Dispersion trades are back after losing big in 2020

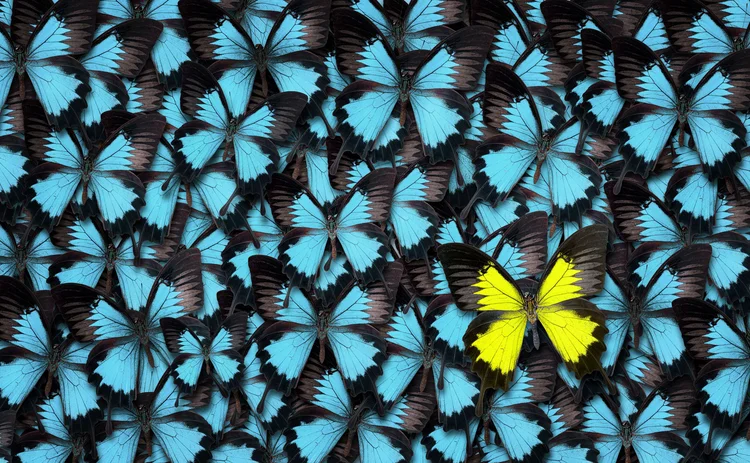

Bets on single-stock versus index volatility are “incredibly attractive by historical standards”

An equity derivatives trade that lost hundreds of millions of dollars during the Covid-19 selloff last March is suddenly popular again.

The prospect of rising inflation leading to further sector rotations has renewed interest in dispersion trades, where investors go long single-stock volatility and short index volatility.

Dispersion is “the most exciting trade in the market right now”, says

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Investing

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

Sticky fears about sticky inflation

Risk.net survey finds investors are not yet ready to declare victory on inflation – with good reason

S&P bull run drives interest in reset and lookback hedges

Variable strike put options proved popular alternative hedging format of 2025

US mutual funds slash short euro positions at record pace

Counterparty Radar: Pimco cut $4.6bn of EUR/USD puts in Q3 amid changing stance on dollar direction

How investment firms are innovating with quantum technology

Banks and asset managers should be proactive in adopting quantum-safe strategies

Top 10 investment risks for 2026

AI, strained governments, inflated private assets: risky bets have become hard to avoid

Review of 2025: It’s the end of the world, and it feels fine

Markets proved resilient as Trump redefined US policies – but questions are piling up about 2026 and beyond

Asset managers prep autocall ETFs with assets tipped to hit $30bn

Actively managed strategies wait in the wings after systematic approach nets Calamos $500m