This article was paid for by a contributing third party.More Information.

Options trading – Real-time tools evolve as ‘butterfly effects’ take flight

Michael Hollingsworth of Cboe Data and Access Solutions discusses the factors accelerating change in the options market and explains why buy- and sell-side participants are demanding a more nuanced view on options pricing and risk management data

Talk of butterflies in the options market typically conjures thoughts of a multi-leg spread trade with low risk and a high probability of limited profit. Lately, however, traders are eyeing another phenomenon associated with the delicate winged insects: butterfly effects.

This well-known theory – that events can be explained by small, seemingly unconnected actions long before they occur – is rooted in 20th-century academic study, but has been adopted in an oversimplified way by no small number of film scripts and pop culture phenomena ever since. In reality, butterfly effects refer to a small change leading to vastly different outcomes over time, often in unpredictable ways. And, in 2021, the hallmark of this butterfly effect rings true. Even if their origins are perched elsewhere in the markets, these butterflies are big, bold and their impacts are now manifest and likely to endure.

The next consideration for proprietary traders, market-making desks and the buy-side managers who know this space well is clear: how to evolve. For many of these participants, the new exogenous effects – be they market-, technology- or regulation-driven – have staying power. They can spell tremendous opportunity or – as has been demonstrated this year – outsized and even existential risk. In this feature, Cboe Global Marketsexplores these trends and asks fundamental questions about why the need for real-time analytics has been brought into greater focus and how Cboe Data and Access Solutions is creating innovative, flexible solutions for risk management and portfolio construction.

Three effects – familiar and novel

Each 2021 butterfly has its own story, yet each is interrelated. First, for most of the 2010s’ post-financial crisis recovery, the options market – like many others – waited with bated breath, wondering when and how volatility would return. After all, these instruments are built for hedging against fluctuations in value of their underlying over time. In retrospect, much innovation was able to come to the markets as the options community held firm and bided time in the form of new products and exposures, new exchange platforms with unique trading models, and more automated and higher-speed trading infrastructure.

The Covid-19 pandemic’s ramp-up early in 2020 put an end to that, roiling global markets for several months in unprecedented fashion, despite equally unprecedented stimulus measures from central banks. A quick look at the Cboe Volatility Index® (VIX®) reveals that implied volatility remains far higher than it was pre-pandemic, after hitting a record closing high of 82.69 on March 16 last year. Even after this initial wave of uncertainty receded, VIX has continued to show sustained volatility, making options all the more vital.

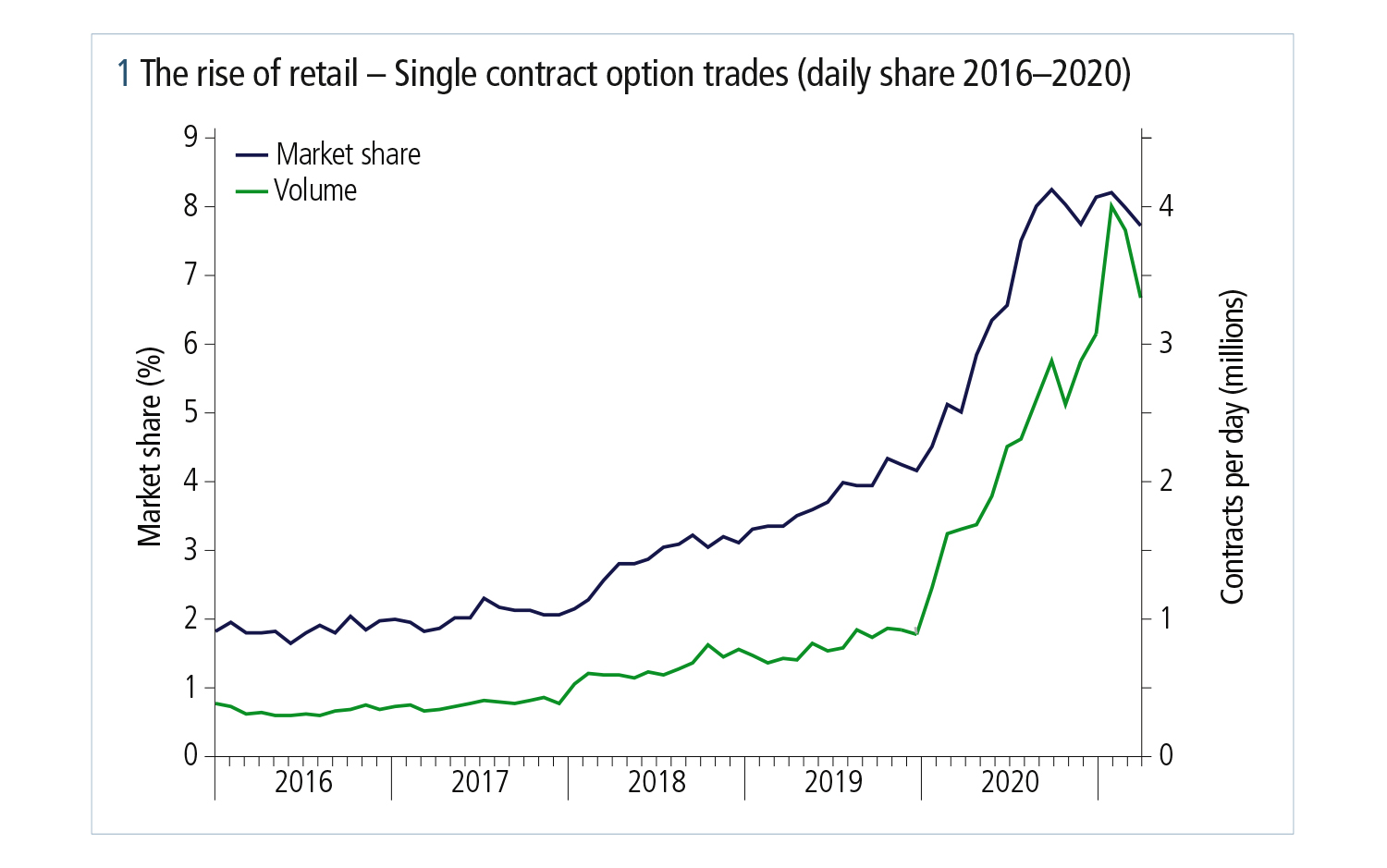

At the same time, the second effect was forming: the tech-fuelled rise and rapidly consolidated influence of retail traders in the options market. This options democratisation was under way with the rise of retail broker trading applications; Cboe data shows single-contract market share began to rise steadily in early 2018 (see figure 1).

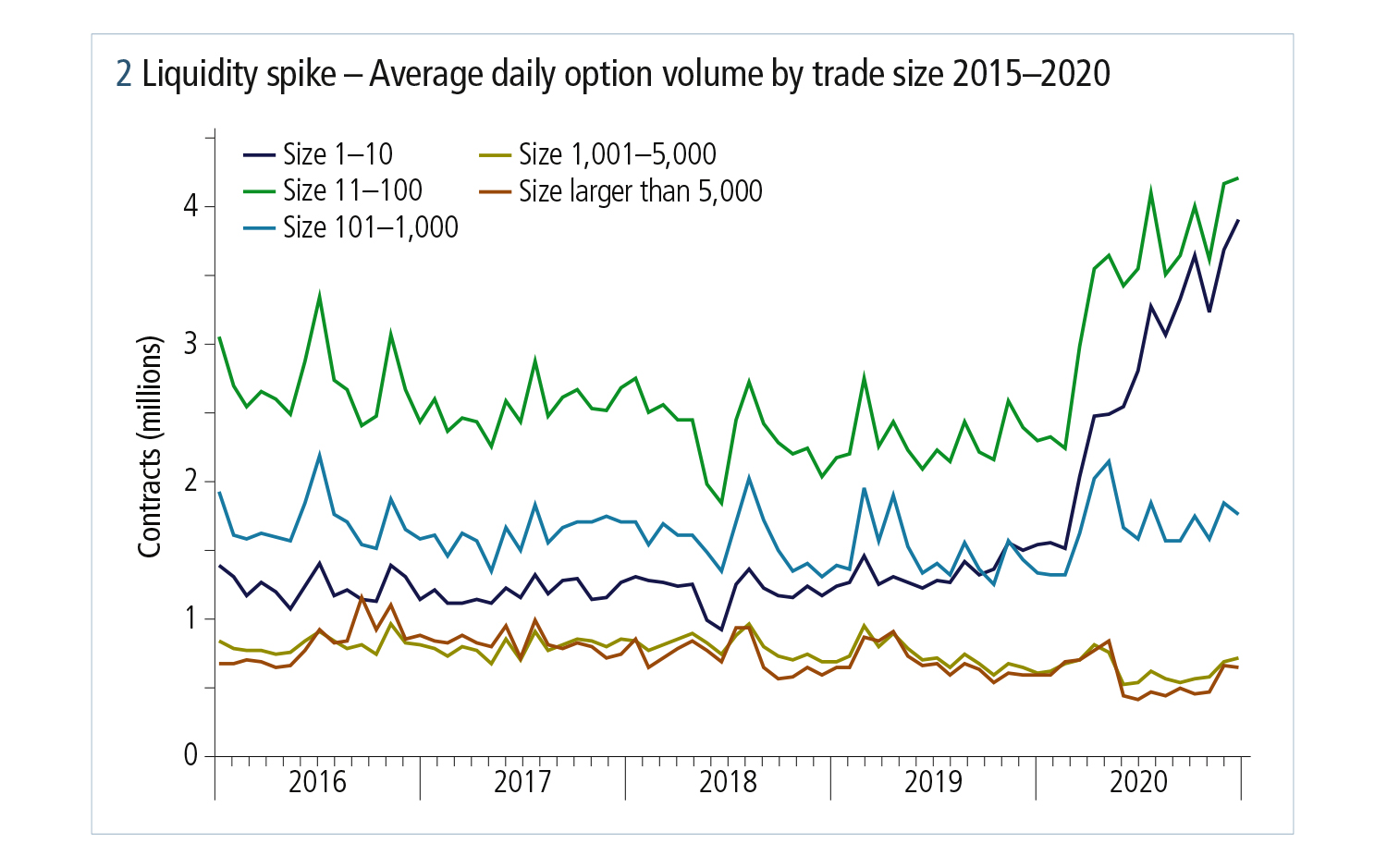

But, in tandem with rising volatility, the trend accelerated as more investors opened accounts during Covid‑19 quarantine measures and boosted the market’s liquidity in the process. Average daily trading volume for trade sizes less than 100 – and particularly for those less than 10 – spiked in the last quarter of 2019 and continued throughout 2020 (see figure 2).

This third effect involves long-awaited, but still incomplete, uncleared margin rules (UMR) frameworks for over-the-counter derivatives that, in many cases, live adjacent to exchange-traded options. While testing new UMR models and margin methodologies, the delay has driven many capital-constrained firms in the later UMR phases to experiment with more efficient, centrally cleared instruments for their hedges.

Here again, on the sell side, options product innovation is bearing fruit – particularly in currency risk. But, for buy-side firms and their banking partners, these experiments have put a spotlight on options valuation, their own cost of capital and, perhaps most importantly, the market and liquidity risk incumbent in holding these instruments on their balance sheets. More nuanced questions are being asked, and increasingly, independent pricing measurements are now sought.

Twin requirements

Whether navigating traditional sources of market volatility, conducting analysis for computing the likelihood of outcomes then mitigating for the next day trading move or evaluating the all-in cost of an option versus a swap, the foundation of the process for dealing with these new effects is the same. Today, many firms are focusing attention on two particular risk management requirements.

One of these is having the right data accessible to traders and the risk managers who increasingly sit alongside them, says Michael Hollingsworth, senior director of Cboe Data and Access Solutions. “A combination of greater overall volume, faster velocity and fragmentation among options venues all promise potential execution opportunities. Yet the pace of change and shifting liquidity can present issues just as quickly from one day – or even minute – to the next,” he says. “Firms need platforms where data is complete along with the capability to decipher these changes before their opportunity to play vanishes or, worse, their positions are picked off. This is where the Cboe offering comes into play.”

The second requirement is the intraday valuation of options. Of course, this includes the traditional volatility surfaces and range of Greek pricing sensitivities as a foundation. However, additional structured risks to buy-side portfolios – such as margin costs – are increasingly incorporated in the process as well. In a world where more work is being done around netting and offsetting exposures, these structured risks have become all the more important.

“Real-time pricing availability is vital for firms looking to incorporate new flavours of analytics to address the current market environment,” according to Hollingsworth. These flavours today include applications in customer portfolio margining services and risk-based haircuts.

“It boils down to providing market participants with accurate information, with which they can evaluate their trading decisions, position values and risk – particularly when that information is not readily available in the market.”

Theoretical value

These requirements will be familiar to veterans of the options community, who have long sought more timely data feeds and analytics to back their operations. The effects now coming to fruition in an explosive way in 2021 simply provide more impetus for traders to upgrade their platforms with stronger services, robust hardware, and intraday pricing and cost calculations.

The goal? A comprehensive view of the derivatives market landscape at a given time and, simultaneously, a more accurate view into options’ future value.

“With options traders across the spectrum becoming more sophisticated, momentum has gathered around this next natural step in this evolution,” explains Hollingsworth. “This lies in creating a new framework and single benchmark that incorporates both implied volatility, price generation and risk data mentioned above – what has been called a ‘theoretical value’. Providing a fair settlement value and accurate real-time visibility into risk for options trading, this filter would allow options trading firms a new kind of continuity in the way they run their books across global derivatives markets.”

Cboe is actively investing in a new benchmark for options pricing called the Cboe Theoretical Value, and the firm believes such a methodology is especially important because it can be applied to many of the new, souped-up challenges present today. For one thing, it can be used to optimise margin calculations, index options valuation and obvious error detection – all issues that become more acute and potentially costly when decisioned in real time. At the same time, an independent benchmark has become more of an operational norm as firms seek to test and apply their own proprietary pricing tools.

“Above all, this would serve as a cornerstone in the broader move towards new vehicles for risk transfer and sourcing liquidity in options – the two races that will define outcomes in the market’s new environment going forward,” says Hollingsworth.

The next evolution

The hallmarks of an effective options strategy are, in the end, fairly simple and enduring: time it out correctly, properly attenuate a perspective on the underlying’s performance and protect for downside risk, and execute it in the most cost-effective way. In no other market do these highly sophisticated calculations come together so elegantly. What the last year has revealed is that exogenous factors – whether new sources of investor influence and pools of money, newly volatile exposures drawing on traditional macroeconomic or fiscal decision-making, or new costs coming to trading elsewhere – are all now coming to bear.

Butterfly effects already playing out in 2021 show that this hotter, faster and more democratic atmosphere can harness the incredible potential that advocates of the options market have long argued for. At the same time, it has many participants wondering just what the next big accelerant will look like and anticipating the kinds of tools they will need to take advantage of to manage that risk.

This much is clear: these firms will want to identify it, digest it, source the right kind of risk and be able to act on it faster than their competition and their counterparties can.

“It’s a novel capability to be able to provide market participants with insights intraday,” says Hollingsworth. “This is one of Cboe Data and Access Solutions’ most distinguishing capabilities: to be able to streamline the complexity, cost and resource commitment typically required to produce the highest-quality risk analytics that inform trading strategies and risk applications.”

Put simply: the game is on.

To learn more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net