Lukas Becker

デスク編集者

ルーカス・ベッカー氏は、 ロンドン拠点のRisk.netにおいて 市場担当編集長を務め、 外国為替市場に関する編集業務を統括しております。 専門分野は、店頭デリバティブの価格設定、商品設計、担保管理、ならびに資産クラス横断的な市場インフラストラクチャーなどです。

2012年にRisk誌の欧州・中東・アフリカ地域担当編集者として入社いたしました。

連絡先は+44 207 316 9129、またはメール lukas.becker@infopro-digital.com までお願いいたします。

Follow Lukas

Articles by Lukas Becker

Central Bank of Ireland diverges from Basel III on AFS bonds

Irish bank capital numbers would filter out unrealised gains and losses on government bonds

Search for new OTC underlyings gets tougher

The history of the derivatives market has been punctuated by regular attempts to find new underlyings – never an easy task. But would-be innovators now face regulatory and political obstacles too. Lukas Becker reports

Leverage rumpus: Banks protest impact of ratio revisions

Client clearing, repo markets, credit derivatives – the leverage ratio casts a shadow over them all. But the overarching complaint is that the ratio should remain a backstop, and it’s a point on which many regulators agree. Lukas Becker and Tom Newton…

IMF: Making Basel III work in emerging markets

For many countries, Basel III is not an all-or-nothing choice. Part of Michaela Erbenova's job at the IMF is to help them work out which bits make sense. By Lukas Becker

Futures reporting delay 'will not take place', says EC's Pearson

Industry had been banking on one-year postponement - Esma now looking for solution to reporting impasse, according to senior EC official

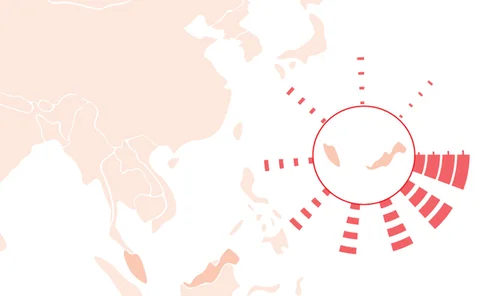

Emerging market volatility not a sign of crisis, says Malaysian supervisor

Emerging markets are much better prepared to deal with foreign investment outflows, says Securities Commission Malaysia chairman

WGMR rehypothecation rules unclear and confusing, say lawyers

Final WGMR rules allow collateral on uncleared derivatives to be rehypothecated under strict conditions, but lawyers say they are unclear on how the rules will work in practice

Leverage ratio changes threaten European clearing model, industry warns

Proposed revisions appear to catch back-to-back trades that are used to get exposure into European CCPs

CCPs in Japan, Mexico, Singapore and US to jump through Esma hoops

Eleven CCPs say they will apply to Esma for approval – sparing European members a capital hit – but Canada's CDCC has no plans to go through the process

Credit Suisse poaches Munich Re CRO, and other recent job moves

Tobias Guldimann moves to newly-created risk position, and other Changing Hats stories from the last month

Barclays leverage explosion baffles experts

Regulatory specialists unable to explain jump in leverage exposure at UK bank - the incoming ratio lacks clarity, say critics

Covered bond industry protests against Esma clearing push

Esma has ignored calls to exempt covered bond vehicles from clearing, to the dismay of issuers

The great unwind: Buy-side fears impact of market-making constraints

Some buy-side firms are already calling it the great unwind – the migration out of the huge bond portfolios buy-side firms have built up in recent years, as rates eventually rise. But with dealers less able to play the role of liquidity provider, it…

Basel Committee has work cut out on interest rate risk charge

Basel Committee taskforce starts work to develop a Pillar I charge for interest rate risk in the banking book, but some bankers and former regulators say the challenges will be too great

FCA narrows AIF definition for SPVs

The UK regulator calms reclassification fears by exempting SPVs that issue debt securities from being classed as alternative investment funds

No CVA exemptions in US Basel III rules

Europe isolated as US regulators opt for broad counterparty risk charge

Basel tries to create clearing pull with new capital rules

Dealers say rules for default fund exposures are an improvement, but risk weights are not tied to "real default probabilities"

Securitisation is "dead in Europe", say critics of new EBA proposals

Rules would require banks to allocate all securitisation exposure by individual, underlying obligor

Basel leverage ratio would double up collateralised OTC positions

Ratio could be a 'game-changer', dealers warn, as Basel Committee proposes counting received collateral as well as derivatives exposures

Bank supervision gets personal as UK focuses on accountability

Regulators and politicians in the UK want bankers to be more accountable for mistakes made by themselves and their teams. But while supervisors are trying to expand the existing sanctions regime, politicians are seeking a more radical overhaul. Lukas…

CVA exemption ignored in UK's capital shortfall exercise

Risk-weighted assets at Royal Bank of Scotland would have been £36 billion lower if exemption agreed earlier this year had been recognised

UK regulators plan to "hold individuals to account"

The FCA and PRA are toughening up their approved persons regime for senior execs, risk managers and traders