Feature

Meeting the pace of change

Energy trading is advancing so quickly it's sometimes difficult for software to keep pace. Energy Risk's software survey reveals almost half of respondents changed systems in 2006. David Watkins reports

The IFRS conundrum

Firms with a public listing in the EU need to adhere to complex accounting standards on financial instruments. Michiel Mannaerts and Pieter Veuger look at the latest implications for energy companies

Designing a market

With Canada likely to embark on an emissions-trading scheme this year, Oliver Holtaway looks at the various forms it could take

Gearing up for ever higher leverage

Rising leverage in the global system coupled with fears for the accuracy of credit risk pricing dominated discussion at the World Economic Forum in Davos this year. But not everyone is downbeat, as Matthew Attwood finds out

The Big Interview: LMA

Should high-yield issuers publicly disclose details of their loan agreements? Nikki Marmery talks to the LMA about this thorny issue

Back to basics

We take you back to the credit basics to review everything you thought you already knew but were too afraid to ask ... Juan-Carlos Martorell, director in structured credit marketing at ABN Amro in London explains the mechanics of CPDOs

CDS documentation

Market graphic

Q: What do the distressed debt market and the Japanese puffer-fish have in common? A: They're both irresistible - but highly toxic

Distressed debt investors gearing up for a bumper year should take note of the name of Babson's new credit fund, Fugu, after the deadly Japanese puffer-fish - a prized delicacy that can be lethal if not prepared correctly. Philip Moore reports on the new…

Bob Buhr

The existence of so-called special shares in some European companies enables governments to block certain transactions such as acquisitions and LBOs. Understanding how they work is necessary for bondholders in assessing LBO risk, says the head of credit…

Moody's hybrid methodology

Talking point

Subprime mortgages trigger ABX sell-off

Investors in the subprime mortgage sector might have been expecting some kind of market correction after a jump in delinquency rates at the back end of 2006. What they weren't expecting was a full-scale stampede out of the ABX index. Credit reports

Harnessing our differences

In the first of a series, Eric Holmquist considers the characteristics, challenges and opportunities in developing a risk culture

Global warming: a new risk for firms

MANAGEMENT

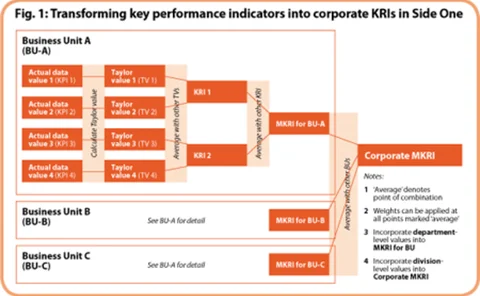

Two heads are better than one

Glenn Christensen of Synovus Financial Corp. introduces an enterprise risk management strategy known as the Bifurcated ERM Methodology

A call to compliance

Mifid, Basel II, SOX - the pace of regulatory change has increased substantially over the past few years, which has led to the large-scale expansion of compliance departments for financial services firms. But the recruitment market is finding it hard to…

GRC - the hot new operational risk product

MEASUREMENT

Resolving the confusion

Risk control self-assessments have become a Tower of Babel for the op risk discipline, with a variety of different approaches being taken. Ellen Davis reports

Paper claims Basel II could drive corruption

CORPORATE GOVERNANCE

ID theft is the most common consumer fraud

FINANCIAL CRIME

Bumf and bumf-ability

Each time a directive is altered in the run-up to implementation, the resulting rewording and reprinting of documentation can prove almost as challenging as getting the changes accepted by the industry. When that directive is as large as Mifid, a whole…

Risk managers: rainbow warriors?

Corporate social responsibility is an oft-bandied term among big business, but frustratingly hard to define. Peter Madigan looks at the risk issues for banks and what risk and compliance executives need to know

Gait marches towards greater security

MANAGEMENT

Getting the balance right

Inflation