This article was paid for by a contributing third party.More Information.

What drives the convertible bond market?

Convertible bond issuance has been somewhat lacklustre since the financial crisis that began in 2007–08. However, over the past couple of years as economies bounced back from the Covid-19 pandemic and stock markets rallied, issuance has surged. Dmitry Pugachevsky, director of research at Quantifi, a provider of risk, analytics and trading solutions, provides an overview of this instrument, modelling aspects, the reasons for its resurgence and whether the trend will continue in light of the current inflationary environment

Overview

The convertible bond is one of the more venerable instruments still in use in the global capital markets.

The basic structure is fairly straightforward and, in this respect, convertibles have remained unchanged since they were developed in the 19th century. They pay buyers below-market fixed income returns, while the attached warrants can be exchanged for equity at the holder’s option. They thus combine features of both equity and fixed income securities, and are often termed ‘hybrid securities’.

These instruments present advantages and disadvantages to borrowers and buyers. The borrower can access capital at a lower coupon than would be the case if the lender were to issue plain vanilla debt. It is also essentially raising equity on a deferred basis. This means the dilution of shareholders is postponed.

Recent trends

The convertible makes a lot of sense for a certain class of borrowers, which is why it has been around for so long. However, the market tanked after the financial crisis, after which issuance dwindled to a trickle. Equity values tumbled and investors lost faith in the instrument. Both demand and supply dried up.

The collapse of interest from hedge funds that specialised in convertible arbitrage was perhaps the killer factor. It is estimated that arbitrage funds constituted perhaps two-thirds of the market pre-crisis, and many were highly leveraged – as was not uncommon at the time. However, the market picked up dramatically with the onset of the Covid-19 pandemic, when the convertible became one of the only ways in which stressed organisations could raise desperately needed capital at an even partially acceptable cost. Issuance boomed in 2020 and continued to do so in 2021. At the end of November 2021, secondary market outstanding in the global convertible market was $509.5 billion, according to investment bank calculations. Issuance over the course of the year was $137 billion.

There is now high inflation to contend with, and convertibles fare particularly well in an inflationary environment. Over the past two years, the convertible market has been dominated by new, high-growth borrowers with limited earning history. For these sorts of companies, inflation is particularly worrisome. According to one bank analyst: “High-growth names now constitute 50% of the market. This is an all-time high, and these are names for whom rising rates are toxic.”

Strategists are calling for $100 billion of global issuance in 2022 and, while this is less than the past two years, it is well above the 2012–19 yearly average of around $80 billion.

What is the right model to use?

In theory, the basic structure of convertibles might not seem overwhelmingly difficult to value. However, in reality, they are, given the myriad additional features they contain.

As a result of the conversion option, convertibles have three sources of risk: interest rate, credit and equity. To build a model for pricing convertibles, one has to first decide which sources of risk should be considered random. There are different possible combinations; however, all should include equity because its volatility has a much higher effect than that of the other two market factors.

One- and two-factor approaches can be modelled with a numerical solver or a tree. To model all three factors as random, Monte Carlo simulation used to be the best solution. However, advances in computational efficiency open up the possibility of using a three-factor solver/tree as well. As technology continues to develop for pricing convertibles, one could consider using machine learning.

The treatment of equity

Equity in convertibles should be modelled as a lognormal process. To model equity forwards properly, it is not enough to merely input the spot and the repo rate of the equity. Other factors such as dividends and funding rate also need to be taken into account. The most straightforward method is to separately model the equity forward curve, which already has all the information and can project forward for any given time.

One other important factor, which is relatively new in the analytics world, is applying no-default probability to the equity forward. By doing so, equity is considered under a no-default assumption because, if a default occurs, the equity goes to zero and the convertible option is worthless.

Treatment of rates

Interest rate models for convertibles are usually analogous to callable bonds. This could be a simple short-rate model, following either lognormal distribution such as Black–Karasinski, or normal such as Hull–White. Alternatively, one can select the forward-rate model, which can follow either normal or lognormal distributions. In this type of model, the volatilities and intracorrelations of forward rates can be calibrated to caps or swaptions.

Treatment of credit

Market best practice is to treat credit as a random factor, especially for high-yield bonds. For a random factor, its volatility and correlation with other factor(s) need to be defined. If a liquid credit default swap (CDS) option on bond issuer exists, one should use implied volatility. Alternative approaches are either proxying by indexes or using historical data. Correlation with equity should be calibrated to historicals as well; in general, it is expected to be negative and large in absolute value.

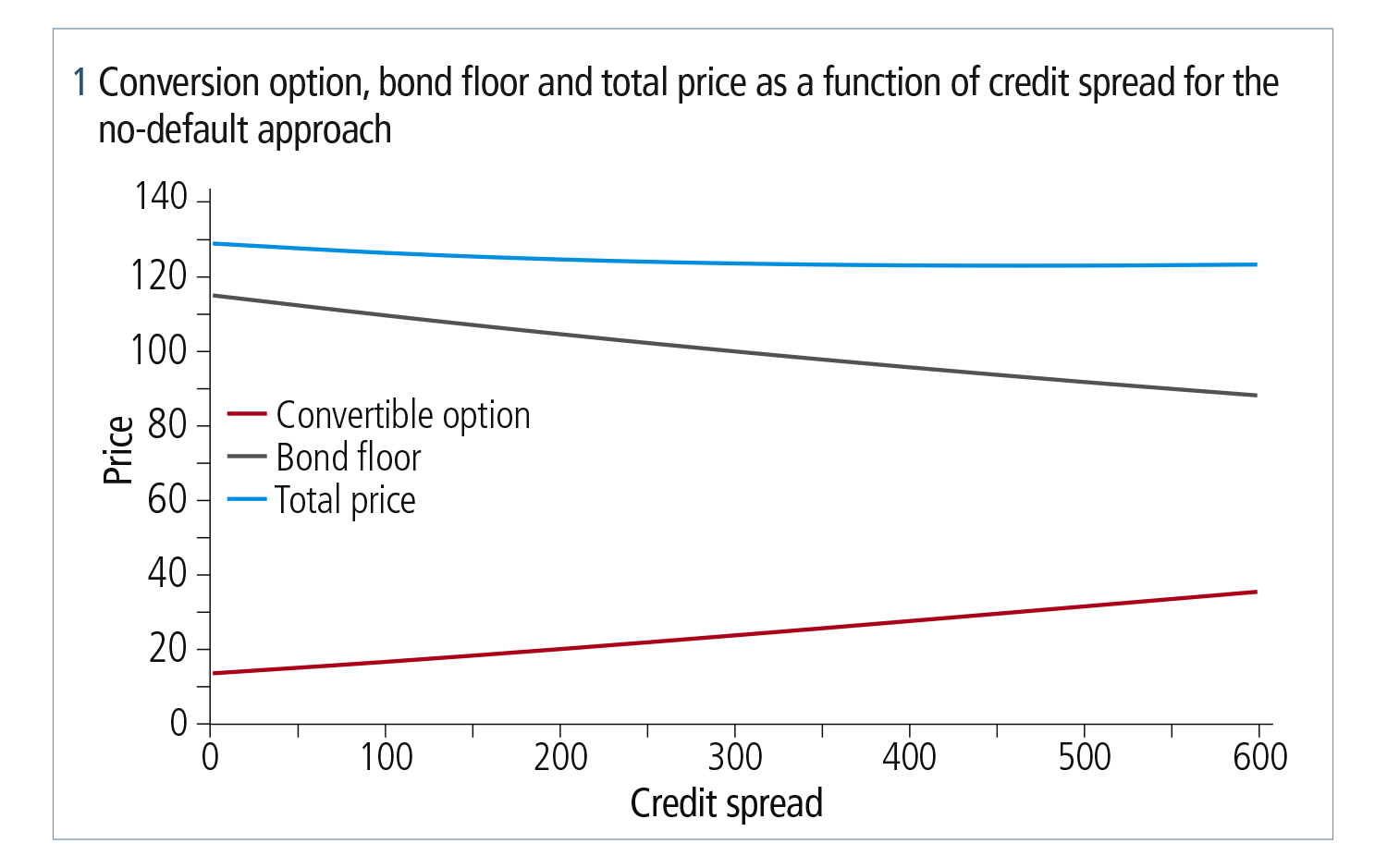

The new approach of applying no-default probabilities to equity dynamics was mentioned previously. With this, the conversion option increases quickly and almost linearly as the credit spread grows. At the same time, the total convertible bond price, which is the sum of the conversion option and a bond floor, is close to flat when the credit spread is growing. This means the convertible bond provides protection against credit volatility. Figure 1 shows the dependency of both the conversion option and total price on a bond’s credit spread.

In some cases, bootstrapping is not applicable and optimisation is necessary. This is particularly the case in scenarios where some input bonds are callable because, for callable bonds, the maturity is not easily defined.

The credit curve should be either a separate input or implied from the market quote. The price of a convertible bond is a good indicator of the credit component. This means the option-adjusted or CDS spread can be implied from a market quote and hedged with a single-name CDS or a relative value trade. Quantifi’s white paper, Take advantage of relative value credit opportunities with advanced bond analytics explores credit relative value strategies in more detail, including the use of bond analytics to execute these strategies.

Advanced features

As outlined, convertibles have several advanced call and put features designed to protect both bond issuers and investors. While modelling call and put simultaneously can seem complex, this is not the case. As long as the strike of the put is less than the strike of a call, the valuation of the bond follows a regular minimum–maximum relationship and is independent of the order of the two options.

Conclusion

The underlying characteristics of convertible bonds make for interesting and complex pricing and valuation dynamics.

To make informed decisions and take advantage of investment opportunities requires sophisticated pricing and risk analytics. In today’s fast-paced environment, firms that realise maximum benefits are those with access to powerful modelling, analytical and pricing capabilities.

Download the Quantifi whitepaper, What drives the convertible bond market?

Learn more

Quantifi’s integrated pre- and post-trade solutions allow market participants to better value, trade and risk-manage their exposures, and respond more effectively to changing market conditions. By applying the latest technology innovations, Quantifi provides new levels of usability, flexibility and integration.

Learn how Quantifi can help your business at quantifisolutions.com

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net