This article was paid for by a contributing third party.More Information.

Beyond Libor: the impact of SOFR on rates, bonds and loans

Dmitry Pugachevsky, director of research at Quantifi, explores how the transition from Libor to the secured overnight financing rate (SOFR) impacts rates, bonds and loans, alongside some of the challenges that are due to arise

The June 30, 2023 deadline for publishing US dollar Libor rates for the one-, three-, six- and 12-month tenors marked a critical milestone in the Libor transition process. This date signified the final stages of the Libor wind-down, as the cessation and atypical nature of these Libor rates triggered fallback provisions in many financial contracts. These fallback provisions outlined alternative reference rates to be used when Libor is no longer available.

Market readiness and transition challenges

During the transition, financial institutions and market participants have been working to develop and adopt new products and contracts based on SOFR as a replacement for those previously linked to Libor. Some of the key products that have been transitioned or developed based on SOFR include:

- SOFR futures and swaps: these derivatives allow market participants to manage their interest rate risk exposure based on SOFR

- SOFR-linked floating rate notes (FRNs): debt securities with interest rates tied to SOFR, providing an alternative to traditional Libor-linked bonds

- SOFR-indexed loans: loans with interest rates linked to SOFR have been introduced as an alternative to Libor-based loans

- SOFR-linked mortgages: some mortgage lenders have started offering mortgages with interest rates tied to SOFR

- SOFR-linked deposits: banks and financial institutions may offer deposits with interest rates based on SOFR

- SOFR-linked swaptions: swaptions – options on interest rate swaps – have been created with underlying SOFR-based swaps

- SOFR-linked structured products: various structured products, such as certificates of deposit and notes, have been designed using SOFR as the reference rate.

The transition from Libor to SOFR has presented several challenges in the market. One of the main hurdles is the fundamental difference between the two rates – Libor is a forward-looking rate, while SOFR is an overnight rate. This disparity necessitated adaptations to pricing and risk models to accommodate the new rate methodology. Another significant challenge was the need for liquidity in the SOFR derivatives market. Although the SOFR market has experienced substantial growth, it still lags behind Libor in terms of depth and breadth.

Challenges for FRNs and loans

One challenge highlighted in Quantifi’s white paper, Farewell Libor, hello SOFR: analytical hurdles and fixed income implications, is the impact of the new SOFR on floating bonds and loans. The challenge arises from replacing the Libor term rate with the daily SOFR, which is paid in arrears and complicates calculating the coupon for bonds and loans. Since SOFR is quoted daily, there is a possibility the rate might not be published on the day of the loan payment, making it difficult to calculate the coupon and prepare the payment in time.

During the transition period, attempts were made to alleviate this issue. The Alternative Reference Rates Committee (ARRC) recommended using a compounding formula based on daily rates for calculating SOFR FRNs and paying them in arrears without any payment delays. Additionally, a two- to five-day lookback period, with or without an observation shift, was recommended. The recommended approach for SOFR loans involved calculating rates using a compounding formula, paying them in arrears, and potentially incorporating several days of lookbacks and lockouts. However, the use of lookback and lockout methodologies is cumbersome, and many market participants still prefer a forward-looking approach – similar to how coupons were determined using Libor.

The ‘SOFR-in-advance’ method, commonly employed in agency bonds, calculates the coupon at the beginning of the period based on the average SOFR quoted on the US Federal Reserve’s website, two days before the accrual period begins. However, significant convexity adjustments are necessary, particularly for longer periods, to account for the differences between forward-looking SOFRs and the fixed coupon rates associated with the bonds.

Term SOFR

An alternative approach involves using CME term rates, which have gained popularity as the preferred rate for new loans and as contractual fallbacks following the discontinuation of Libor. These rates have seen significant trading activity in term SOFR loans and swaps. However, the use of term SOFR in swaps is restricted to hedging purposes and limited to end-users only, as per the ARRC’s recommendation.

CME currently releases term rates for SOFR spanning one-, three-, nine- and 12-month periods. These rates are derived from the calculation of the most actively traded instruments, such as SOFR futures.

Calibrating SOFR curves

As SOFR daily rates have become the primary reference rates and the SOFR curve is predominantly used for discounting, the process of constructing the SOFR curve has gained significant importance in various rate calculations. Similar to the methodology used for the FedFund curve or previously employed for the Libor curve, the prevalent approach for calibrating the interest rate curve involves bootstrapping it from market quotes with high liquidity. In the case of SOFR, these quotes typically include the overnight rate, futures rates and swaps rates.

Since October 2018, CME has facilitated the clearing of SOFR swaps, which are similarly based on compounding daily SOFRs and settled retrospectively. Among these swaps, the most actively traded instruments are the SOFR overnight indexed swaps (OIS) – SOFR versus fixed rate – and basis swaps relative to the Effective Federal Funds Rate (EFFR). It is important to note that, if the SOFR curve is selected for discounting, the SOFRs can be bootstrapped exclusively from SOFR quotes, including overnight rates, futures rates and OIS. If necessary, the EFFR curve can be constructed using the basis swaps.

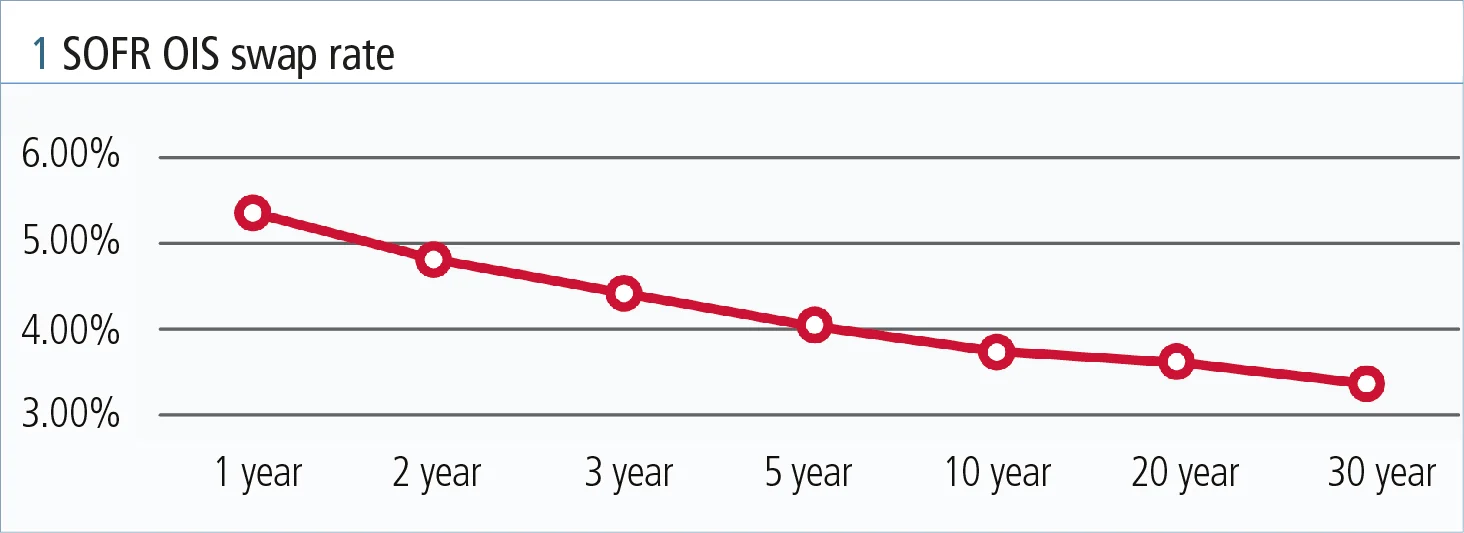

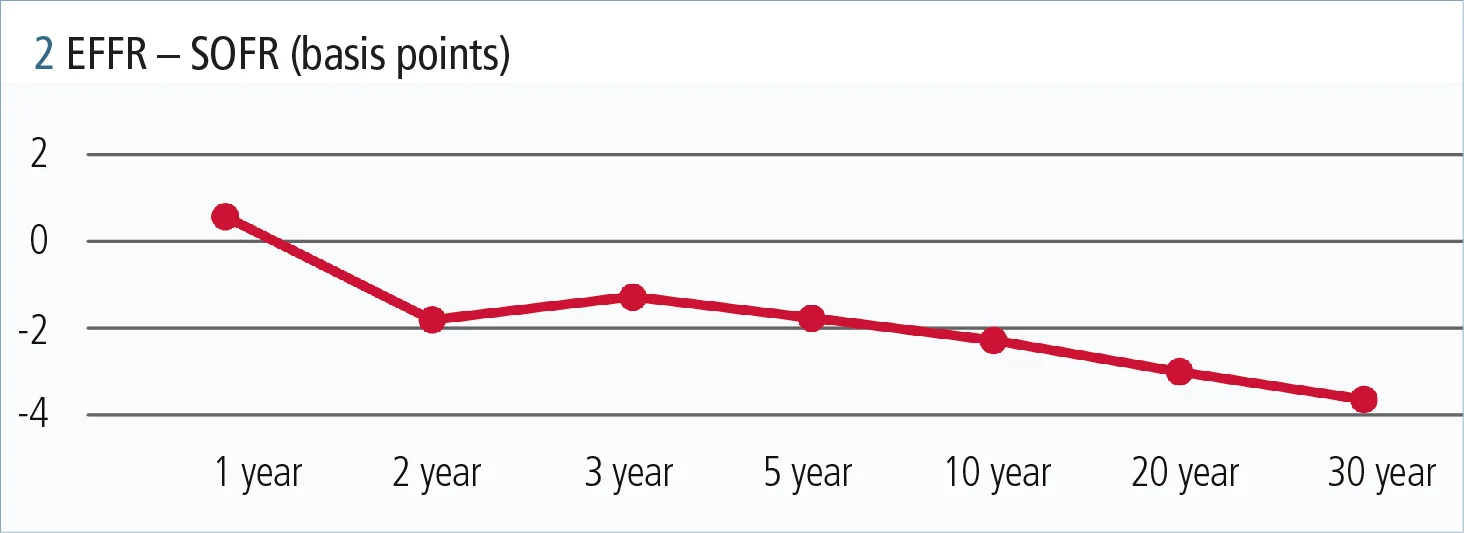

Figures 1 and 2 illustrate the rates for SOFR OIS swaps and the basis between EFFR and SOFR. It is important to note that, if the SOFR curve is selected for discounting, the SOFR rates can be bootstrapped exclusively from SOFR quotes, including overnight rates, futures rates and OIS swaps. If necessary, the EFFR curve can be constructed using the basis swaps.

Compared with the EFFR and Libor curves, calibrating the SOFR curve presents new challenges. The daily averaging and retrospective payment nature of SOFRs, as well as the use of compounding formulas or geometric averages in SOFR three-month futures and swaps, adds complexity to the calibration process. Another challenge arises from the inclusion of historical and projected segments in the curve calibration, which is unique to the SOFR curve.

Accounting for the convexity adjustment of forward-future rates is another challenge specific to SOFRs. The adjustment considers the distinction between the future rate, calculated under the risk-neutral measure, and the forward rate, calculated under the forward measure. Calculating the convexity adjustment requires rate volatilities, obtained from implied volatilities of SOFR futures options cleared by CME.

While the daily published term SOFRs are available, they only extend up to a maximum maturity of 12 months, posing challenges when projecting rates into the future. Additionally, the SOFR curve is not directly calibrated to term SOFR, making it difficult to calculate the present value of a loan accurately.

Synthetic Libor

‘Synthetic Libor’ is an alternative approach to determining Libor rates following its discontinuation. Its purpose is to ensure continuity and prevent market disruption. Regulators and industry organisations have devised a methodology for calculating these rates, aiming to replicate the economic conditions that would exist if Libor were still active.

It is important to note that, although synthetic Libor is quoted until September 30, 2024, it is a non-representative rate. It incorporates spread adjustments fixed by the ARRC and is a transitional solution rather than a true representation of the original Libor benchmark.

Enhancing capabilities

The transition from Libor to SOFR presents several market readiness and transitional challenges. These challenges include adapting pricing and risk models, addressing liquidity in the SOFR derivatives market, dealing with complexities in calculating coupons for FRNs and loans, calibrating the SOFR curve and incorporating synthetic Libor as a transitional solution. Enhancing capabilities through robust analytic libraries and strong operational capabilities is crucial to overcoming these challenges successfully. This can be achieved either through in-house development or by employing third-party solutions, such as Quantifi, to enhance the necessary functionalities.

Request a copy of Quantifi’s white paper:

Farewell Libor, hello SOFR: analytical hurdles and fixed income implications

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net