Feature

Asia Risk 15: Lee Kwok Kwan, CIMB

CIMB Group has navigated through the current financial crisis with minimal difficulty. Indeed, the Malaysian bank’s deputy chief executive, Lee Kok Kwan, believes strict capital and liquidity standards have given CIMB a distinct competitive advantage…

Asia Risk 15: James Sheu, Chinatrust

Chinatrust is one of Taiwan’s leading financial groups with businesses spanning venture capital, asset management, securities broking and commercial banking. Its growth has taken place alongside the development of the island’s financial markets, says…

Asia Risk 15: Doug McTaggart, QIC

Queensland Investment Corporation has been at the vanguard of asset managers in Australia promulgating sophisticated risk and portfolio management techniques during the past 15 years. Rachel Alembakis speaks with its chief executive, Doug McTaggart

Asia Risk 15: Rodrigo Zorrilla, Citi

Citi’s global footprint has enabled it to benefit from the development of onshore, offshore and basis markets. The bank’s head of markets for Asia, Rodrigo Zorrilla, says Citi has also catered to client demand by supplying a steady stream of exotics…

Asia Risk 15: David Jiang, BNY Mellon Asset Management

Investors in different parts of Asia have different needs. But they have all gained a greater insight into risk during the past 15 years, especially during times of crises. Rachel Alembakis speaks with David Jiang, chief executive of Asia Pacific for BNY…

Asia Risk 15: Noboru Terada, GPIF

Noboru Terada presided over Japan’s $1.35 trillion Government Pension Investment Fund in the mid-1990s, where he overhauled the fund’s governance structure and portfolio management approach. He speaks to Joti Mangat about Japan’s pension industry

QIC’s Hazel McNeilage in dynamic asset allocation drive

The Queensland Investment Corporation is pushing ahead in its bid to promote dynamic asset allocation, according to Hazel McNeilage, head of funds management. But dynamic downside risk services have yet to gain strong support from clients. By Rachel…

Asia Risk 15: Derivatives regulators ask the wrong questions and get the wrong answers

Regulators globally are grappling with legislating the derivatives sector, but the first hurdle to overcome is to understand how exactly the industry works. Satyajit Das argues it is important to first come up with the correct definitions before…

Asia Risk 15: Interdealer brokers in quest for deeper liquidity

Interdealer brokers have continued to build ever-deeper pools of liquidity in Asian markets as they have forged profitable businesses from Asia’s fragmented economies. While moves to electronic platforms are gaining momentum, relationships are still…

Asia Risk 15: Derivatives netting not fully in place in Asia

The standardisation and enforceability of documents represents a cornerstone of the over-the-counter derivatives market in Asia. But as the sector continues to grow, risk mitigation from close-out netting has yet to gain legal certainty in many …

Asia Risk 15: Exchanges have profited from derivatives but face new threats

Asian exchanges have undergone a radical transformation during the past decade as systems were overhauled, new derivatives instruments traded and new ventures formed. Yet perhaps their biggest challenge awaits them. Jill Wong reports

Asia Risk 15: Technological evolution facilitates modern financial risk management

Economic growth in Asia, coupled with increased investment in electronic derivatives trading technology during the past 15 years, has resulted in a vastly improved risk management culture in the region. Clive Davidson reports

Asia Risk 15: Philip Combes, New Zealand Treasury

The New Zealand Debt Management Office (NZDMO) has managed both assets and liabilities on behalf of the New Zealand government. Here, deputy secretary to the New Zealand Treasury and head of the NZDMO, Philip Combes, explains how a prudent approach to…

The swaps carve-out conundrum

Section 716 of the Dodd-Frank Act will force swap dealers to hive off certain derivatives businesses into separate affiliates. But the legislation is fiendishly complicated, riddled with oversights and requires daring interpretative leaps, which has left…

The end for one-way CSAs

Sovereign derivatives users have been able to avoid posting collateral to their dealer counterparties in the past, but pending reforms to bank capital and funding rules are changing the equation. If sovereigns refuse to budge, they will have to accept…

Basel CVA changes criticised

The Basel Committee on Banking Supervision has adapted its proposals for a capital charge on counterparty risk following industry feedback, but banks were hoping supervisors would go further. By Mark Pengelly

Surviving the liquidity squeeze

Excess liquidity in the euro funding markets halved at the beginning of July, causing Eonia to leap higher. The extent of the move surprised traders and caused problems for some participants. Christopher Whittall reports

Saying no to algos

A number of banks have launched algorithmic trading systems for foreign exchange, intended to provide more efficient execution for clients. But some question whether algorithmic models are actually needed in the highly liquid foreign exchange market. By…

Playing on forex correlation

The eurozone crisis sent market participants scrambling to put on macro hedges. A popular trade was to short the euro, but with the cost of this strategy escalating, some turned to correlation products. By Christopher Whittall

Lufthansa wary of OTC regulations

Corporates across the globe have lobbied to ensure end-users are not subjected to new clearing requirements for derivatives. For Lufthansa’s treasury department in Frankfurt, ensuring it is able to continue to hedge its foreign exchange and interest rate…

Bespoke solutions for an Islamic CSA

Islamic derivatives users are still getting to grips with a new sharia-compliant master agreement, but some argue the market will be stunted without an accompanying collateral document. Lawyers say that is some way off, so they’re cooking up bespoke…

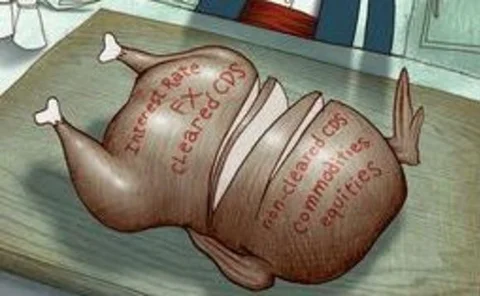

Clearing dilemma for CCPs

Dealers have made progress towards clearing swaths of the over-the-counter derivatives market. But market participants are likely to have to clear more awkward products to satisfy regulators’ demands. Mark Pengelly investigates

Equity volatility backlash

Taking a long equity volatility position is a favourite macro hedge for risk managers and traders across asset classes, but the trade doesn’t always work as expected. How has the volatility experienced in May and June affected macro hedging? Joel Clark…

A focus on gone-concern contingent capital

Regulators have found it easier to reach consensus on a standard for contingent capital that converts at the point of a bank’s insolvency, but continue to struggle with the definitions for going-concern conversion. How will supervisors proceed? Joel…