This article was paid for by a contributing third party.More Information.

Alternatives in an interest rate low: Custom investment solutions

A surprising key interest rate reduction in the eurozone – to a historic low of 0.25% – brought the market to life at the beginning of November. The DAX® climbed to an all-time high of 9,193 points in a matter of minutes – a sign that investors are looking for investment alternatives in the equity market. At the same time, one has to ask: what is the best way to invest in the market? Have the equity markets already finished their run? Are ‘long only’ investments still a good idea at this point in time? Or are solutions that also allow for falling and sideways market trends a better alternative? Investors have to answer these questions for themselves, based on their own portfolios. In general, structured products allow positions to be taken for a variety of market situations. Around one million products, with a wide variety of terms, are available in Germany. In spite of the large number of products available, investor demand is growing for custom-tailored solutions. The primary market does offer a large selection of products for blue chip stocks, however, for small- and mid-caps, the selection is considerably smaller. In addition, many products are issued with subscription periods, which often restrict ad hoc decisions that are based on current market developments and desired terms.

For this reason, in September 2012, HypoVereinsbank (HVB) began to offer a special service to private investors. Using the my.onemarkets product configurator, private banking advisers and selected financial advisers in our branches can help investors design a custom-tailored solution in a matter of minutes for a minimum investment of €10,000. A large selection of key financial ratios, underlyings, structures, terms, barrier levels and interest payments are available. Investors can choose from a range of products, including: reverse convertibles (classic, protect, express protect); express certificates (classic, plus); bonus certificates (classic, cap); reverse bonus cap certificates; and capital-protected notes (classic, cap). Around 135 underlyings are available. In addition to the better known indexes, such as the DAX®, MDAX® and Euro Stoxx® 50, a large number of individual stocks, both blue chips and small- and mid-caps, can also be chosen. Investors can change individual parameters to precisely adjust the risk-reward relationship in order to meet their needs. Issuer risk is always present for bearer notes such as these. Once the client and adviser reach an agreement, the product is issued at the push of a button. Thanks to the way my.onemarkets is integrated into the advisory process, the key investor document (the Produktinformationsblatt, or PIB) and flyer are then automatically generated, thereby satisfying all regulatory requirements. The individual International Securities Identification Number can then be used on the onemarkets website to obtain information on the product during its entire life cycle. Although the products are generally not listed, they can be sold at the daily price on any stock exchange dealing day.

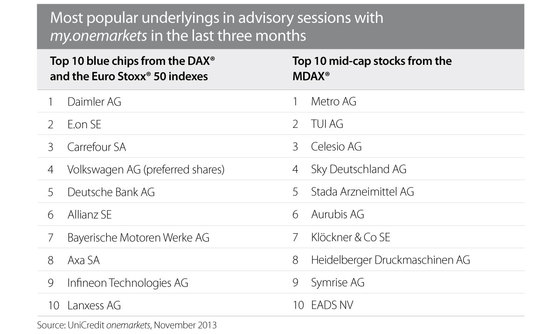

HVB advisers feel my.onemarkets provides a clear competitive advantage. An integrated advisory approach can be used to develop custom-tailored solutions with the client that lead to increased customer satisfaction. Fast automated issuing of the product leaves more time to perform a needs analysis during the meeting with the client. Around 8,800 products, with a volume of approximately €330 million, have been issued since my.onemarkets was launched. Currently, 40 to 50 transactions with an average investment of €37,500 are being performed per day. Given the market situation, since August 2013 the focus has been on express structures. Blue-chip stocks, such as Daimler and E.on, TUI and Celesio from the MDAX®, and European stocks Carrefour and Axa have been the most popular underlyings in advisory sessions with my.onemarkets in recent months.

my.onemarkets is currently being used in the German HVB network and in other UniCredit banks in central and eastern Europe.

Read/download the article in PDF format.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net