Feature

How low can you go: falling cost of FX fix sparks concern

Algorithms reducing fixing fees, but some dealers willing to go even lower – perhaps dangerously so

The buy side and Libor: it’s decision time

Investors weigh pros and cons of signing newly released Isda fallback protocol, as Libor demise looms

Asia’s private wealth giants shift gears to market-neutral

With interest rates low, structured product investors bypass capital-protected products for market-neutral strategies

G-Sibs see little sign of relief on Fed’s systemic buffer

Central bank liquidity and Treasuries will push US firms into higher G-Sib buckets

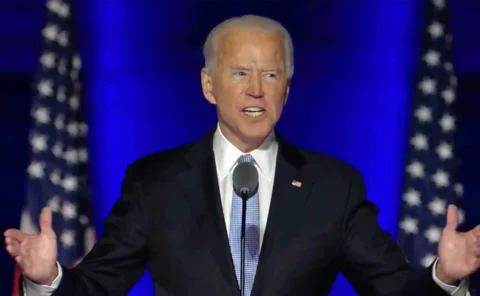

Joe Biden’s slow road to remaking US financial regulation

Moves on climate risk could come early; other changes may have to wait until end of 2021, or later

Funding pain prompts calls to rehome FVA

Dealers push to move derivatives funding costs out of P&L following March’s outsize losses

Botched copy: Esma delivers cut and paste pastiche of Trace

Mifid transparency mishmash misses key aspects of US system it emulates, say dealers

Investors weigh merits of ESG hedging

Opinion divided over proposed tool for transferring risk of non-sustainable activities

US election scenarios: meltdown fears if poll contested

Crowdsourced election scenarios show sharp falls and correlation breaks if Trump challenges results

Bailed-out basis traders face regulatory backlash

The cash/futures basis trade could be a test case for regulating systemically risky activities

Quants tout alternative carry trades for the ‘new normal’

Low rates and flatlining yield curves leave investors seeking carry in swaps and swaptions

Fight against dirty money falters in blizzard of SARs

Authorities are swamped with suspicious activity reports, many of which are never investigated

Covid policy risk hangs over bank stress tests

Banks and regulators are second-guessing the policy response to new outbreaks

Banks rent ready-made algos for FX trading

NatWest, XTX Markets and others develop new outsourcing model for tech

Forward momentum: the new world of NDF trading

NDF landscape is changing as trading volumes drive electronification and algo execution – but challenges remain

Europe’s clampdown on fund outsourcing chills market

Esma proposals spark worries AIFMD review could wreck existing delegation models

Science friction: some tire of waiting for quantum’s leap

Use cases for new tech are piling up – from CVA to VAR. But so are the obstacles

Broken backtests leave quant researchers at a loss

As historical data loses relevance, quants must find new ways to validate their theories

Escape from Emir? Not so fast, swaps users

Emir Refit, which seemed to promise reporting relief for corporate users, is not a master key

Unsettling times: why is settlement risk on the rise?

Regulators and market participants searching for answers after BIS figures show substantial increase

Alt data aims to shake up credit scoring business

Young firms, using machine learning methods to scrape consumer info, challenge established agency model

Hammer time? Clearers mull co-operation on default auctions

Some CCPs are mooting joint auctions to resolve large defaults – but critics deem them unworkable

Fund managers seek to plug holes in ESG data

Social intel proves elusive as virus reawakens sense of corporate virtue

Autocalamity: can hit product be reinvented?

Spreads on ‘worst-of’ bonds leap 50% as some dealers retreat and others pile on hedges