This article was paid for by a contributing third party.More Information.

ETFs – Transforming the investment landscape in Asia

A bumper year for equities over the past 12 months has strengthened the case for ETF investments, as passive strategies once again deliver for investors. Coupled with an increased appetite for factor indexes, such as smart beta, ETFs continue to be the poster child for investor diversification.

Asia-Pacific exchange-traded product assets reached US$234 billion at the end of May, according to Deutsche Bank research, representing an impressive 16% increase since the start of the year and the highest rise across all regions globally. The market sentiment in China – during the February to May period in which the ETF survey was conducted – has contributed to the ETF growth.

Allocation

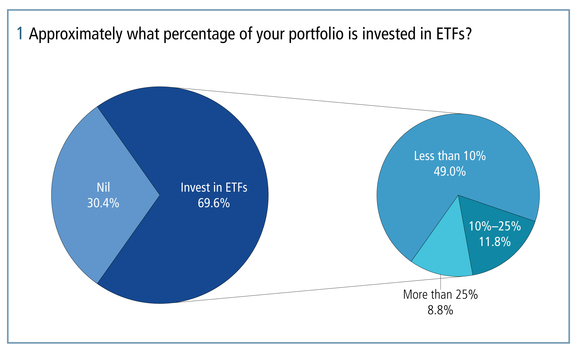

The survey results reflect this rise, with a greater proportion of investors increasing their ETF investments in 2015 over those of last year. This year, nearly 12% of respondents have a portfolio allocation to ETFs of between 10% and 25%, compared to just 6.3% in 2014. And nearly 9% of investors have an allocation greater than 25% this year compared to just 4.8% last year and 4.5% back in 2011. It is also worth noting that, five years ago, just 55% of respondents invested in ETFs at all, compared to almost 70% today, which demonstrates the extent to which investors have embraced ETFs as an increasingly important element of their portfolios (figure 1).

Diversification

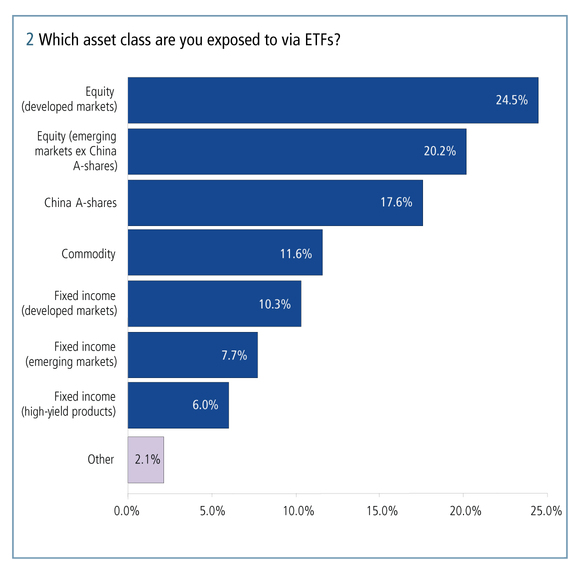

Investors are once again exposed to a very broad range of assets via ETFs without a huge bias towards a particular instrument. But there has been a noticeable tilt towards developed market ETFs this year, with 24.5% favouring this category compared to 18% last year, which may suggest that investors latched onto the positive tailwind created by Europe’s massive quantitative easing programme, in particular.

Two further trends are noteworthy. First, an increased allocation to China A-shares (18%) reflecting the sentiment on the mainland where a relaxation in policy earlier this year has boosted equities. Second, a decrease in allocation to commodity ETFs (12%) compared to 20% last year, which is not surprising given continued lower prices in oil and industrial metals this year (figure 2).

“Across the board, figures versus the previous year show a clear interest towards developed market equity and emerging market equity ETFs. China A-shares also saw more interest during the survey period. ETFs remain a platform from which to express a broad range of views,” says Anson Chow, vice president, passive asset management Asia Pacific at Deutsche Asset & Wealth Management.

Chow also points out that the lower allocations towards developed market fixed income this year may have been expected given the uncertainty created by a long-awaited change of course in rates out of the US that may happen later this year.

Asian advantage

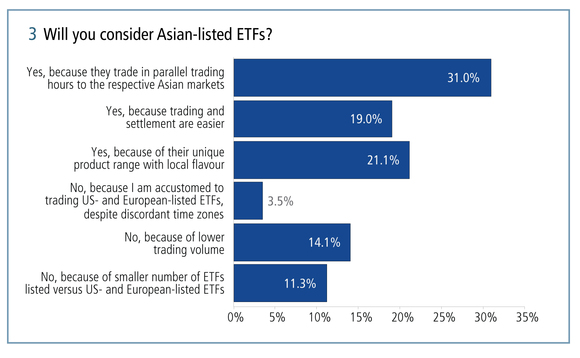

When asked why they choose Asian-listed ETFs, respondents this year focused in particular on parallel trading hours (31%) compared to 16% last year (figure 3).

“More investors are gradually becoming comfortable with trading in the Asian time zone, which reflects the education process going in the right direction,” says Chow.

The question of Asian-listed ETFs also drew out an interesting data point when it comes to tax. More investors are aware of the tax disadvantage of US-listed ETFs and therefore avoid them (53%) in 2015 compared to just 29% in 2011. This highlights how investors are far savvier in their reasons for choosing ETFs than ever before.

Tracking performance

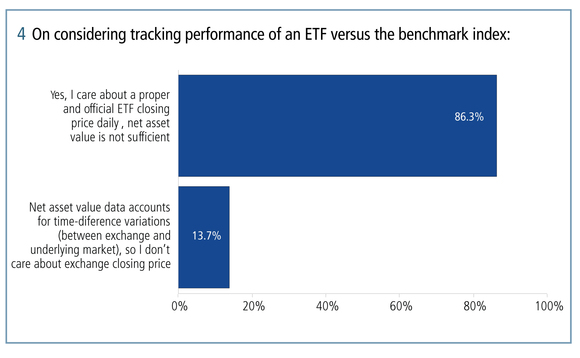

One area in which investors seem entrenched in their thinking is their insistence on a proper and official ETF closing price daily, with 86% in favour of this compared to 60% last year (figure 4).

“We will continue to focus on conveying the message that ETFs carry features of a stock and index fund and remind investors that closing price isn’t the only indicator of value to measure an ETF,” says Chow.

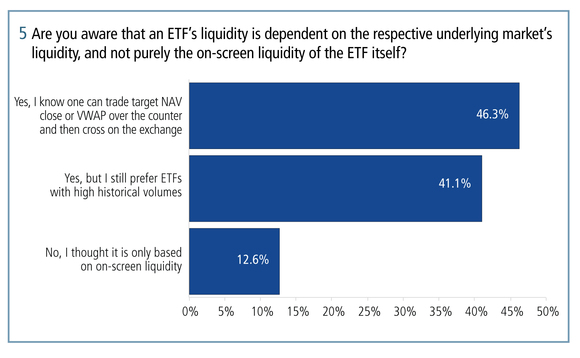

Liquidity

Liquidity of ETFs has long been a talking point in Asian ETF markets, with distributors keen to point out that liquidity of the underlying shares are the best determinant of actual liquidity rather than the turnover of the ETF itself.

This year’s results show substantial progress in this area, with 46% of respondents understanding they can trade target net asset value (NAV) close or volume-weighted average price (VWAP) over the counter and then cross on the exchange, compared to just 17% last year (figure 5).

Furthermore, a lower number (41%) of respondents said they still preferred ETFs with high historical volumes compared to 59% last year.

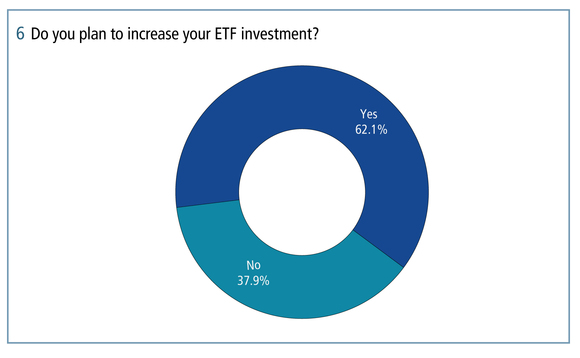

ETF allocation

Positive momentum also appears to be benefiting ETFs into the future, with 62% of respondents looking to increase their allocations over the next 12 months compared to 42% last year (figure 6).

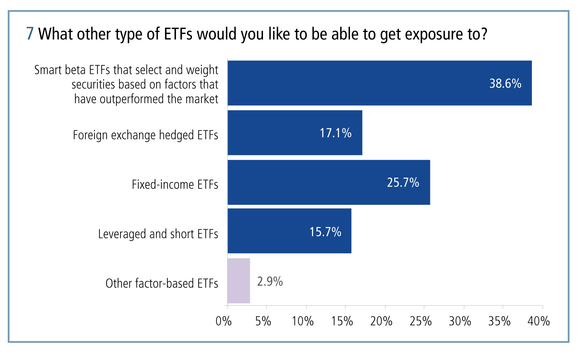

ETF products

This year, respondents were asked what ETFs they wished to be exposed to – apart from China – and the results reflected some clear trends.

Nearly 12% selected smart beta ETFs that select and weight securities based on factors that have outperformed the market (figure 7).

“Smart beta is in the news more often, and we can see that this captured more attention from respondents. Examples include minimum volatility, specific equity factors or high dividend, to name a few. It shows that ETFs are not just vanilla instruments to express delta one views; the trend of using ETFs is expanding into a more sophisticated space and away from the first and second generations of products,” says Chow (below).

He adds that, while there has yet to be an explosion in growth of Asian-listed smart beta ETFs, in Europe and the US, smart beta products already have a bigger market share. Institutional demand for these products is growing in Asia, but investors currently have to look outside of the continent to consider such allocation.

He adds that, while there has yet to be an explosion in growth of Asian-listed smart beta ETFs, in Europe and the US, smart beta products already have a bigger market share. Institutional demand for these products is growing in Asia, but investors currently have to look outside of the continent to consider such allocation.

Chow also says that foreign exchange hedged ETFs have seen an increase in flows over the past 12 months, globally and in Asia, which is mirrored in our survey with 5% of respondents indicating they are interested in these products.

“The strength of the US dollar over the past year shows that investors are becoming aware of mitigating the risk that, while the underlying investment may be stable, the foreign exchange volatility could eat into potential equity returns,” says Chow.

Overall findings

Overall, the survey findings show that, over the past five years, ETFs have moved from being a discretionary diversification tool to being a key component of any portfolio. Factor-based ETFs are now posing a challenge to active alpha-seeking strategies, which will increase the prominence of ETFs even further.

A number of drivers are already bolstering the case for ETFs. As institutional investors become more accountable for the fees they pay to alternative managers, ETFs – with their low cost structures – are a chief beneficiary of this crackdown on fees. In the Australian market, for example, the elimination of embedded compensation that mutual fund manufacturers pay to dealers and advisers, and pressure on performance fees by hedge funds charged to the superannuation industry are positive catalysts for ETFs.

With Europe and Japan still in monetary easing mode, the macro-environment has also bolstered the appeal of ETFs by removing some of the relevance of stock selection and making a broad-index play a good choice for investors. The Bank of Japan is even purchasing ETFs as part of its strategy to create growth and inflation.

Central banks from China to New Zealand have also lowered rates this year, which is providing further support for equity-linked ETFs as cash on deposit becomes less attractive.

The July launch of a mutual funds recognition scheme between China and Hong Kong, as well as plans for a 2016 launch of an Asia funds passport under the auspices of the Asia-Pacific Economic Cooperation, promises to add further momentum to the intra-regional funds industry, which should also benefit ETF volumes in the coming years as it becomes easier to list ETFs across borders.

Deutsche Asset & Wealth Management

With US$1.25 trillion of assets under management (as of March 31, 2015), Deutsche Asset & Wealth Management (Deutsche AWM) is one of the world’s leading investment organisations. Deutsche AWM’s passive investment business offers its institutional and private investors access to a variety of investment classes and markets via simple, transparent and cost-efficient investments. These include exchange-traded funds (ETFs), exchange-traded commodities (ETCs), exchange-traded notes (ETNs), certificates, warrants, obligations and funds, as well as private mandates. Deutsche AWM is currently the largest ETF provider in Hong Kong and Singapore in terms of number of products offered, with 35 and 48 ETFs listed, respectively. Source: Hong Kong Exchanges & Clearing Limited and Singapore Exchange Limited

Investment involves risks. Past performance is not indicative of future results. The information contained within this article is for general reference only. Before making any investment decision, investors should understand the details of the investment and consult an independent financial adviser.

Read/download the survey analysis in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net