QIS – Expanding the asset allocation toolkit

Amid market uncertainty brought about by the Covid‑19 pandemic, decisions on asset allocation and diversification, effective risk management and portfolio construction have become crucial

The Covid‑19 outbreak has led to unprecedented economic uncertainty. A record-breaking stock market drawdown in March was followed by a swift market rebound, with the S&P 500 rallying to a record high in mid-August. It goes to show how important asset allocation and diversification decisions are, when complemented by appropriate risk management and portfolio construction considerations.

In a world of very low yields and high asset valuations – which presents challenges in both yield enhancement and portfolio diversification – the quantative investment strategies (QIS) toolkit offers some respite. A number of investors are in the process of reviewing their portfolio composition to ensure they harness diversifying sources of returns and take advantage of systematic strategies that have proven resilient to external shocks in the recent Covid‑19 crisis.

Markets have recovered, but strongly implied volatility levels remain rather elevated, reflecting uncertainty around the extent of the economic damage. In conjunction with concerns regarding a second wave of Covid‑19, this is amplifying the need for an enhanced hedging solution with limited carry cost, such as the UBS S&P Intraday Trend Strategy. From an asset allocation point of view, the recently launched Gold Covered Call strategy, which introduces an income overlay to a non-income-generating asset, should not only appeal to commodity investors but also to asset allocators more broadly. In backtests, the Gold Covered Call strategy has outperformed spot gold handsomely, so far this year performing in line at +16%.

UBS S&P Intraday Trend

Demand for hedging strategies resurfaced recently, especially following the Covid‑19 outbreak. However, when implied volatility levels are elevated – seen more than a few times this year – outright long put strategies do not appear attractive and are easily eclipsed by implicit hedging strategies, such as the UBS S&P Intraday Trend.

The UBS S&P Intraday Trend is a low carry hedging solution, which has retained almost all of its positive performance from the first quarter of 2020, proving a very cheap and robust source of convexity for a portfolio. In fact, the S&P Intraday Trend ended August with a year-to-date performance of +32%, and similar strategies also worked for other markets such as the Nasdaq, WTI and Brent.

Intraday trend strategies tend to perform well in high realised volatility regimes, and the upcoming months should be fruitful ground for these strategies given the lingering uncertainty surrounding the course of the pandemic, together with mounting unemployment rates in the US and Europe.

In high-stress environments, polarising headlines and other catalysts, such as historically bad economic data or announcements of new monetary or fiscal stimuli, tend to set the market sentiment for that day, either positive or negative. And the combination of both human nature – panic selling on large down days or buying on the fear of missing the recovery on large up days – and market internal dynamics, such as risk parity and dealer positioning, help drive that initial price action throughout the day. The S&P Intraday Trend strategy looks to monetise trends from the volatility space. For a volatility flow trader, (higher) hedging frequency is a state-of-the-art decision balancing (lower) volatility versus (higher) transactional cost, and highly dependent on their view of the market move before close (see figure 1).

The strategy aims to capture the difference between the ‘close-close returns variance’ versus ‘close-intraday point-close return’ and decomposing variance exposure through delta replication, with an intraday threshold to initiate position only on days with enough conviction in price-trending momentum.

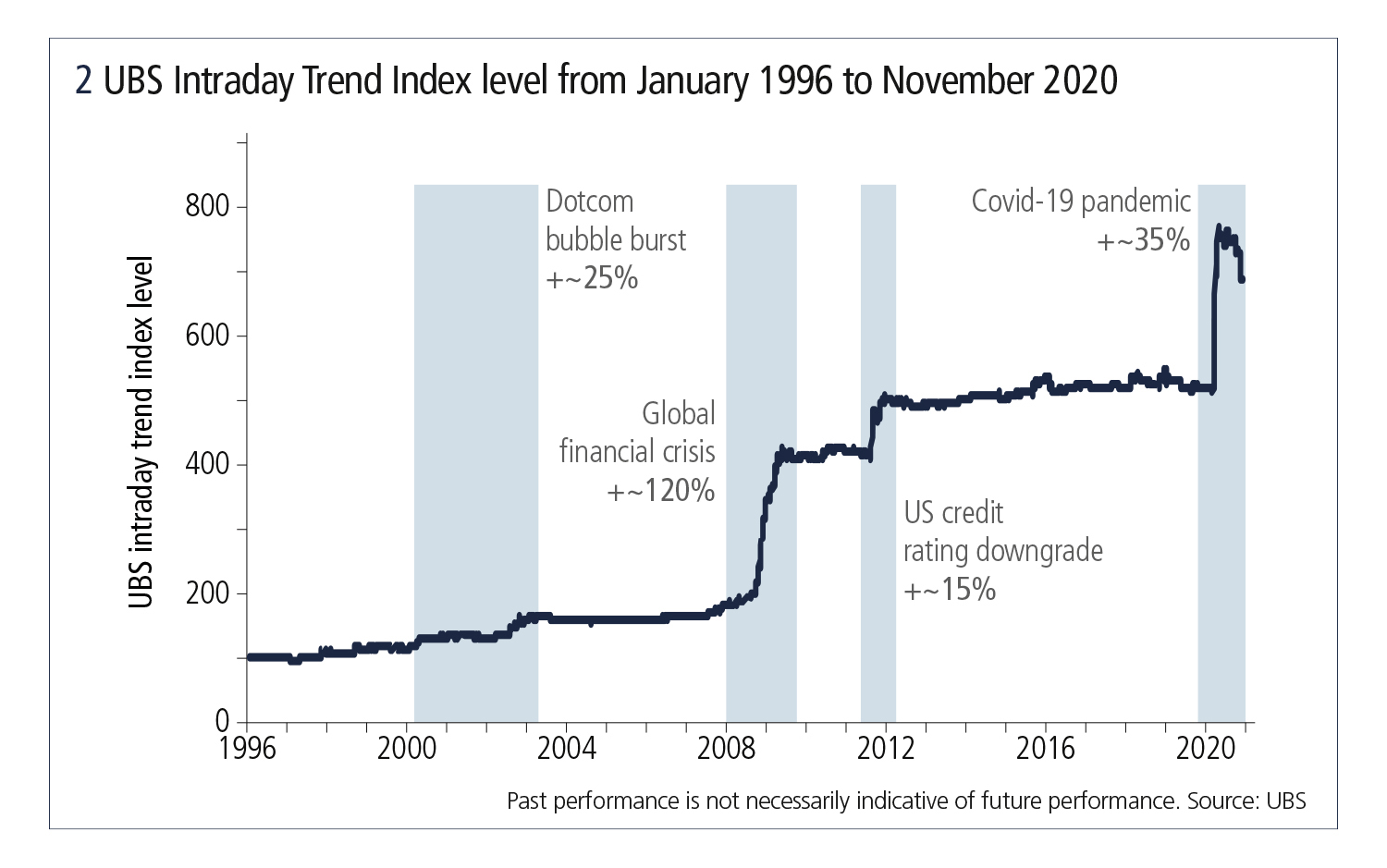

This strategy has shown attractive live returns during crash periods – particularly in Q1 this year – while remaining relatively flat during quiet market periods (see figure 2). It has been gaining a lot of traction with UBS clients, who have utilised it either as a low cost-of-carry hedging solution or as a systematic overlay on existing portfolios to enhance risk-adjusted returns.

UBS Gold Income Strategy

Due to the pandemic and ensuing recession fears, central banks across emerging and developing markets are annualising $24 trillion in monetary stimulus.1 The combination of this new money creation with negative real yields is value-destructive for bond holders, and we therefore expect to see a shift away from bonds and into alternative stores of value.

After falling in the initial stages of the pandemic, gold has rallied strongly and is up about 26% this year,2 being one of the best performing assets of 2020. Both retail and institutional investors are looking to increase their gold allocations for portfolio diversification, hedging against rising inflation – or falling real rates – and against risky assets in risk-off environments. However, one of the precious metal’s main drawbacks is that it is not expected to generate any income.

The Gold Income Strategy generates that income from the asset by selling out-of-the-money call options on a daily basis. The daily selling mechanism leads to a diversification in entry points (strike, implied volatility) and expiries.

UBS is the first and only bank to have been ranked top in all precious metals categories in the Energy Risk Commodity Rankings this year, and named Equity Derivatives House of the Year in the Asia Risk Awards for five consecutive years – from 2015 to 2019.

Systematically selling upside calls tends to be a good funding trade to generate income, as richly priced upside implied volatility came about because of an excess supply of structured products, comparing with the realised variance. Investors further benefit from the spot-up/vol-up dynamics witnessed in the market.

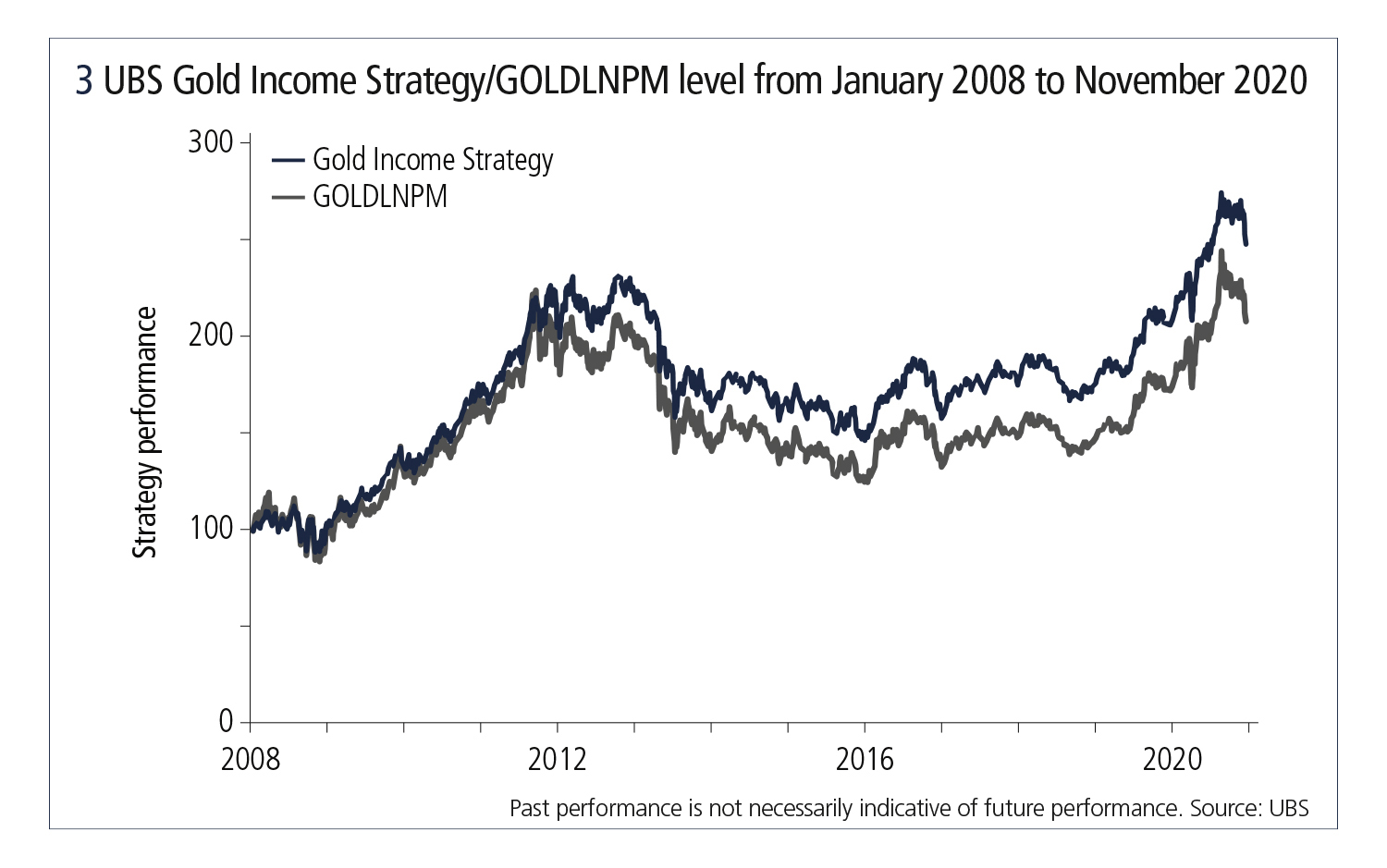

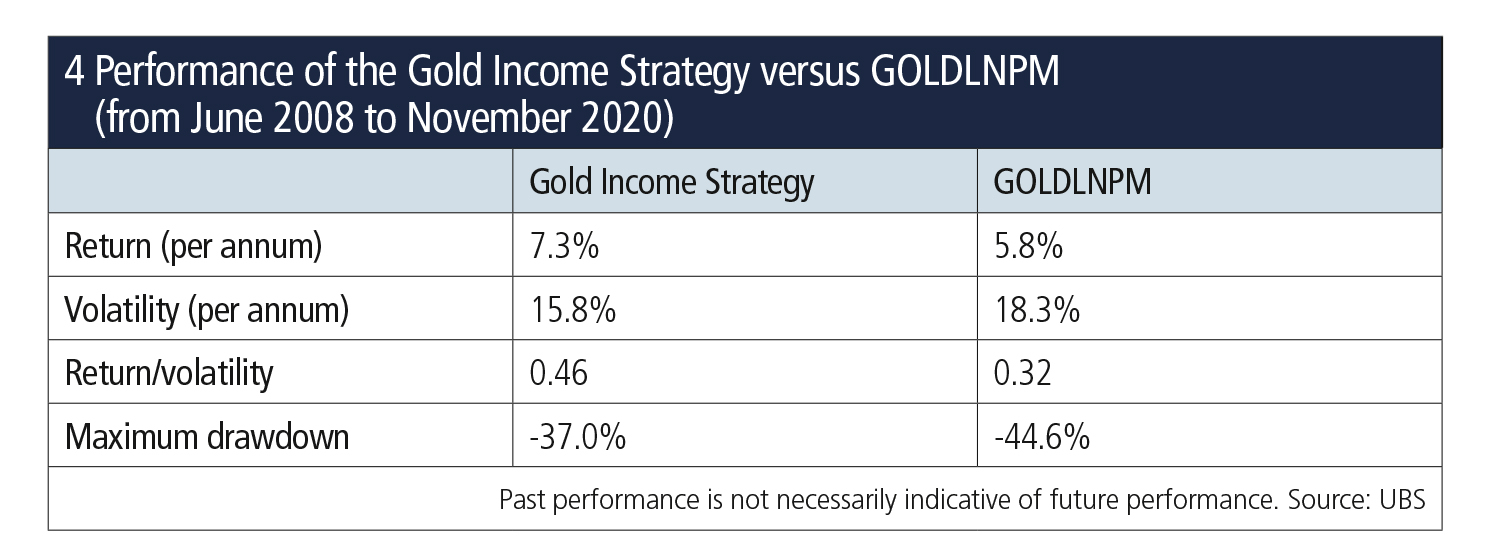

Backtesting revealed that the Gold Income overlay has significantly improved the absolute risk-adjusted performance of gold, reduced drawdowns and increased annual return from gold in all considered market scenarios. It has generated additional income in upside or sideways markets, and has provided hedging benefits in downside markets (see figures 3 and 4).

Notes

1. UBS calculations, Bloomberg

2. Bloomberg

Family office investing – Special report 2020

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net