This article was paid for by a contributing third party.More Information.

Taking advantage of relative value credit opportunities with advanced bond analytics

Dmitry Pugachevsky, director of research at Quantifi, a provider of risk, analytics and trading solutions, explores the challenges of bond analytics and how access to the right analytics can provide opportunities for more comprehensive trading strategies

Relative value trading is a popular investment strategy for firms looking to achieve high returns while minimising risk. This strategy depends on the isolation of identical or very similar credit instruments where one is assessed to be comparatively under- or overvalued. These might be bonds issued by the same borrower but at different points of the yield curve, or bonds issued by different but similar borrowers.

Although these strategies can differ significantly, they have one thing in common – they require sophisticated bond analytics to take advantage of opportunities. Quantifi’s advanced analytics enables firms to take fundamental and relative credit views across the whole spectrum of fixed income and credit asset classes, including bonds, credit default swaps (CDSs), index and basket products, exchange-traded funds and derivatives.

Bond analytics

One can successfully trade fixed and floating bonds based on yield and discount margin, as well as their first (duration) and second (convexity) derivatives. A more comprehensive take on the bonds’ performance and associated risks requires a more complex measure – Z‑spread. Z denotes zero volatility and is defined as a flat spread over the discounting curve, which replicates the bond price.

To gain consistency with credit markets, one has to imply a bond-equivalent CDS spread, which is a flat CDS spread of the credit curve used to replicate the bond market price. This requires building interest rate and credit curves, making this calculation strongly dependent on corresponding modelling assumptions.

Bond analytics for callable bonds

Faster-moving and more complex markets have increased demand for more sophisticated analytics. This is particularly relevant for callable bonds. Accurate valuations and sensitivities are key components of relative value credit strategies. This is because many firms issue both regular and callable bonds, and having advanced analytics allows anomalies in market prices to be captured.

Callable bonds create a challenge for yield calculations because the maturity of the bond is not well defined. This requires not only the yield to maturity to be calculated, but also the yield to first, to second, to worst, and so on. Calculating Z‑spread – which, in the case of callables, is referred to as the options adjusted spread (OAS) – requires an interest rate model, ranging from the simple short-rate model to the more comprehensive forward-rate model, to be implemented. Note that the OAS spread is usually assumed to be non-stochastic.

In this environment of high and volatile credit spreads, a one-factor interest rate model is inadequate. The most effective way to improve this is by implementing a two-factor interest rate credit model, where interest rate and credit components are correlated.

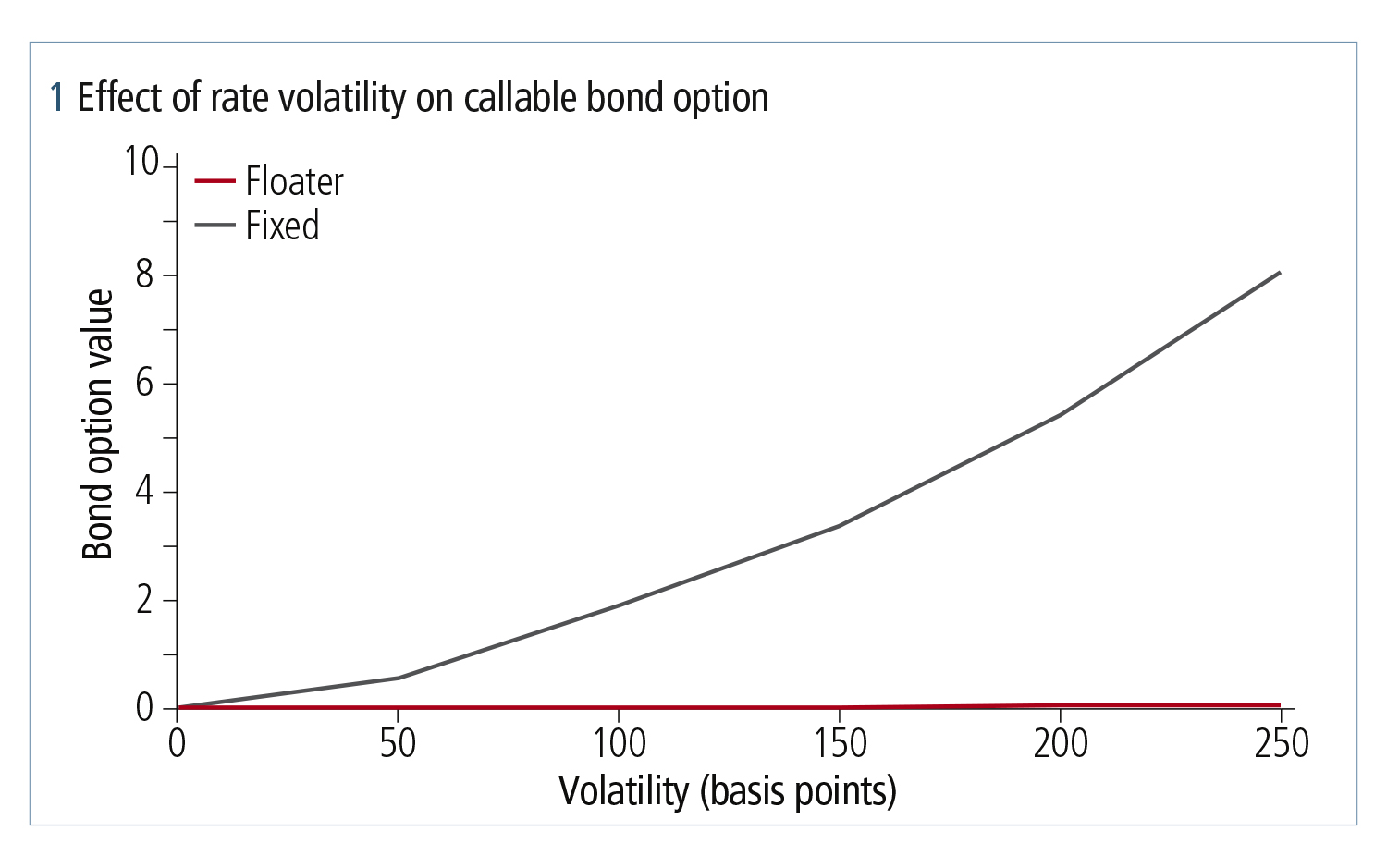

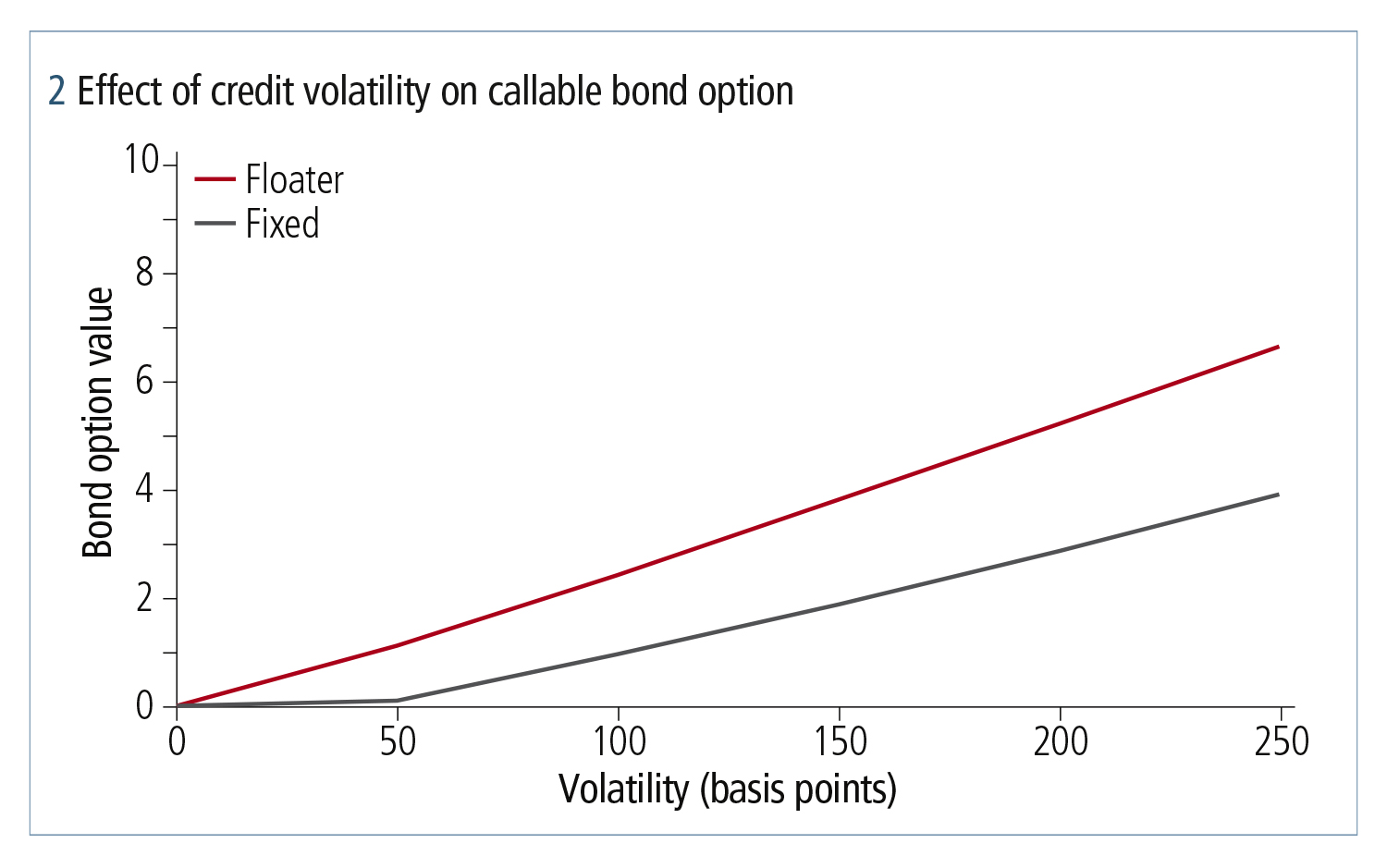

Figures 1 and 2 display how rates and credit volatilities affect the prices of callable floater and callable fixed bonds. Both the bonds are par, and option is struck at par. It is clear that rate volatilities are not affecting the floater bond call, whereas the credit vols are affecting both the fixed and floater calls. Therefore, implementing credit as stochastic is important not only for floaters but fixed bonds too.

Calibrating credit curve to bonds

Successfully applying relative strategy across different horizons of a credit curve requires the curve to be built from traded credit instruments – for example, bonds from the same issuer. The best approach is to apply bootstrapping. This involves calibrating the first tenor of the credit curve to the first bond; calibrating the second tenor has to take into account the credit spread of the first tenor, and so on. For this methodology to work, bond maturities should not be too concentrated.

In some cases, bootstrapping is not applicable and optimisation is necessary. This is particularly the case in scenarios where some input bonds are callable because, for callable bonds, the maturity is not easily defined.

Advance analytics required for convertibles

Convertible bonds can be converted into equity shares at specified dates, at specified conversion ratios. Convertibles therefore have three sources of market risk: interest rate, credit and equity. In terms of valuing the bond, a two-factor model would require a two-factor tree or partial differential equation solver – either interest rate equity or equity credit. Three-factor solver/trees are very slow so firms have to decide which components are most important – which volatilities and correlations affect price the most.

Having decided on the important components, one has to consider the treatment of equity. The most direct way is to input the equity forward curve, which already contains all of the information and can provide forwards for any given time. Another important factor, which is also new in the analytics world, is to apply no-default probability to the equity forward.

Credit can be treated as either random or non-random and can be a separate input or calibrated to market quote – this flexibility in the models is necessary to imply credit spreads. The price of a convertible bond is a good indicator of the credit component, so one can imply an OAS or CDS spread from a market quote, and then hedge with a single-name CDS or execute a relative value trade.

Libor replacement

One of the most recent challenges for building comprehensive bond libraries is related to the transition from Libor rates. At the end of 2021, all non-US-dollar Libor rates were discontinued, alongside two-week and two-month USD Libor. The remainder of USD Libor rates is scheduled to end by June 30, 2023.

The Alternative Reference Rates Committee (ARRC) recommends using daily secured overnight financing rate (SOFR) rates for floating bonds and loans, and compounding them daily with the payment of a compounded rate in arrears, which for bonds and loans means at the end of accrual period. The issue, though, is that the rate at the end of the accrual period has not been quoted at this point, therefore the coupon cannot be calculated in time for payment. To solve this problem, the ARRC proposes using different methodologies such as lookbacks, lookbacks with observation shifts and lockouts.

It is not only the calculations of coupons from SOFR rates that present difficulties – the same applies to building SOFR interest rate curves for forecasting. More details are available in Calibrating the SOFR term structure and other modelling challenges, which Quantifi presented at the World Business Strategies Conference in October 2021.

Adopting new technology

The use of analytics for debt securities has come into sharper focus and has been the subject of increased investor attention. To be able to spot opportunities, institutional investors need adroit analysis at their disposal.

Leading firms are deploying the latest advancements in technology and the best expertise to assist with the generation and retention of alpha. These firms are adopting technology providers such as Quantifi, which use new technologies including data science and artificial intelligence to provide actionable insights.

Learn more

Quantifi’s integrated pre- and post-trade solutions allow market participants to better value, trade and risk-manage their exposures, and respond more effectively to changing market conditions. By applying the latest technology innovations, Quantifi provides new levels of usability, flexibility and integration.

Learn how Quantifi can help your business at quantifisolutions.com

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net