US markets fret over ‘unrepresentative’ fallbacks

Two-year gap between spread fixing and cessation leaves fallback signatories tied to outdated basis

The extended timetable for US dollar Libor’s demise may have thrown a lifeline to firms scrambling to move safely off the doomed benchmark, but it is also causing agitation among some participants. Across cash and derivatives markets, many fear they will be locked into unrepresentative fallback rates that were crystallised more than two years before taking effect.

So-called hardwired fallbacks

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら 市場

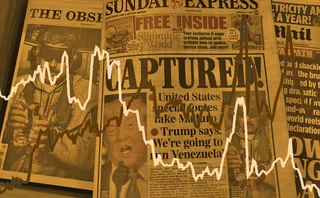

トランプ氏のラテンアメリカ地域のギャンビットの一手が、FXヘッジのラッシュを刺激する

ベネズエラ情勢の悪化により、リスク・リバーサルへの関心が強まっております。投資家がキャリー取引の保護やリスク軽減を図る動きが見られます。

ワントレーディング、24/7の株式取引をヨーロッパに導入

スタートアップ取引所は、金融庁の認可を得た後、第1四半期に永久先物取引「Clob」を開始いたします。

FXGOの取引高は手数料の切り替え後も急増している

販売店により、課税がSDP全体での販売数量増加の背景にあるかどうかについて意見が分かれております。

銀行たちは新たな取引プラットフォームにより債券取引コストの削減を期待している

ディーラー系TP Icapのベンチャー事業は、ブルームバーグ、マーケットアクセス、トレードウェブという主要3社を揺るがすことを目指しております。

キリバ社は、AIを活用したFXヘッジングツールの導入が進んでいると見ている

ベンダーによれば、自動化されたデータ収集と清算は、企業がより優れたヘッジを構築するのに役立ち、説明のつかない損益変動を87%削減しました。

2025年の振り返り:世界は終わりを迎えたが、特に問題はない

市場はトランプ氏が米国政策を再定義する中で回復力を見せましたが、2026年以降については疑問が積み上がっています。

クリプトにおいて、本当にすべての取引がT+0である必要があるのか?

即時決済には固有のリスクが伴いますが、必ずしもデフォルト設定である必要はありません、とBridgePortのソリアーノ氏は記しています。

資産運用会社は、資産規模が300億ドルに達すると見込まれるオートコーラブル型ETFの準備を進めている

システマチックアプローチによりカラモスが5億ドルを獲得した後、アクティブ運用戦略が待機状態にあります。