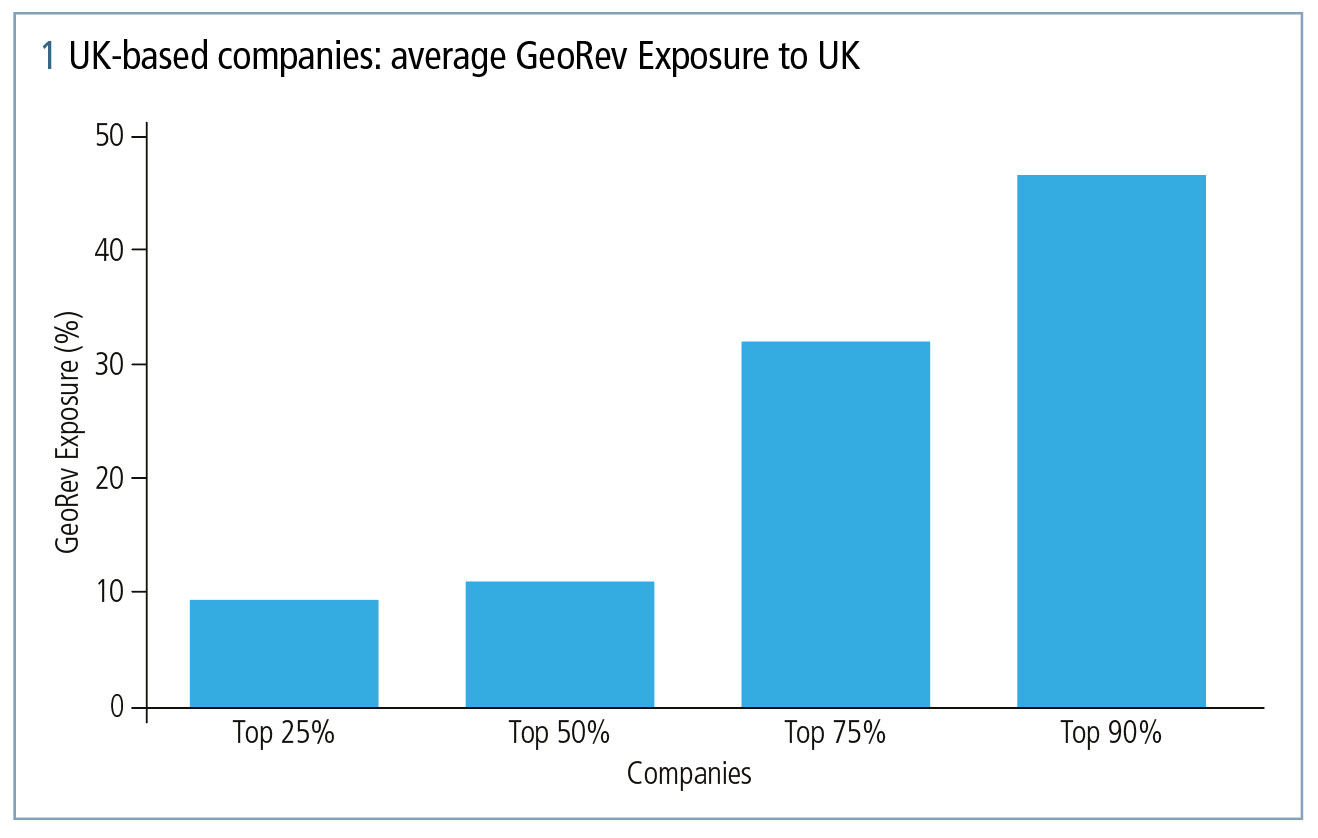

It is increasingly difficult to think of managing a portfolio concentrated in a single asset class, country or sector without considering the global interdependencies between them. For example, companies’ profits do not necessarily originate from their country of domicile. Looking specifically at the UK, FactSet Revere Geographic Revenue (GeoRev) Exposure data can be leveraged to provide a highly structured and normalised display of companies’ revenues by geography.

Figure 1 highlights GeoRev data showing that, for the largest 25% of UK‑based companies, less than 10% of revenue originates from the UK. Clearly, those companies depend much more on the rest of the world than their home market. Measuring the impact of an exchange rate scenario where the British pound depreciates in value compared with other major currencies would not have the same impact on companies that have almost 100% GeoRev exposure to non-UK markets. On the other hand, the impact would be different for a company that fully operates and sells its products or services in the UK. Without such an insightful source of data, one would rely on historical correlations between the local returns of those companies’ stocks and the foreign exchange rate fluctuations, which usually cannot provide the full picture.

This is just one example of how good data can be leveraged and combined with the appropriate technology and people to analyse the outcomes and enhance risk management practices.

Future challenges

All of the matters discussed in this article are relevant to economic cycles that have been observed in the past. However, there are new challenges beyond what we have observed until now – such as climate change. This is something greater than a local political conflict or a standard recession cycle. Here, one should create scenarios and estimate the impact not only on a given financial portfolio but on the economy and humankind.

Climate change happens along with environmental, technical, social and cultural changes. Therefore, we need to look for an even deeper use of both financial data with non-financial data within our stress-testing frameworks. Since there is no historical data from which to draw conclusions, one needs to introduce some prior beliefs about the events. As these processes evolve and constantly change, people become a key factor in stress-testing frameworks. It will no longer be enough to have just high-quality data and technology – firms will need to also rely on knowledgeable, open-minded people to build adequate risk management practices.

Download the Forbes Risk Research eBook, How the Covid-19 pandemic altered the future of risk

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net