Feature

Buy-siders eye ways to get ahead of US resolution stay rules

Come July 1, asset managers will be unable to dump derivatives as a G-Sib is unwound. Lawyers are standing by

Functional programming reaches for stardom in finance

Fans highlight more reliable code, and suitability for complex tasks and distributed ledgers

Banks hope final FRTB rules will ease NMRF burden

Internal models approach buoyed by more liberal rules on price observations and risk factor aggregation

Giancarlo’s last stand: the race to complete Sef reforms

Part of flagship proposals could be left to his successor, putting their fate in doubt

Apac bank boards: light on risk experience

Survey of 24 large Apac bank board risk committees shows dearth of risk managers

Margin or membership? Regulators react to Nasdaq default

Six supervisors – from Bafin to the MAS – downplay idea of mandatory increase in futures MPOR

Dawn of CVA threatens hedging woe for Japan banks

Japan’s thinly traded CDS market will make CVA hedging challenging, dealers say

Quants use AI to cut through murk of ‘sustainability’

Separating the wheat from the chaff is fundamental to ESG investing. Machine learning can do that

SOFR, so bad: liquidity lags transition ambitions

Thin current trading may lead to poor fallback choices, and dim SOFR’s appeal ahead of Libor’s death

Prop traders sound warning over EU capital regime

Non-banks fear topsy-turvy capital requirements under new rules based on clearing margin

Basel haircut floors threaten securities financing desks

Banks fear capital hit unless regulators provide exemption for stock borrowing

Unmoved, Fed stands by G-Sib surcharge

Facing down frenetic lobbying and even US Treasury, central bank doesn’t blink on surcharge

AI moves into middle office at energy firms

Energy firms explore how artificial intelligence can boost returns

Quant guide 2019: industry entrants face cultural ‘abyss’

Divide between industry and academia worries practitioners and professors

Non-payment insurance grows as banks shun stuttering CDS market

Credit portfolio managers explore insurance contracts to offset risk from loan book

Eurostoxx dislocations signal autocall hedging pain

Swings in dividends and volatility reveal year-end stress as European index slump tests “peak vega”

Banks bet on data to rescue research

Barclays, Morgan Stanley, UBS among those using data science to pep up their research offerings

Fed’s MBS exit surprises some with muted rates vol

Shrinking of huge portfolio led to predictions of vol jump that – so far – has not appeared

Regulators rethink Volcker overhaul to solve accounting glitch

Bankers urge cancellation of new definition of prop trades that could capture liquidity buffers

For US banks, billions in regulatory manna

The unwind should help mid-tier banks, but the G-Sib impact is a complex balancing act

A threat to the Ion throne?

Banks need connections to e-trading venues; they don’t want the other services that come with them

Shipping and energy firms revisit hedging on IMO 2020

Upcoming shipping rules set to impact fuel prices across the energy complex

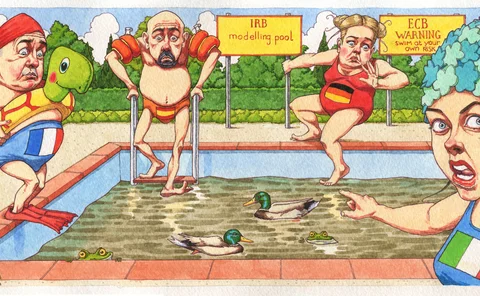

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements