Feature

Newman: why commodities will stay OTC

As he retires, Icap Energy founder on his acid test for picking emerging markets, and the promise of LNG derivatives

Libor transition calls for modelling overhaul, quants warn

All pricing, risk and valuation models will need to be changed to reflect the new rate

A fool’s gold (or data) mine

Quants are building statistical toolkits to avoid the pitfalls of data mining

OK, computer? Hurdles remain for machine learning in credit risk

Concerns over cost, applicability and oversight give pause to banks’ use of ML techniques in credit risk

Gas traders fear US winter price spike

Shale’s ability to step up production rapidly is being relied upon to shore-up under-supply

US carbon trade surviving below the radar

State-level carbon trading markets are thriving without federal support

Best execution in Asia faces data deficit

Lack of trade information undermines Mifid-style shake-up of investment activities

Bank risk committees: desperately seeking risk managers

Most boards still lack career risk specialists despite tighter governance requirements

Climate risk joins ethics in driving lending decisions

Barclays, BNP Paribas and others are analysing risk of climate change-related losses

Libor transition raises basis risk fear

Shift to secured benchmark could cause dislocation between bank funding and lending rates

Seeing red: EU banks swamped by stress test demands

Banks’ stress test submissions receiving tens of thousands of error messages from local supervisors

Swap spreads halve as dealers fight for corporate market share

US bank push, rate movements and evolving market practice driving spreads to “suicidal” levels

NDF nightmare: banks seek fix for benchmark ‘mess’

European firms face bar from using three Asian fixings from 2020, raising concerns about legacy trades

The special one: a eurozone G-Sib waiver for BNP Paribas

Experts say French bank’s G-Sib buffer could fall to 1%, saving €3 billion in regulatory capital

Buy-side modellers seek ‘Holy Grail’ of investing

When stocks and bonds fell in tandem this year, it sparked a debate about whether a lasting regime shift could be predicted

Lenders reveal struggles over IFRS 9 roll-out

Size of task caught some banks unawares, leading to botched home-grown systems or data problems

Funding in the dark: EU banks wait on bail-in bond rules

Issuance strategies clouded by uncertainty over MREL subordination and pre-positioning

Buy side using compression tools to create, not destroy

Custom-trading services are booming at Bloomberg and Tradeweb, but not for the reasons intended

Banks explore new data techniques to tackle money laundering

Artificial intelligence in tandem with human analysis seen as effective for know-your-customer

Brexit: banks consider four ways to move swaps en masse

Statutory business transfers in frame as bilateral novation may take too long

Asia-Pacific banks grapple with conduct risk rules

Australia, Hong Kong regimes lead in developing conduct risk guidelines; Singapore lags behind

Trade data initiatives aim to unify regulatory reporting

Standardised data would improve systemic risk monitoring and save firms billions, say data engineers

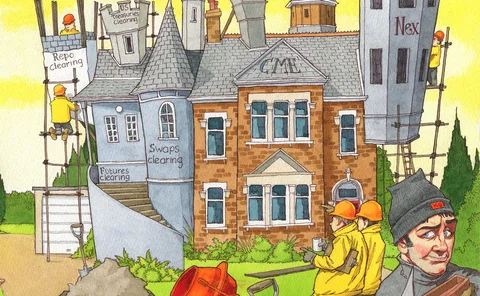

CME has chance to rule US rates after Nex deal

Market expects exchange to unite bond, repo, futures and swaps clearing – eroding grip of banks and DTCC

Going local: Brexit prompts rethink on MREL governing law

One EU regulator has already asked banks to avoid reliance on English law for bail-in