This article was paid for by a contributing third party.More Information.

Trading Micro E-mini Nasdaq-100 vs. FAANG

By Craig Bewick, CME Group

From hedge funds to retail investors, the “FAANG” trade continues to be among the most popular US equity trades as the economy navigates the recovery from the economic shutdowns earlier this year. The individual equity shares represented in this trade of Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Alphabet (GOOG), have led the Nasdaq-100 index to new high levels and have been the subject of much press coverage from the mainstream financial media.

Because of the continuing popularity of this trade, we decided to revisit the idea of using CME Group’s Micro E-mini Nasdaq-100 futures and options products as a proxy for a basket of FAANG stocks. CME Group lists E-mini Nasdaq-100 futures, which presently have a notional value of about $227K as well as Micro E-mini Nasdaq-100 futures that, at 1/10 the size, have a notional value of about $22.7K as of September 23. Additionally, with the addition of Micro E-mini options on August 31, CME Group lists options on both futures products. We’ve used the smaller “Micro” sized contract for the purposes of this paper but the same concepts can be applied with the “Mini” for traders seeking larger notional values.

Trading example 1: Long 1 Micro E-mini Nasdaq-100 (MNQ) vs long basket FAANG stocks

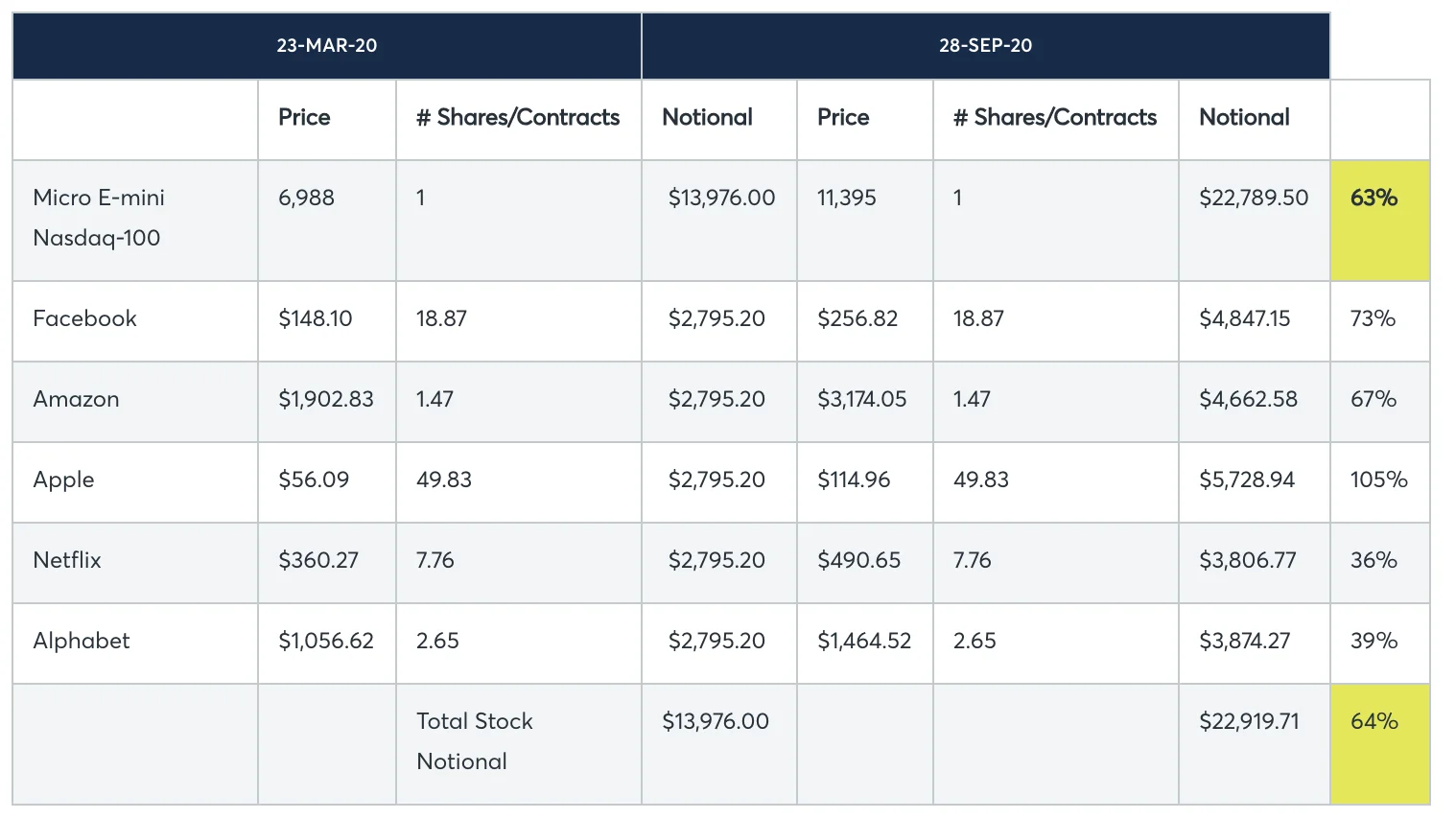

First, let’s compare the returns of a trade comparing 1 MNQ contract vs an equally weighted, notionally comparable basket of FAANG stocks. To do this, we used the closing prices of these instruments on the March 23 lows and the closing prices as of the time of this writing on September 28.

- The price settlement price of the MNQ on March 23 was 6,988. This represents a notional value of $13,976.

- In order to equally weight each stock, we assigned the number of shares that would weight each stock at 1/5 of $13,976, or $2,795.20 (we used fractional shares to maintain precision)

As you can see in this chart, the price appreciation of the equally weighted basket of FAANG stocks and the MNQ during the stock market recovery since March 23 was remarkably similar (64% vs 63%).

Let’s examine some other considerations with respect to these two positions:

Capital requirement

To hold a futures contract, a trader must post a performance bond; to hold an equity position, a trader must either fully fund the position or borrow up to 50% of the notional value (Reg T margin).

As you can see, due to the inherent leverage in the Futures market, the holder of the futures contract realizes significant capital efficiencies relative to the Equity position. Further, equity trades made on margin are typically subject to interest expense charged by the broker.

Execution costs

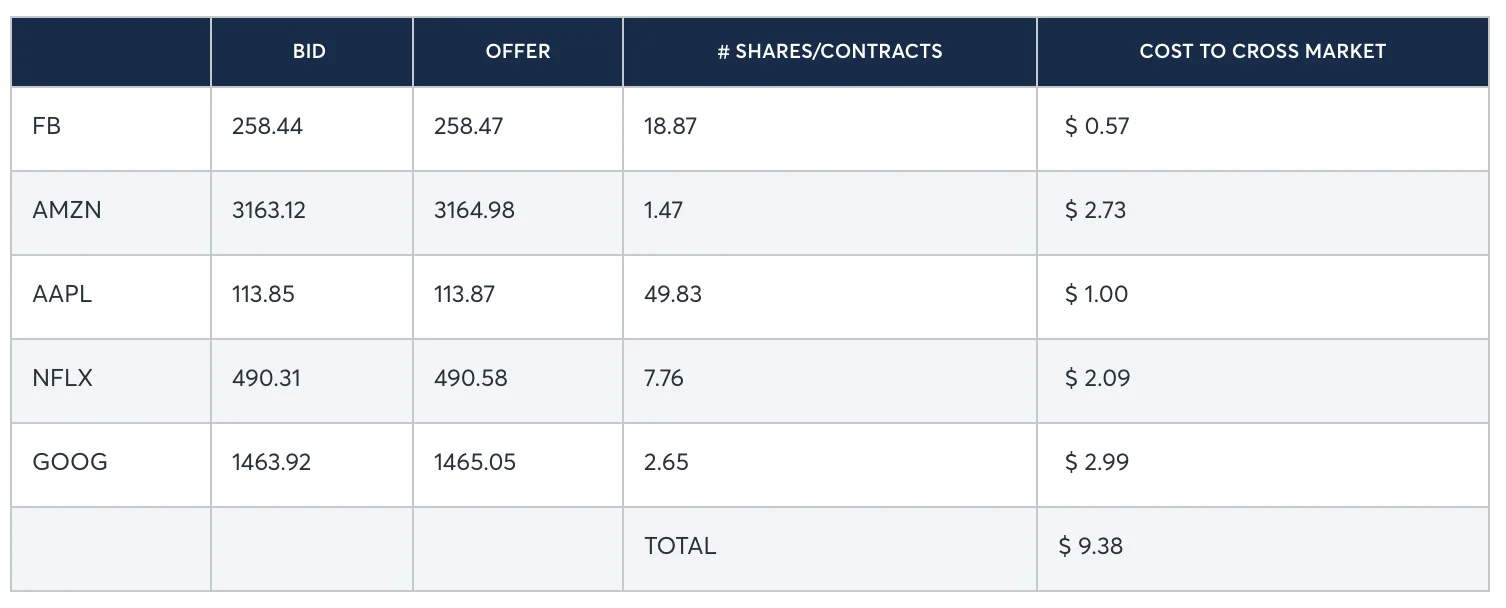

Assumption: The cost to “cross” the bid/offer (buy the offer/sell the bid) is incurred by the retail trader.

Establishing the FAANG basket of stocks requires five distinct equity market transactions. Multiplying the difference between the bid and offer by the number of shares yields the execution costs detailed here:

The 0.25 point difference in the bid/offer in the MNQ is the dollar equivalent of $.50 per 1 contract.

Of course, commissions on equities at most US brokerages have been reduced to zero while traders continue to pay brokerage commission for futures. However, the published “all-in” costs we found among major US brokers on their respective websites were far less than the difference in market execution costs.

As we mentioned earlier, CME Group also lists options on the Micro E-mini Nasdaq-100 futures which offer an alternative product with which to gain exposure to the index. Let’s look at another way to assume a long position in the Nasdaq-100 index at CME Group.

Trading example 2: Long Micro E-mini Nasdaq-100 call option

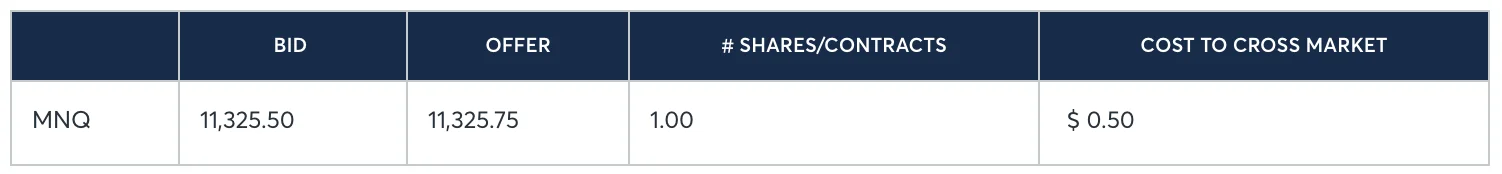

To analyze the position using options, we used QuikStrike software to derive the theoretical value of an option with 185 days until maturity using the implied volatilities at which the options were trading at the time. We picked a strike that, given the price of the futures at the time (6,988) and the implied volatility of the call, was trading with a delta value of about 24.

So, assuming we could get filled on a Micro E-mini Nasdaq-100 option (which weren’t yet available, but we’ll use the value of the E-mini Nasdaq-100 option as a proxy) near the theoretical value we calculated using QuikStrike, the following are the specifics of the trade.

As you can see, we selected an option that was 1,312 points out of the money, giving as that delta value of 24, which means, at execution, the value of that option would gain about 0.24 points for every 1 point the future rallied (and vice versa). However, it’s important to keep in mind, the delta value is not a static number and will change as the futures price moves, volatility changes and time to expiration declines.

Let’s assume we held this call until its expiration date (many options traders make adjustments to their positions as market conditions change but for sake of example, we are going to simply hold a long call position). At expiration, we’d expect this call to be worth what we call the “intrinsic value” of the option which is simply the current futures price minus the strike price, or 11,395 minus 8,300 = 3,095 points ($6,190). It follows then, that our theoretical profit on this trade would have been $6,190 minus what we paid for it ($386), or $5,804.

Obviously, $5,804 is less than the theoretical profit from the long futures position we looked at earlier of $8,813.50. So, why would someone trade the option rather than the future? One of the basic tenets of options trading is that when you buy an option, your risk is capped at the amount you pay for that option, in this case $386. So, while the risk in a long futures trade that we looked at is theoretically unlimited, in the options trade we could not lose more than $386 and while it’s easy for us to look back at the tremendous rally we saw in the Nasdaq index since March 23, at the time, we were experiencing economic uncertainty and global economic shutdowns the likes of which most of us had never seen. During times of unprecedented volatility like we saw then, traders may want to cap the potential downside risk when assuming a position, which a long option position accomplishes.

Trading example 3: Long risk reversal using 25 delta Micro E-mini Nasdaq-100 options

For our final example, we’ll assume a trader who is comfortable with unlimited downside risk and wishes to construct an option strategy resulting in a directionally long position. Let’s also assume our trader is a veteran options trader who wants to take advantage of the higher volatility in the 25 delta puts relative to the 25 delta calls (a concept options traders refer to as “skew”).

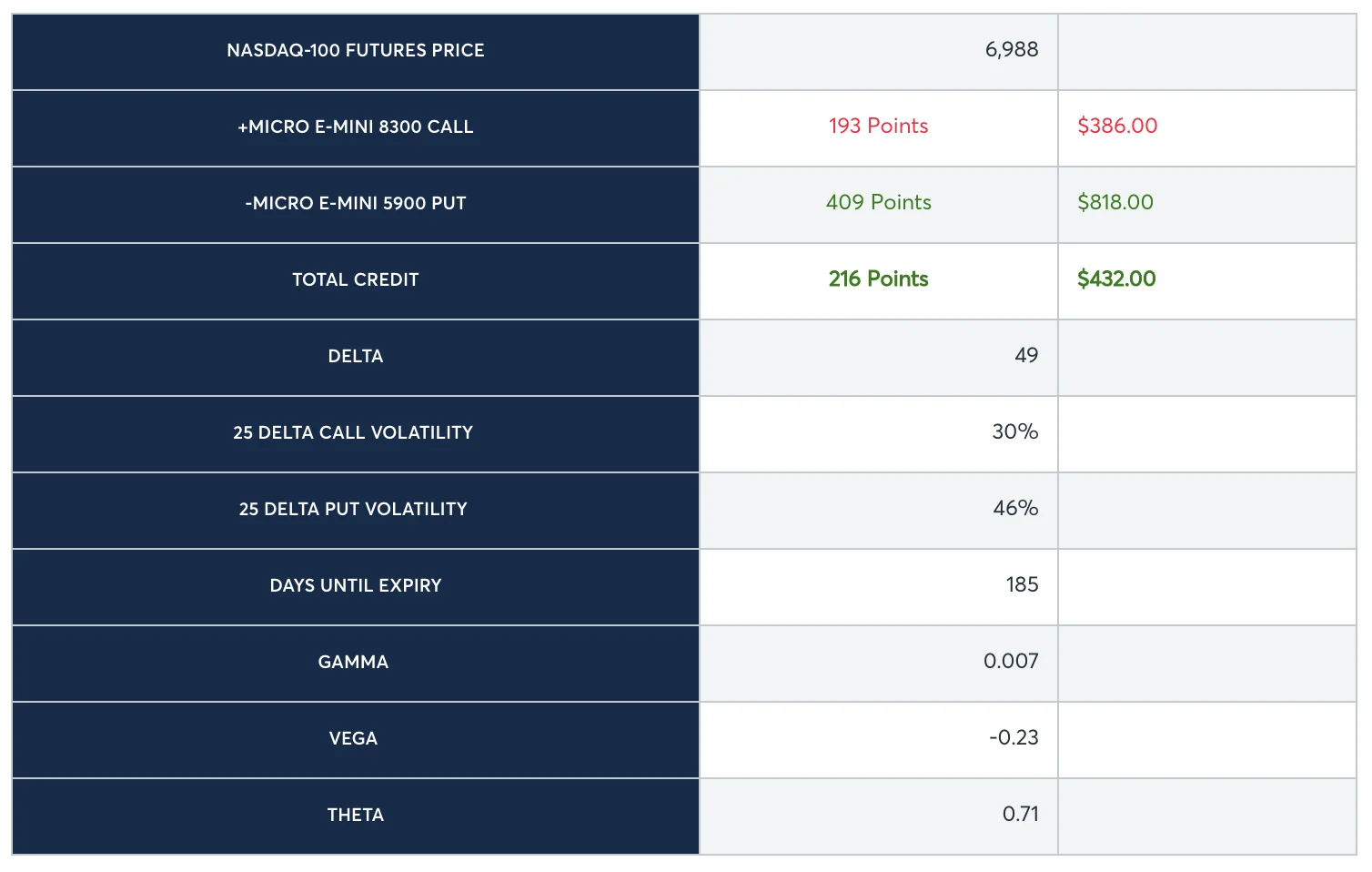

To accomplish this, we’ll keep the 24 delta call we just looked at but also sell a 25 delta put, resulting in a net long position called a “risk reversal.” In other words, we are going to fund the purchase of our call by selling the put against it and because the put is trading at a much higher implied volatility, the position results in a net credit of 216 points or $432 as opposed to the net debit $386 that we paid just for the long call. The summary of this position follows:

Trading example 3: Long risk reversal using 25 delta Micro E-mini Nasdaq-100 options

As you can see, the position has a larger net delta position so will be more sensitive to a change in the underlying than our long call position. However, in this case, the theta value is positive at the initiation of the position, indicating that, all else equal, the passage of time will result in an increase to the value of the position.

In order to compare this position to the previous two we’ve examined, we are going to leave it untouched through its theoretical expiration (185 days); in practical application, traders may adjust such a position as market conditions change. in this case, the call would, of course, realize the same profit of $5,804 that we just saw before (it’s the same instrument) but we’d also realize the additional $432 that we collected when we executed the trade for a total profit of $6,236 as the put we sold would expire worthless. However, as opposed to our long call only, this position holds theoretically unlimited risk as the put we sold would continue to work against us in the case of a futures price decline.

So, this position would be favorable relative to the long call if the futures price remained in a tight range through the life of the position or rallied substantially, as actually happened, but comes with significantly more downside risk.

Conclusion

As you can see, in some cases, the suite of Nasdaq-100 futures and options products available at CME Group can serve as a proxy for a basket of the popular FAANG stocks and can provide some capital efficiency and cost advantages. Additionally, futures and options on futures trading is not subject to pattern day trading rules and do not require locate or incur borrow costs in the event a trader wants to short a market and, of course, offer nearly 24 hour trading from Sunday evening through Friday evening.

However, while we looked at an example of a time period during which the price appreciation of both positions was nearly the same, in our research we observed some time periods during which the price returns, while still positively correlated, diverged a bit more substantially. At the time of this writing, these 5 stocks comprised 33.7% of the Nasdaq-100 index so you would reasonably expect a positive correlation. However, relative outperformance or underperformance by any of these five names could potentially cause the returns to differ.

SOURCES

Historical Stock Prices – marketwatch.com

Historical futures and volatility numbers – QuikStrike

Current Bid / Offer prices – stocks – Etrade Real-time Data over internet

Current bid/offer prices micro Nasdaq – CME Direct over internet

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net