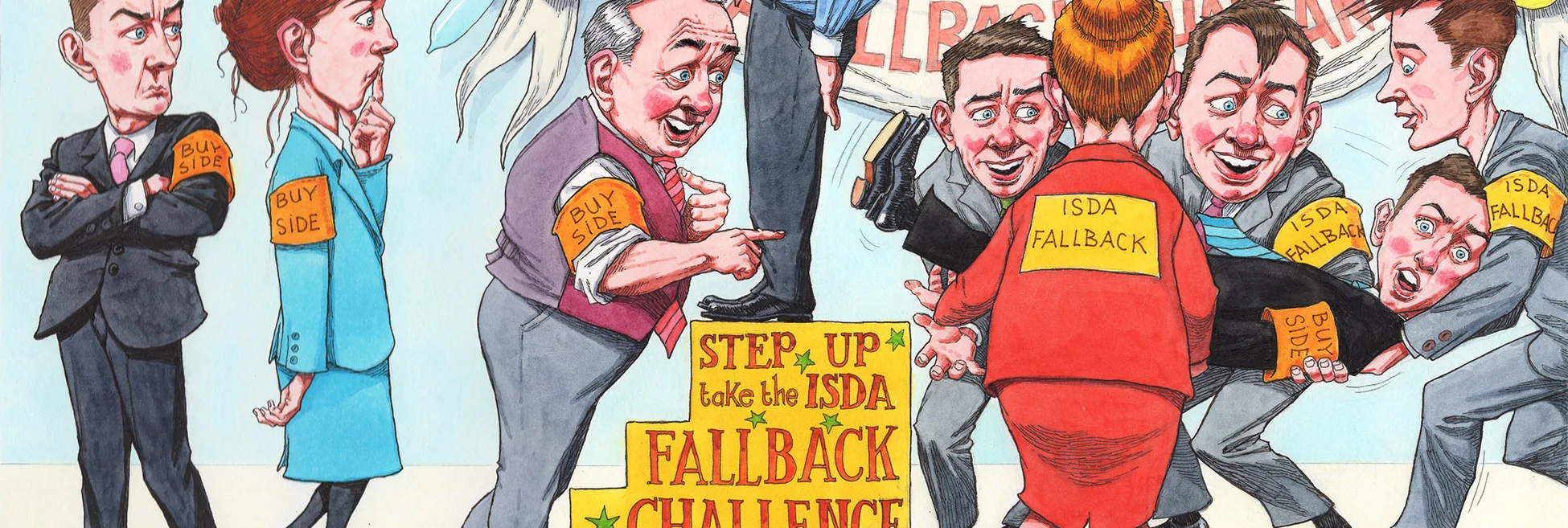

The buy side and Libor: it’s decision time

Investors weigh pros and cons of signing newly released Isda fallback protocol, as Libor demise looms

The long and gruelling exercise to replace the Libor benchmark has reached an important phase for buy-side firms.

Last month, the influential swaps industry body, Isda, issued its fallback protocol. This legal patch for derivatives allows contracts to flip automatically to alternative reference rates on Libor’s death.

Asset managers, investment firms and hedge funds around the world must now

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Opinions split on EU bond balance sheet squeeze

Some say QT and issuance wave will hamper intermediation; others say dealers nimble enough to respond

Eurex looks to shine ‘more light’ on off-book liquidity

Block order book initiative to aid price discovery slated for later this year

CME outage sparks FX soul search

How November’s halt exposed fragile wiring of new futures-led market structure

CME outage exposed FX market’s futures dependency, says SNB

Study finds EUR/USD spreads widened eightfold as non-bank PTFs blew out by nearly 30 times in November halt

CME rankles market data users with licensing changes

Exchange began charging for historically free end-of-day data in 2025

Gap risk fears push FX traders into Sunday-night Asia hours

Volumes surge at Singapore open as Trump’s weekend announcements force early risk management

BBVA joins growing Spire repack platform

Spanish bank becomes 19th dealer on multi-bank SPV issuer amid rising investor interest

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move