This article was paid for by a contributing third party.More Information.

Does a regulated FX marketplace bring tangible benefits for customers?

By CME Group

The global foreign exchange (FX) market is arguably the largest and the most fragmented of all financial markets in terms of trading venues and access to liquidity. Across the multitude of venues, platforms and brokers that provide customers with access to the FX market, there are ultimately two main ways that this asset class can be traded ‒ either exchange traded (listed) or over the counter (OTC). Historically, the bulk of the $6.6 trillion a day FX market has been traded in the OTC market, but recent trends and records have illustrated a growing level of adoption for the listed market as a complementary source of liquidity that is both regulated and governed by a transparent rulebook.

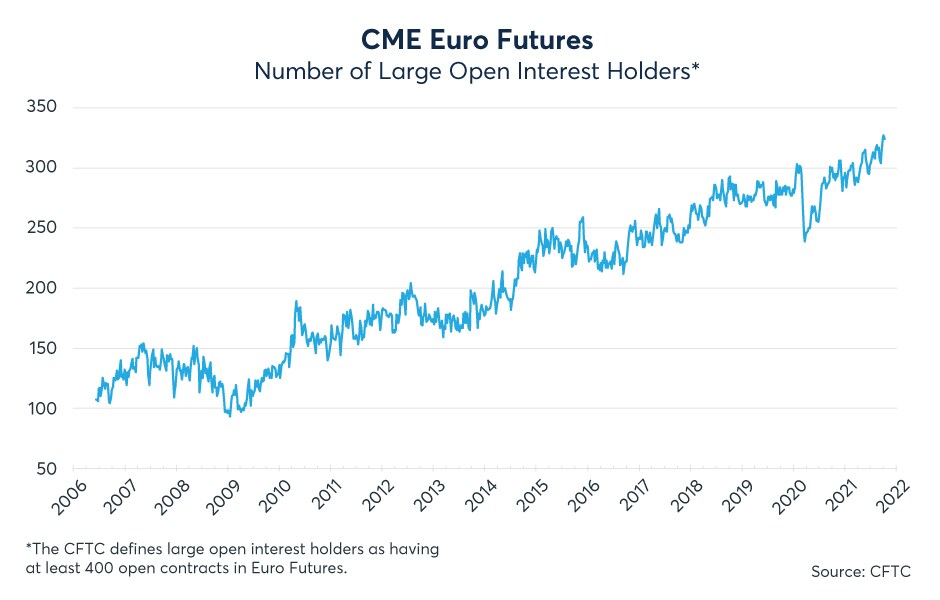

Chart 1: Number of large open interest positions held by customers in EUR/USD FX futures using CFTC data

Trading on an exchange

The Chicago Mercantile Exchange (CME), which is not only the largest listed FX venue globally but also one of the largest primary venues for price discovery in global FX markets, is a regulated designated contract market (DCM). As a result, it operates under the regulatory oversight of the CFTC, and as such, all its activities take place under a set of rules and regulations in a transparent and systematic manner. Furthermore, to obtain and maintain its designation, a DCM must also comply, on an initial and ongoing basis, with twenty-three Core Principles established in a suite of regulations from the CFTC.

This level of market oversight and compliance is very different to most platforms and relationships within the OTC space, but does this regulatory scrutiny and backdrop provide any tangible benefits for customers?

Potential advantages of trading on exchange in a regulated market

- Trading on an all-to-all basis: The central limit order book (CLOB) means that all participants enter the market via a single point and trading takes place on a multilateral basis, rather than bilateral. This means that all buyers and sellers interact with each other at the same time, providing a regulated, centralized arena where everyone can see and trade upon the best price available.

- Firm pricing with no last look: All prices within the CME CLOB are firm and with no last look, providing traders with transparency and certainty in the market. Trading in the CLOB is also totally anonymous, meaning that all traders can trust that their trading intention will be executed in a fair and consistent manner without the liquidity provider knowing anything about the price taker, their intentions, or their existing positions.

- FIFO (first in, first out): The non-discretionary nature of an exchange order book means that orders are matched automatically on a price-time basis, without discrimination or preference to any entities involved.

- Credit agnostic pricing: The credit rating of each entity is not relevant to the prices that they can see or trade upon. The whole CLOB is truly all-to-all, with every client trading on the same FIFO principle, irrespective of their credit rating or status.

- Choice of trading styles: Trading on a regulated, listed marketplace does not limit the trading styles available to customers. The CLOB provides the ability to aggress on firm prices, but also to use algos and to trade passively to avoid, or even earn, the spread on transactions. As a complement to the CLOB, customers can also trade on OTC liquidity directly with chosen counterparts via ‘blocks’ or ‘EFRPs’, which ultimately still result in cleared positions.[i]

- Counterparty credit risk: Trading listed FX means that all resulting positions are centrally cleared against a CCP which heavily mitigates counterparty risk and provides margin efficiencies via the benefits of netting as well as model differences in the context of regulation, such as the uncleared margin rules (UMR). As a result of the cleared model, no ISDAs or bilateral credit lines are required between the customer and the liquidity providers, reducing the legal costs to trade whilst also separating liquidity provision from credit provision.

Bottom line

Historically, the global FX market has largely been traded in the OTC environment market but a number of factors ‒ ranging from the impacts of regulation through to investor pressures ‒ have led to a growing adoption of listed FX as a complement to OTC activity.

The potential advantages of listed FX include market transparency, margin efficiencies, a hugely diverse liquidity pool, and the reduction of counterparty risk. As a result, trading FX on a regulated venue such as CME can provide potential tangible advantages that customers should consider as they evaluate their FX trading behaviours.

To discuss these topics directly please contact fxteam@cmegroup.com.

Standardized Approach for Counterparty Credit Risk (SA-CCR)

See how the transition to SA-CCR opens new possibilities for optimizing risk exposures and decreasing capital costs with TriOptima’s services.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net