This article was paid for by a contributing third party.More Information.

ESG: remarkable progress, evolving indices and futures growth

By Payal Lakhani, CME Group

The unprecedented economic turmoil caused by the COVID-19 virus has led for calls to reshape the global economy to make it fairer and more environmentally sustainable. Campaigners are challenging governments to direct their record stimulus funds towards projects and investments that benefit broader society.

As pressure builds on improving businesses’ performance in terms of Environmental, Social and Governance (ESG), it is no surprise that the world is also seeing a corresponding boom in socially responsible investing.

Now, more than ever, investors are accelerating their search for opportunities that align with their values. ESG is increasingly shaping the investment landscape, and a whole new ecosystem is evolving to meet changing demands.

Exchange Traded Funds (ETFs) focused on ESG are booming, while derivative solutions, such as the CME E-mini S&P 500 Index ESG Futures contract, have emerged to allow for hedging and portfolio diversification, thus giving investors the products that align with their values.

ESG growth

ETFs that prioritise ESG matters have grown exponentially, surpassing $100 billion in August 20201.

An increasing number of investors now know it is perfectly possible to link index management with responsible investment by choosing an ESG index-based future, index fund or ETF for the core of their portfolio. The number of European pension plans that have explicitly created and formalized ESG beliefs has increased significantly, from 19% in 2019, compared with 55% in 20202.

Evolving ESG indices to match investor convictions

As ESG ideologies and thoughts continue to evolve, index providers are on the quest for the right methodology and exclusions; ensuring that their criteria effectively allow socially conscious investors to assess the behaviour of companies.

For many investors, climate change is one of the most important ESG risks and investment opportunities. Increasing attention on fossil fuel exposures has been bought into stark focus by the Paris Climate agreement. This has led an increasing number of investors to commit to divest from thermal coal companies by the end of 2020.

Thermal coal consultation

In response to these changing investor demands, S&P Dow Jones Indices (S&P DJI) conducted a consultation on thermal coal. Based on the results of the consultation, from market open on Monday, September 21, 2020 the S&P 500 ESG Index eligibility rules will be modified to exclude companies that generate 5% or more of their revenue from thermal coal.

S&P DJI have opted for the strictest measure based on the consultation results. The options presented in the consultation were to exclude companies generating more than, a) 25% b) 10% or c) 5% of revenue from thermal coal.

In order to properly frame the potential impact of this exclusion, the individual index objectives must be considered. The S&P 500 ESG Index aims to offer a more sustainable variant of the broad-based S&P 500 Index, with similar risk and return, while at the same time achieving a boost in S&P DJI ESG Score performance.

Built on the traditional broad-based S&P 500 Index, the S&P 500 ESG Index is comprised of companies that best manage their business while conforming to ESG principles. Eligibility and inclusion in the S&P 500 ESG Index are based on a robust ESG scoring system. Currently, those firms with the lowest ESG compliance, meaning those involved in tobacco, controversial weapons, with a low UNGC3 score, or in the lowest ESG ranked quartile of their sector are excluded. Post the implementation of this methodology change, those companies with more than 5% revenue deriving from thermal coal will also be excluded from the S&P 500 ESG Index.

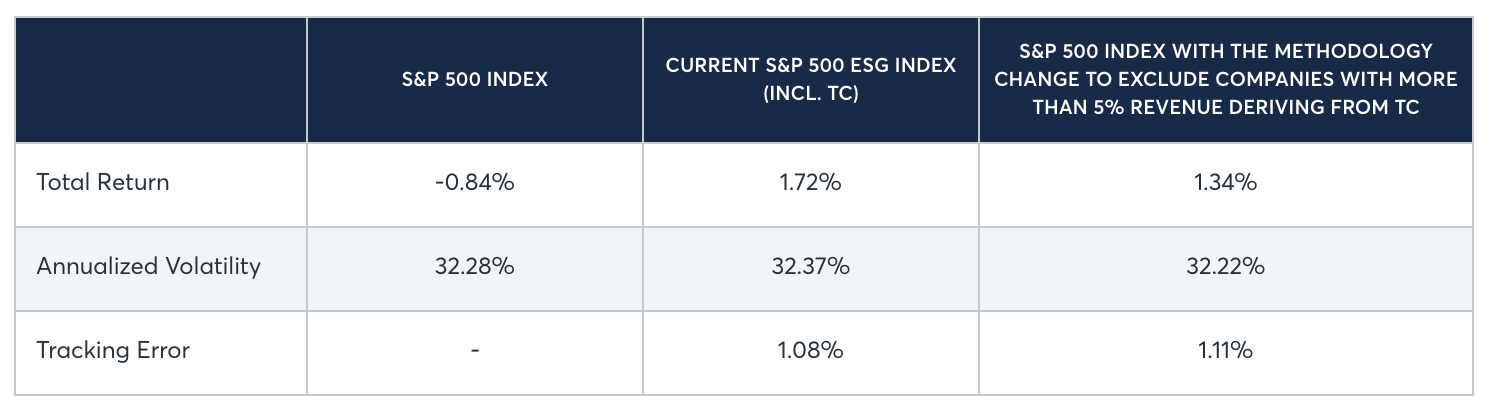

Using data from the April 2019 rebalancing up to the end of April 2020, Table 1 shows the total return, annualized volatility, and tracking error of the S&P 500 ESG Index versus the S&P 500 Index, as well as the hypothetical results that would have occurred had the thermal coal (TC) methodology change to 5% been in effect.

Using data from the April 2019 rebalancing, Table 2 shows the rebalancing changes and the weight impact that would have resulted had the methodology change options been in effect at that time.

There were a further seven companies that feature in the headline index that are involved in thermal coal which were not included in the respective ESG index.

The newly rebalanced S&P 500 ESG Index should be better aligned with investors objectives where they are increasingly taking a stand with their investment choices.

For companies, growing regulatory importance makes inclusion in an ESG index more relevant now than ever before. It also demonstrates adherence to specific investor values and so makes it easier for money managers to allocate funds.

The ESG futures space

The addition of E-mini S&P 500 ESG Index futures provides a cost effective way for market participants to gain access to one of the most actively traded ESG benchmarks, it also allows opportunities for investors to effectively manage risk whilst further adding to liquidity.

Since launch in November 2019, the E-mini S&P 500 ESG Index futures contracts have surpassed $10bn of traded notional and at the start of September 2020 had accumulated over 4,350 contracts of open interest, equivalent to $650 million. The contract enjoys the highest average daily volume (ADV) of any ESG future listed globally in terms of notional traded per day in 2020.

Unusually for a relatively new future, the majority of the orders are occurring on the central limit order book rather than via blocks (although block functionality is available). At its recent peak4, over 5,000 contracts were traded in a single day.

More than 100 different market participants have used this product so far, with demand largely being driven from asset managers and hedge funds.

Clients are using the ESG Future for beta exposure, to cash equitize and for easy-access hedging purposes. They are using it in both ESG specific funds where they need more ESG-orientated solutions and in non-ESG funds, where, from a top-down perspective having an ESG future helps make the overall portfolio more ESG friendly.

Using E-mini S&P 500 ESG Index Futures to manage the rebalance

As the September futures roll period nears, the implementation of the Thermal Coal Consultation, via an extraordinary index rebalance taking place at the close on Friday 18, September, to be in effect for the start of trading on Monday, the 21st, is likely to be a key driver in increased activity into the autumn. The ESG future can offer a liquid and cost-efficient alternative to incorporate these changes into investment strategies and manage undesired sustainability risks.

Market participants can enjoy several versatile ways to manage positions. Flexible execution, through the Basis Trade at Index Close (BTIC) mechanism or block trades ensures liquidity can be found. Both outright and BTIC transactions on ESG futures will be block eligible. Margin offsets will also be available for those interested in trading or spreading ESG futures versus other CME stock index products to maximise capital efficiency. This should further encourage and facilitate transfer to ESG benchmarks.

Liquidity is very important. Clients will often need liquidity in non-roll periods to manage their portfolios and the open interest and volumes are equally strong in non-roll months. The bid-ask is currently around 2 basis points wide in US hours, allowing investors the possibility to manage risk and benefit from all market scenarios.

Strong ESG returns

Investors have long debated if ESG detracts from returns. In the year to May 2020, the S&P 500 ESG Index provided outperformance of +2.68% to the S&P 500 Index. The 5-year tracking error is 0.83%, allowing clients S&P 500-like performance in an ESG positive manner. The E-mini S&P 500 ESG Index Future, is one of the most actively traded ESG benchmark index investment products globally. Furthermore, correlation to MSCI ESG benchmarks is typically 99.5% or higher, so clients benchmarked to MSCI can also enjoy the liquidity benefits from the S&P 500 ESG ecosystem whilst still getting the performance exposure they require.

2020-21 outlook

Renewed focus and innovation are being driven by several factors. Firstly, amid growing concern for the future of our planet, ESG investment is being spurred by the transfer of wealth to a younger, more environmentally conscious generation.

On the regulatory side, there is tremendous activity at the European Union level– such as developing climate benchmarks and a common taxonomy. Clearer guidelines and details on regulation will help build momentum in terms of index and product development. ESG is set to be a part of the MiFID II sustainable finance measures, scheduled for early 2021.

The International Organization of Securities Commissions (IOSCO) aims to harmonize global sustainability disclosure standards to make comparing information easier for investors. Such reporting requirements will mean asset managers face greater pressure to invest in these areas and will further drive volume in ESG products.

In the equity market, exclusion from an ESG-focused benchmark may mean that raising equity capital may become harder or more expensive for a company.

Any lingering reservations about ESG investments — performance, data and analytics, cost, and choice — seem in decline. The ecosystem now exists. The rise of ESG derivatives provide asset managers who have strict mandates to achieve ESG compliance with a flexible, cost efficient solution, with capital efficiencies and proven liquidity.

The prior years have seen tantalizing growth in ESG investing. This has brought renewed focus, innovation, regulatory reporting requirements and many more opportunities for the next year and beyond. CME ESG Futures provide a capital efficient, liquid way to allocate to this important and growing segment.

References

1. Research carried out by ETFGI

2. According to a survey carried out by Mercer

3. The United Nations Global Compact is a non-binding United Nations agreement to encourage businesses worldwide to adopt sustainable and socially responsible policies, and to report on their implementation.

4. May 19, 2020

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net