This article was paid for by a contributing third party.More Information.

CVA swap: a new type of capital relief trade

Dmitry Pugachevsky, head of research at Quantifi, a provider of credit analytics, risk management and valuation adjustments (known collectively as XVA) to hedge funds and banks, discusses the emergence of the credit valuation adjustment (CVA) swap market. These transactions resemble interactions typically observed between banks’ XVA desks and trading desks when adding new derivatives trades. Quantifi anticipates that the CVA swap market will play a pivotal role in financial markets, offering participants a means to mitigate counterparty credit risk in over-the-counter derivatives

CVA swap dynamics

While significant risk transfer and capital relief trade transactions have become established practices for banks when transferring counterparty credit risk to hedge funds, CVA swaps have only recently entered the trading arena. The purpose underlying all of these transactions is to enable banks to offload counterparty credit risk, reducing the capital they are required to hold for regulatory compliance. With rising rates and increasing volatility in credit markets, the cost of capital has surged, heightening the significance of such trades.

XVA traders are aware that each new trade executed with the counterparty can significantly increase CVA and other XVA metrics. This increase in ‘incremental exposure’ has the potential to breach limits established by credit officers or substantially drive up regulatory capital – particularly the Basel III CVA capital charge. To avoid such increases, banks are now opting to trade off CVA risk.

The CVA swap market will play a pivotal role in financial markets, offering participants a means to mitigate counterparty credit risk in over-the-counter derivatives

The structure of the new CVA swap closely mirrors the operational dynamics between banks’ trading desks and XVA desks. In this setup, trading desks pay an incremental CVA charge at the begining of the trade, followed by the XVA desk hedging all of the associated risks, which, in the event of a default, bears all the losses. In the context of CVA swaps, apart from the initial upfront payment of CVA from the bank to a hedge fund, there are also daily margins. Effectively, the hedge fund pays the daily difference in CVA. If no default occurs before the trade matures, CVA diminishes to zero at maturity. However, in the event of a default, it equates to losses incurred by the bank. Since CVA is always negative for the bank, the hedge fund pays when CVA increases in absolute value, and receives payment when CVA decreases in absolute value. For example, if CVA changes from -$1000 today to -$1100 tomorrow, the hedge fund pays $100. Conversely, if tomorrow’s CVA is -$950, the hedge fund receives $50.

Enhancing CVA hedge effectiveness

When it comes to CVA hedges, the primary focus is hedging counterparty credit risk, which typically involves buying and selling credit default swaps (CDSs) on a counterparty’s credit name. However, there has been a shift in the landscape, with single-name CDSs becoming less liquid and the largest portion of credit trading now done on indexes. This trend contributes to banks’ preference of transferring CVA risk to the buy side, where credit specialist funds have better opportunities to identify suitable credit hedges – potentially involving indexes or proxy hedges by single-name CDS.

The structure of the new CVA swap closely mirrors the operational dynamics between banks’ trading desks and XVA desks

Additionally, market risk hedges play a key role in offsetting movements in major market factors, which impact the exposure of the underlying derivatives trade, such as interest rates or foreign exchange. Recently, the volatility of these market factors has significantly increased, influenced by decisions made by central banks or geopolitical events, underscoring the heightened importance of market risk hedging. Hedge funds trading CVA swaps should be able to calculate XVA sensitivities to market factors. This requires an XVA system that can efficiently and robustly generate effective hedges.

Cross-gamma and wrong-way risk (WWR)

There is a critical factor known as cross-gamma, reflecting the impact on CVA from simultaneous movement of market factors and counterparty spread. While challenging to hedge, cross-gamma should be incorporated into scenario analysis and profit and loss (P&L) explanations. Another analytic approach involves calculating WWR, where the growing exposure coincides with a widening counterparty spread and the cumulative effect is a CVA increase.

Hedge funds trading CVA swaps should be able to calculate XVA sensitivities to market factors

It is essential to consider these risk factors when reviewing daily CVA explanations. The interplay between credit and market factors is most pronounced in cross-currency swaps – particularly those that are not resettable (essentially, not mark-to-market). This causes significant FX risk due to a large payment at maturity. Another scenario to be considered for such trades is jump at default, where a nation’s local currency may devalue in the event of a counterparty – such as a major local bank – defaulting. Hedge funds engaging in CVA trades with banks should carefully consider all these factors to make well-informed decisions.

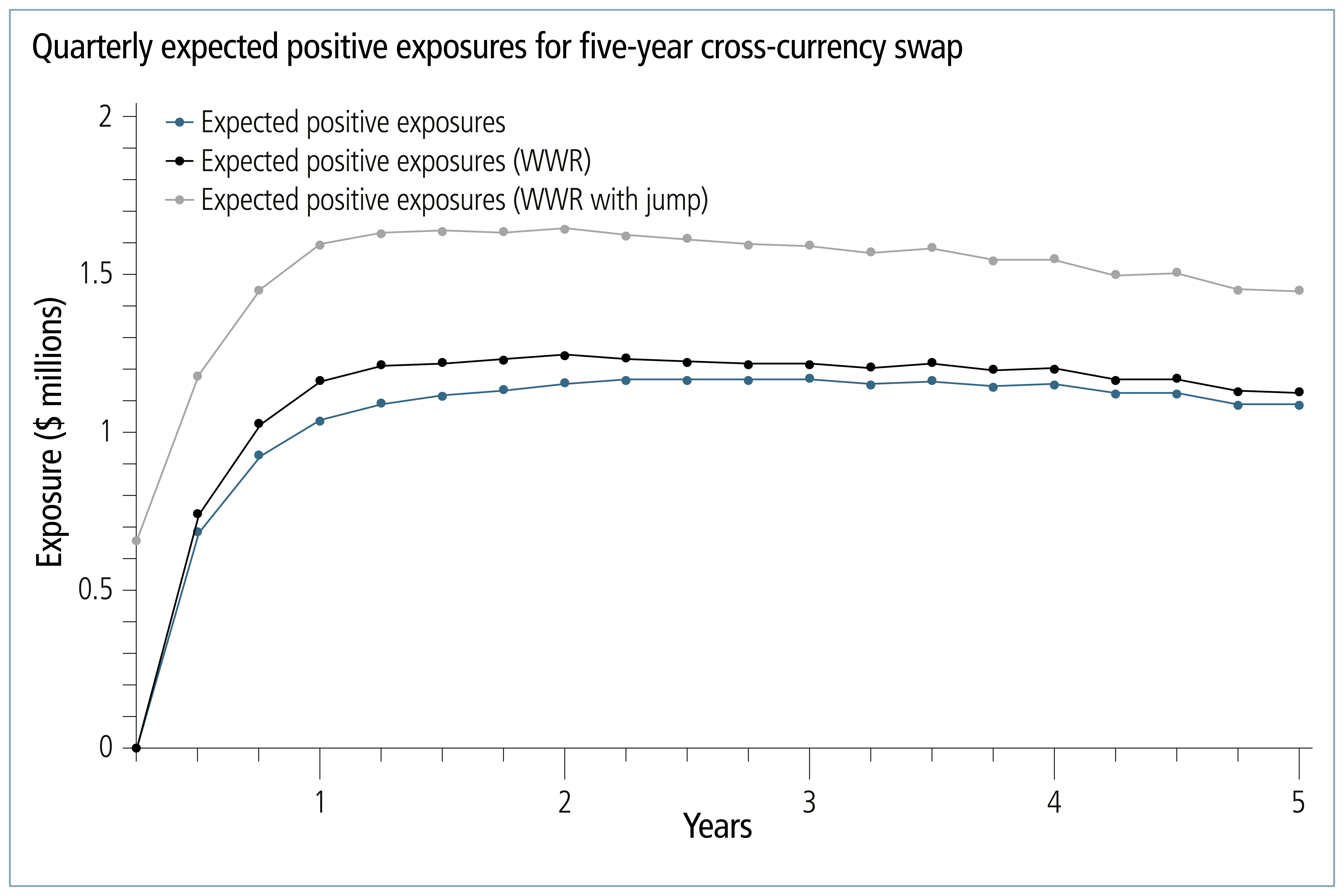

The example illustrated in the following graph highlights the importance of WWR and, especially, jumps at default. The calculations are undertaken for at-the-money, five-year, non-resettable and cross-currency swaps with $10 million notional. With regular CVA equal to -1.5%, WWR CVA increases 6% to -1.6% of notional. But even a 5% devaluation at default increases CVA another 35% to -2.15% of notional. The following graph shows expected positive exposures for each of the three cases: regular, WWR, and WWR with 5% devaluation. Note that WWR could be significantly higher, depending on the volatilities of FX and counterparty credit and the correlation between them.

A proven XVA system for hedge funds

In general, while banks typically provide daily quotes for the current value of CVA, many hedge funds are keen to independently verify these quotes. To do this, they require a sophisticated solution capable of producing CVA and sensitivities, incorporating special features such as generating CVA P&L explanations, calculating WWR and right-way risk, and accommodating jumps at default.

Quantifi is well positioned to assist clients in making informed decision on credit hedges – particularly where the single-name CDS on counterparty credit is not sufficiently liquid

Large banks commonly have comprehensive XVA solutions that incorporate the aforementioned features. In contrast, many hedge funds that are less familiar with counterparty risk often do not have such systems in place. Building a solution from the ground up is a demanding and time-consuming process, requiring several years to build an efficient XVA Monte Carlo solution. Buying a third-party solution can prove to be a more cost-effective and faster option.

Quantifi has successfully implemented its XVA solution at several sell- and buy-side firms, with all the features described implemented and in use by its clients. The high-performance calculation engine and sophisticated analytics support the Monte Carlo simulations and path-wise pricing necessary for XVA. These calculations are highly intensive and time-consuming.

Leveraging its expertise in credit derivatives, Quantifi is well positioned to assist clients in making informed decision on credit hedges – particularly where the single-name CDS on counterparty credit is not sufficiently liquid.

Future-proofing CVA strategies

CVA swaps serve the important purpose of reducing banks’ counterparty risk limits and addressing the increased regulatory capital requirements for CVA. Hedge funds with expertise in credit have an advantage in deploying credit hedges for CVA. This points towards a growing market for CVA swaps.

For hedge funds to validate banks’ quotes and calculate market and credit sensitivities, an advanced XVA system is essential. The system should be able to calculate WWR, estimate daily CVA P&L and incorporate devaluation scenarios. Building such a system is time-consuming, making the acquisition of third-party solutions, such as Quantifi’s, the most efficient and cost-effective option.

For firms looking to enter the CVA swap market that lack the tools to price and manage the associated risk, Quantifi can help. Quantifi provides expertise in various areas, including CVA swap pricing, sensitivity analysis for hedging rates, credit and FX, and the ability to model CVA scenarios. Additionally, Quantifi specialises in derivative pricing across a range of asset classes including rates, FX, credit and commodities. Quantifi has helped other credit funds enter this market and its sophisticated XVA engine is used by leading investment banks.

Find out more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net