This article was paid for by a contributing third party.More Information.

US dollar Libor transition: the role of CCPs in conversion

As the transition from Libor to alternative risk-free rates (RFRs) approaches a new milestone, Philip Whitehurst, head of service development, rates at LCH SwapClear, discusses the central counterparty’s (CCP’s) plans for US dollar Libor conversion, the implications for non‑US dollar benchmarks that depend on it and the future direction of these markets

Given the success of the non-US dollar Libor conversion processes for cleared swaps in the fourth quarter of 2021, what plans have been made for the US dollar Libor transition?

Philip Whitehurst: After all the good work to get the International Swaps and Derivatives Association’s (Isda’s) fallbacks adopted, there was belief in some areas of the market that it was ‘job done’ as far as swaps remediation was concerned. This led to initial scepticism about LCH’s cleared swap conversion processes. But, once market participants recognised that CCP conversion built on and relied on Isda’s fallbacks – rather than cutting across them – we got the necessary buy-in and, ultimately, the processes worked really well.

As a reminder, the conversions turned each Libor trade into RFR equivalents, eliminating non-representative Libor dependency while maximising cashflow continuity and preserving representative Libors. We used cash compensation to tidy up the small net present value change driven by the observation period shift implicit to the fallbacks.

In Q2 2022 we consulted on what was essentially an equivalent US dollar process, and received strong support from the market. There are a couple of minor changes: we won’t perform a mandatory basis splitting and we have slightly modified the zero coupon swap solution. Otherwise, we are replicating the tried-and-tested approach, and it should look familiar.

What were the reasons for the success of the non‑US dollar processes?

Philip Whitehurst: The biggest factors were the clarity, certainty and rigidity of the economic relationship between Libor and each corresponding RFR created via Isda’s fallbacks. This locked down the pricing dynamics and, although there are some subtleties, meant we were working from a rock-solid platform. It’s great to have parallel arrangements in place for the conversion from US dollar Libor to the secured overnight financing rate (SOFR).

What were the main reservations? Do they still apply?

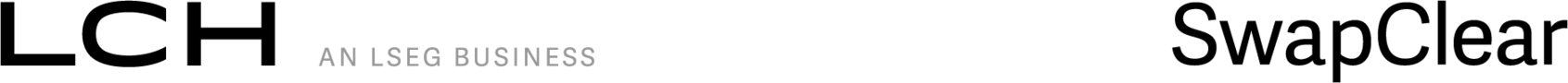

Philip Whitehurst: If there was a reservation, it was that liquidity in SOFR swaps was not entirely proven – especially going back to our original consultation in early 2021, when it was expected that US dollar Libor would cease along with other non‑US dollar Libors on December 31, 2021. SOFR liquidity has grown enormously in the past 18 months (see figure 1). I think most market participants are now glad to have a backstop exit route for US dollar Libor contracts.

CCPs have supported legacy Libor activity in the non‑US dollar markets. Do you expect an equivalent in US dollars?

Philip Whitehurst: Yes – market participants have made the case for an equivalent, and CCPs are likely to offer a similar solution. There has been relatively light use of the non-US dollar capability – accounting for less than 1% of market volumes – but it helps minimise disruption in target markets, such as swaptions.

There are some idiosyncrasies in the US dollar market – and the dates are different – but a parallel solution seems warranted given the demand.

Are any non-US dollar benchmarks dependent on US dollar Libor?

Philip Whitehurst: Yes – both the Singapore dollar swap offer rate (SOR) and Thai baht interest rate fixing (THBFIX) are dependent on US dollar Libor in a very direct way. The cessation of US dollar Libor has an immediate impact, as these two indexes cannot be produced using the formulaic link that applies currently. This is a big challenge in these markets, but is well understood, and plans have been developed to cater for US dollar Libor cessation over several years.

What are the implications for transition in these markets?

Philip Whitehurst: As a first step, recommended alternative RFRs needed to be identified. These are the Singapore overnight rate average (Sora) and the Thai overnight repurchase rate (Thor). Many of the important building blocks have been put in place over recent years, including the Isda floating rate options definition necessary to enable use in swaps contracts along with other infrastructure.

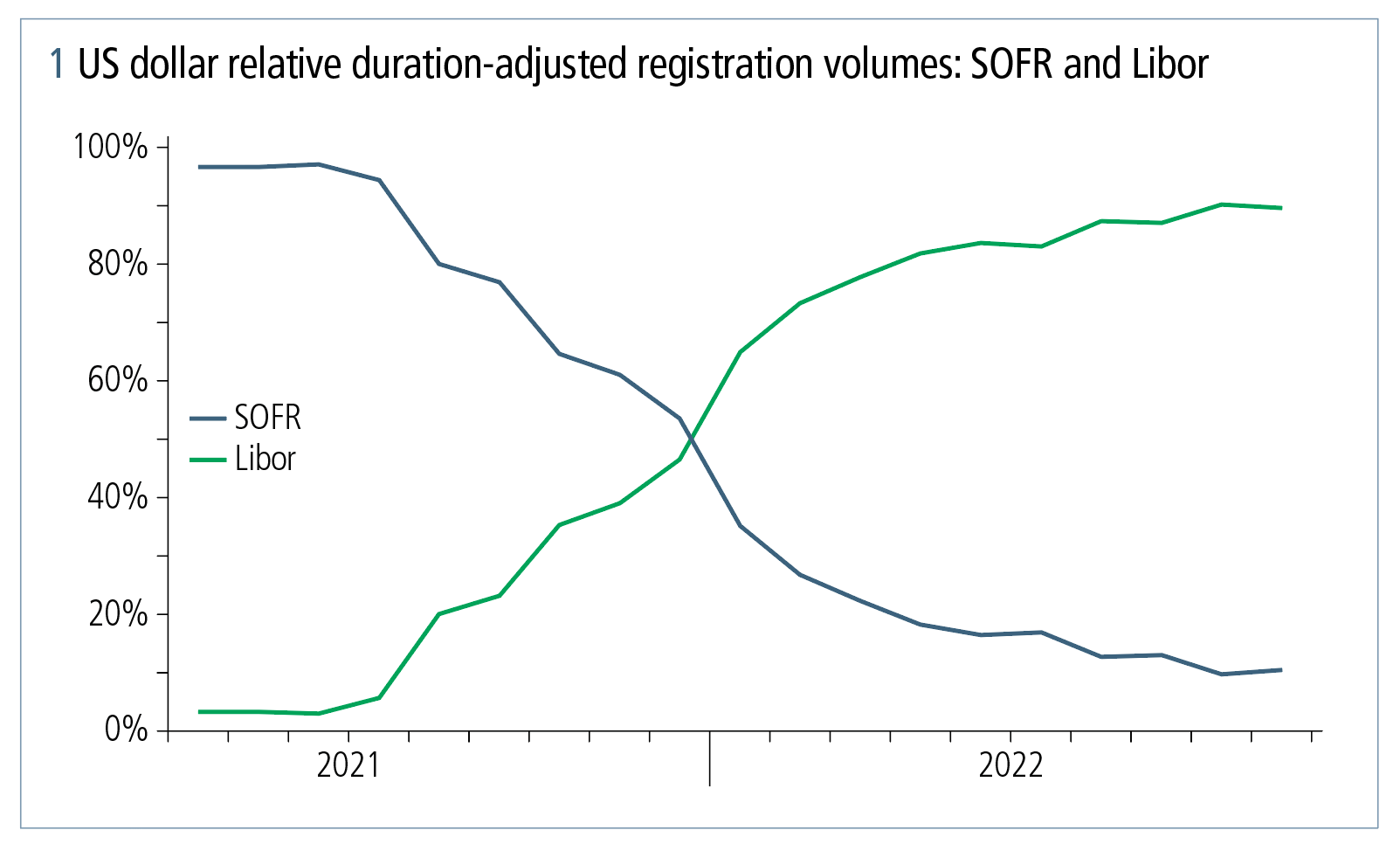

CCPs such as LCH have introduced a clearing capability, and there have been strong gains in liquidity (see figure 2). The liquidity transition happened earlier in the Singapore dollar market, but adoption of Thor in the Thai baht market has been strong since the launch of clearing earlier in 2022.

Now we have good adoption of Sora and Thor in the swaps market, are we able to replicate Libor transition processes?

Philip Whitehurst: Unfortunately not – as previously highlighted, the rigid and immediate link created via Isda’s fallbacks between each Libor and its corresponding RFR was the single most critical success factor. The cessation of Libor in each currency activated the dependence on the RFR cleanly and immediately. This is not the case in the Singapore dollar and Thai baht markets. Isda’s fallbacks were developed before Sora and Thor were in play, with the result that Singapore dollar SOR and THBFIX do not directly fallback to Sora and Thor, respectively.

Instead, the cessation of US dollar Libor on June 30, 2023 causes a fallback to a SOFR-based formulation. This introduces a complication over a known time horizon – around 18 months in the Singapore dollar market, and two and a half years in the Thai baht market – when the fallback rates involve a forward-looking foreign exchange rate input and a backward-looking interest rate input into their calculation. It is only beyond this horizon that we get back to a direct link to the RFR.

Are you able to elaborate on these fallbacks? Things seem more complex in this instance than was the case for the Libors.

Philip Whitehurst: The best way to think of this is as a two-step fallback versus the one-step process for Libors. For both Singapore dollar SOR and THBFIX, the first fallback is to a SOFR-based rate – known as fallback rate (SOR) and fallback rate (THBFIX), respectively. Only when these rates are themselves discontinued does a second fallback kick in. In the case of the Singapore dollar market, this second fallback is to the Monetary Authority of Singapore recommended rate, which is based on Sora using the same formulation as for the Libors.

In the case of Thai baht market, the second fallback takes us directly to Thor, given that the Bank of Thailand (BoT) confirmed it will not produce a BoT recommended rate. This effectively creates a three-phase yield curve in both markets: phase one uses representative rates available until June 30, 2023; phase two uses the SOFR-based fallback rates; and phase three gets to the local currency RFR-based rates.

How has that affected CCP plans?

Philip Whitehurst: CCPs have had to either rethink or introduce additional steps into their plans. For the Singapore dollar, LCH has concluded a market consultation, and the conversion will leverage the approach taken for Libor. It will create contracts with a backward-looking Sora-based coupon incorporating the industry standard spread adjustments. Cash compensation for phase three – as above – is the same as for Libors, but in phase two we need to sample SOR/Sora basis swap market prices that embed the projections of the relevant risk factors: the spot SGD/USD FX rate, the relevant FX forwards points and SOFR.

For the Thai baht, things are less certain. Phase two is longer and the Thor swaps market is younger. We remain in consultation with the market and – although we can’t prejudge – there is a chance things could look quite different.

Where does this leave the market in terms of timetable?

Philip Whitehurst: It makes sense to take care of the US dollar Libor conversions first, and CCPs have scheduled these events for early- to mid-Q2 2023. That leaves room to conduct the Singapore dollar and Thai baht conversion events later in Q2, and LCH has scheduled the weekend of June 9, 2023 for a joint event. We also have contingency plans in all cases.

What’s next? Are we done with interbank offered rate (Ibor) transitions (for cleared swaps) once these conversions are behind us?

Philip Whitehurst: For better or for worse, there is plenty more to do in this global programme. We already know about cessation of the Canadian dollar offered rate in mid-2024, which will necessitate plans in/for Canadian dollars. There are several other markets – for example, some Nordic nations and Poland – that will need attention in the years ahead. So there is still plenty of road to travel.

LCH SwapClear is here to partner with the market to navigate the US dollar Libor transition process. Contact LCH SwapClear’s specialist sales team or visit LCH SwapClear for further information.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net