Systemic Risks in Central Counterparty Clearing House Networks

Introduction

Variation and Initial Margin in the ISDA Credit Support Annex

Variation and Initial Margin Required by Central Counterparty Clearing Houses

Margin Requirements for Over-the-Counter Derivatives: A Supervisory Perspective

The Emergence and Concepts of the SIMM Methodology

The ISDA Standard Initial Margin Model Backtesting Framework

The Impact of Margin on Regulatory Capital

XVA for Margined Trading Positions

Modelling Forward Initial Margin Requirements for Bilateral Trading

Forward Valuation of Initial Margin in Exposure and Funding Calculations

Margin Value Adjustment for CCPs with Q-Simulated Initial Margin

Bilateral Exposure in the Presence of Margin

Central Counterparty Risk

Robust Computation of XVA Metrics for Central Counterparty Clearing Houses

Efficient Initial Margin Optimisation

Procyclicality in Sensitivity-Based Margin Requirements

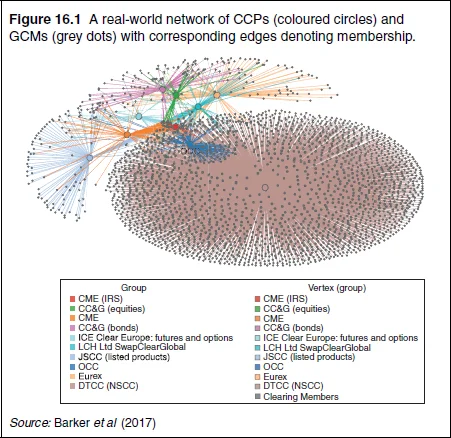

Systemic Risks in Central Counterparty Clearing House Networks

16.1 INTRODUCTION

The global financial crisis of 2007–10 had enormous implications for the financial ecosystem as a whole. Among many other changes to its way of working, both the range of products and the number of trades cleared by central counterparty clearing houses (CCPs) increased enormously (see, for example, US Office of Financial Research 2017). As a result, whether they like it or not, all large banks are engaged in trading on CCPs. Accordingly, there is a clear need for banks to assess any potential losses due to defaults of general clearing members (GCMs) and CCPs through the CCP network they participate in. The interconnectedness of the CCPs themselves, arising due to the fact that they are linked through common clearing members, means that it is important to model most of the network.

In this chapter, we take the perspective of a hypothetical banking group, “XYZ Bank”, and explain how it may assess its risks based on the partial information available to it. Typically, a banking group has multiple subsidiaries, each of which are distinct clearing members.

Understanding the risk of XYZ Bank is a challenging task, which requires

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net